What are the online procedures for PIT refund on icanhan of the General Department of Taxation of Vietnam?

What are the online procedures for PIT refund on icanhan of the General Department of Taxation of Vietnam?

The online procedures for PIT refund on icanhan of the General Department of Taxation of Vietnam follows these steps:

Step 1: Access the website: https://thuedientu.gdt.gov.vn/ -> Select the individual section.

Step 2: Select the login account and fill in the information.

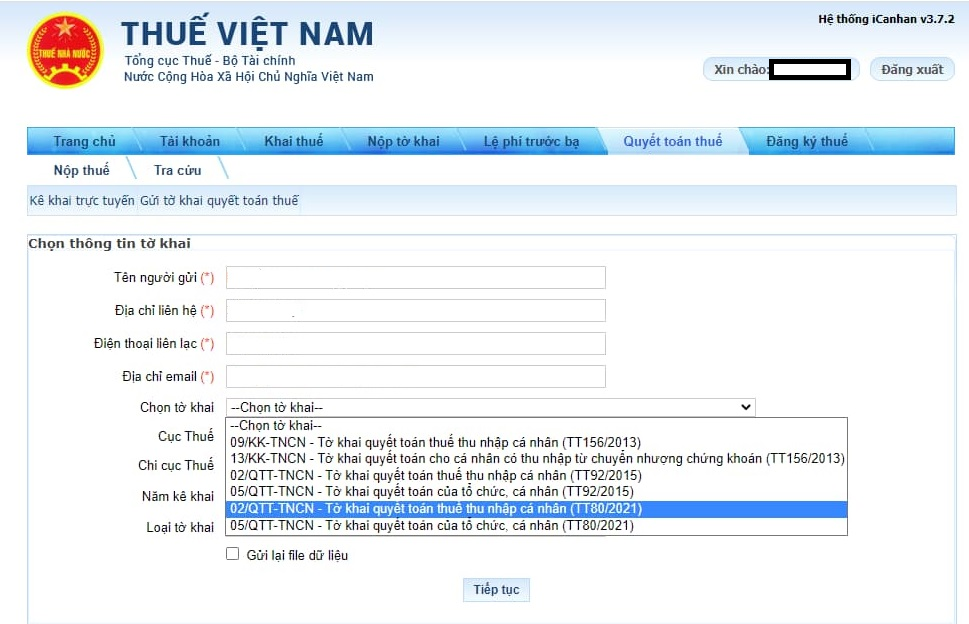

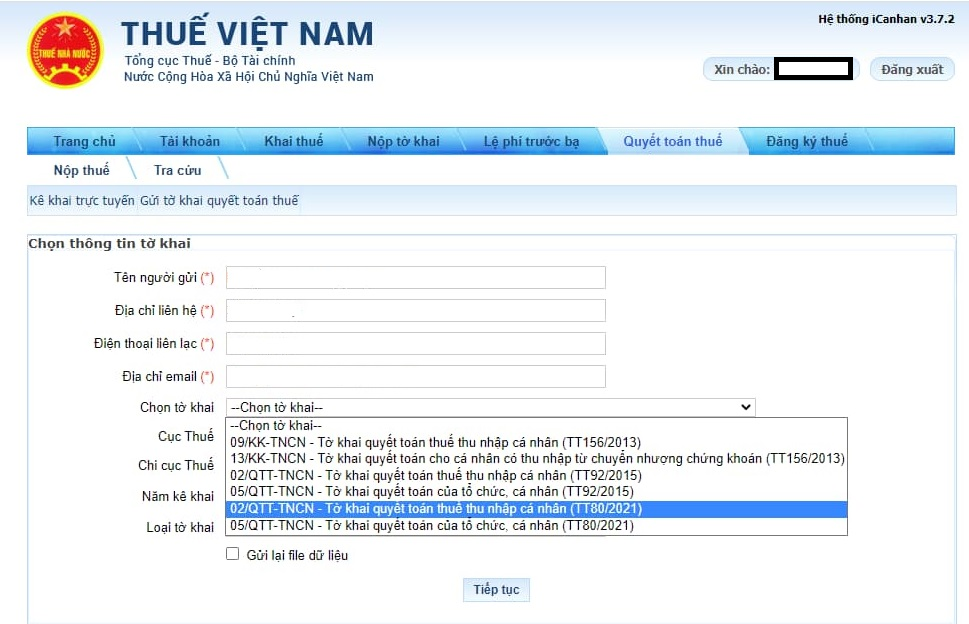

Step 3: Select “Tax Finalization” -> Select “Online Tax Declaration”

Step 4: Select the declaration information.

Step 4: Select the declaration information.

- Taxpayer’s Name: Name of the person self-finalizing

- Contact address: Permanent or temporary address

- Contact phone: Phone number of the person self-finalizing

- Email address: Email of the person self-finalizing

- Select declaration: 02/QTT-TNCN-Tax Finalization Declaration (TT80/2021)

Download 02/QTT-TNCN-Tax Finalization Declaration form: Download

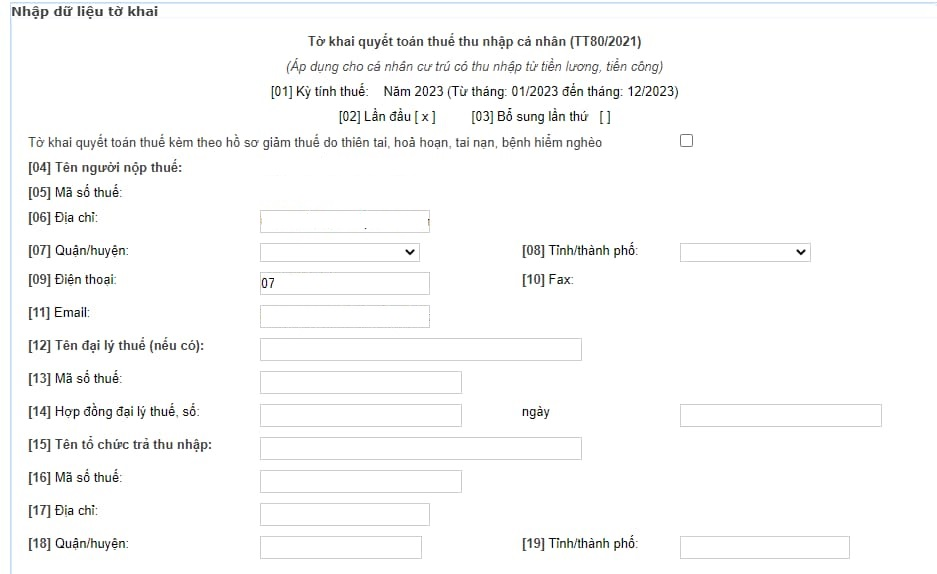

The system will display the screen for filling out the request for refund form for the taxpayer to input data:

- From [01] to [06]: The system auto-fills.

- From [07] to [08]: Select the province/municipality in point [08] first, then select the district in point [07] (Permanent address).

- [09]: Fill in the taxpayer's (NPT) phone number (mandatory).

- [10]: Fax: Optional.

- [11]: Fill in the taxpayer's email address (mandatory).- From [12] to [19]: Tax agency information (skip if none).

- [20]: Total taxable income (TNCT) during the period [20]=[21]+[23]- [21]: Total PIT incurred in Vietnam: The income occurred where the paying organization issued the documents for the individual, and the individual uses the income information from those documents to input into the declaration.

- [22]: Total PIT incurred in Vietnam exempted according to the Agreement (if any): Total PIT exempt according to the Agreement: Total taxable income from wages; salaries and other taxable income; considered as wages or salaries that the individual receives and is exempted under the Agreement on Avoidance of Double Taxation (if any) (Leave blank if none).

- [23]: Total PIT incurred outside of Vietnam: Total PIT incurred outside of Vietnam: is the total taxable income from wages; salaries and other taxable income; considered as wages or salaries incurred outside of Vietnam (Leave blank if none).

- [24]: Number of dependents.Auto-calculated when declared. If you already registered dependents with the tax authorities, scroll down and click on 02-1/BK-QTT-TNCN to proceed with the declaration.

- [25], [26], [27]: The system auto-fills.

- [28]: Charity, humanitarian, scholarship support: contributions to organizations, childcare facilities for children in especially difficult circumstances; disabled people; elderly without shelter; contributions to charity funds; humanitarian funds; scholarship support funds established and operated according to state regulations (Leave blank if none).

- [29]: Deductible insurance payments: social insurance, health insurance; unemployment insurance; professional liability insurance for certain professions participating in mandatory insurance.- [30]: Deductible voluntary pension contributions: total contributions to the voluntary pension fund up to a maximum of 3 million VND/month (Leave blank if none).

- [31], [32], [33]: The system auto-calculates.- [34] Tax withheld at the income payer: Total tax withheld from the individual's salaries and remunerations, based on the tax withholding certificates issued by the income payer.

- [35] Tax paid directly during the year not through income payer: Tax directly declared and paid by the individual to the tax authority in Vietnam, based on the payment receipts to the state budget.

- [36] Tax paid abroad deductible (if any): Tax paid abroad deductible up to the amount of tax payable corresponding to the income received abroad compared to total income but not exceeding the tax amount calculated as [32] x {[23]/([20] –[22])}x 100%.

- [37] Tax paid abroad due to overlapping year-end settlements: Tax paid abroad due to overlapping year-end settlements. Tax paid abroad due to overlapping year-end settlements determined by the individual if declared and paid abroad in the first tax year. If there is no overlapping tax paid abroad, then this field does not need to be declared.

- [38] Tax paid during the year not through an income payer due to overlapping year-end settlements: Individuals self-determine the tax amount due to overlapping year-end settlements if declared in the first tax year. In case the individual determines no overlapping tax amount paid during the year not through the income payer, this field does not need to be declared.

- [39] Total personal income tax reduced during the period: [39]=[40]+[41]- [40] Tax due to overlapping year-end settlements: Individuals declare tax due to overlapping year-end settlements at the withholding organization in this field.

- [41] Total other personal income tax relief: Individuals declare tax relief under legal provisions, excluding cases of tax relief due to natural disasters, fires, accidents, and serious illnesses affecting the ability to pay taxes.

- [42] Total tax payable during the period [42]=([32]-[33]-[39])>0: [42]=[32]-[33]-[39] in case [42]=([32]-[33]-[39])>0.

- [43] Tax-exempt due to the individual having tax payable after finalization of 50,000 VND or less: Individuals only declare the exempt tax amount after finalization by declaring [42] in case 0<[42]<=50,000 VND.

- [44] Total excess tax paid during the period: [44]=([32]-[33]-[39])<0, individuals with excess tax paid declare in this field as a positive amount.

When filling declaration 02, the system auto-calculates:

+ If the field [42] shows 0, the field [44] is a certain amount, the displayed amount is the TNCN refund amount equivalent to the surplus in field 44.+ Conversely, if TNCN already paid is still insufficient and needs additional payment as per the amount displayed in field [42].

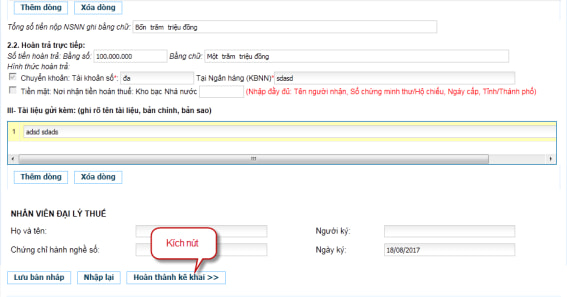

- [45] Total tax requested for refund: [45]=[46]+[47]- [46] Refund amount to taxpayer: Individuals with excess tax paid and requesting a refund declare in this field.- [47] Amount offset for other state budget obligations: Individuals with excess tax paid requesting an offset for other state budget obligations (including budget debts, incurred taxes such as value-added tax, licensing fees, special consumption tax) declare in this field (not exceeding [45]).- [48] Total tax offset for the next period: Field [48]=[44]-[45]

Step 5: Click

Step 6: Fill in the declaration data.

Step 7: Select “Complete Declaration”.

Step 8: Finalize.

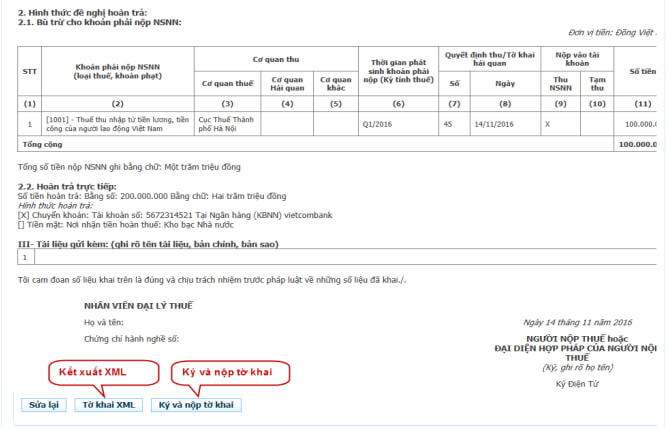

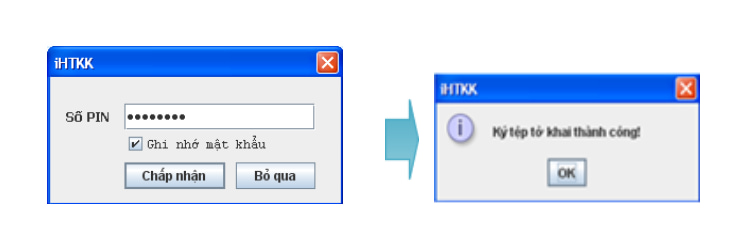

Select “XML Declaration” to export the refund request form in XML format.

Then, the taxpayer selects “Sign and Submit Declaration,” and the system will display the screen for the taxpayer to enter the PIN and click “Accept”. The system will notify “File declaration signed successfully”.

In the latest version, after completing the tax declaration as instructed above, the tax authority will automatically process the refund request (if any) based on the tax finalization return information.

Note: The person filing the tax refund must have an account on the General Department of Taxation's portal to proceed.

What are the online procedures for PIT refund on icanhan of the General Department of Taxation of Vietnam? (Image from the Internet).

What is the time limit for PIT refund in Vietnam?

Under Article 75 of the Tax Administration Law 2019:

Time limits for processing tax refund claims

1. In case a claim is eligible for refund before inspection, within 06 working days from the day on which the tax authority issues the notice of receipt of the claim, the tax authority shall decide whether to provide the refund, demand inspection before refund in the cases mentioned in Clause 2 Article 73 of this Law, or reject the claim if it is unqualified.

In case information on the tax refund claim is different from that of the tax authority, the tax authority shall request the taxpayer in writing to provide explanation and additional information. The time needed for providing explanation and additional information shall not be included in the time limit for processing tax refund claims.

2. In case a claim is subject to inspection before refund, within 40 working days from the day on which the tax authority issues the notice of receipt of the claim, the tax authority shall decide whether to provide the refund or reject the claim.

3. If the tax authority fails to issue the tax refund decision by the deadline specified in Clause 1 and Clause 2 of this Article, the tax authority shall pay an interest at 0,03% per day on the refundable and the number of days late. The interest shall be paid by central government budget in accordance with regulations of law on state budget.

Thus, the time limit for PIT refund is stipulated as follows:

- For applications subject to tax refund before inspection, no later than 6 working days from the date the tax authority issues a notification of acceptance of the application and the processing time.

- For applications subject to inspection before the tax refund, no later than 40 days from the date the tax authority issues a written notification of acceptance of the application and the processing time.

What documents are included in the PIT refund application for income from salaries and remunerations in Vietnam?

According to Clause 1, Article 42 of Circular 80/2021/TT-BTC, the PIT refund application for income from salaries and remunerations in Vietnam includes:

- For organizations or individuals paying income from salaries and remunerations conducting finalization for individuals with authorization:

The application includes:

+ A document requesting the processing of excess tax, late payment interest, and fines according to Form 01/DNXLNT, enclosed in Appendix I of this Circular;

+ A power of attorney as per legal regulations if the taxpayer does not personally handle the refund procedure, except for tax agents submitting refund applications under a signed contract with the taxpayer;

+ A list of tax payment vouchers according to Form 02-1/HT, enclosed in Appendix I of this Circular (applies to income-paying organizations and individuals).

- No separate refund application is required for individuals with income from salaries and remunerations who directly finalize taxes with the tax authority with excess tax payment and request a refund on the PIT finalization declaration form.

The tax authority processes the refund based on the PIT finalization application and refunds the excess payment to the taxpayer as regulated.

Download Form 01/DNXLNT here.

Download Form 02-1/HT here.