What are the online procedures for PIT refund in 2024 via eTax Mobile in Vietnam?

What are the online procedures for PIT refund in 2024 via eTax Mobile in Vietnam?

Note: Tax refund is a form of handling overpaid tax amounts.

The online procedures for PIT refund in 2024 via Mobile in Vietnam are as follows:

Step 1: Log in to the eTax Mobile application

Step 2: Select the Request to handle the overpaid amount

Step 3: Select the Tax Department and Sub-Department (if any) to send the request form -> Select "Continue"

Step 4: Fill in the information of the applicant requesting to handle the overpaid amount -> Select "Continue"

Note: The * symbol indicates required fields.

Step 5: Verify the information on the tax amount, late payment interest, and penalties overpaid -> Select "Continue"

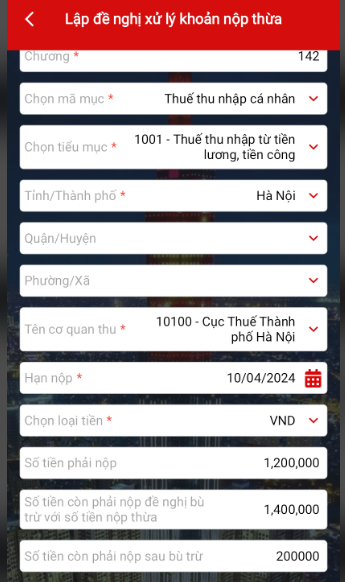

Step 6: Enter the payable amounts, the amounts to be offset against the overpaid amount, the remaining amount after offsetting, and the required information -> Select "Continue"

Note: The * symbol indicates required fields.

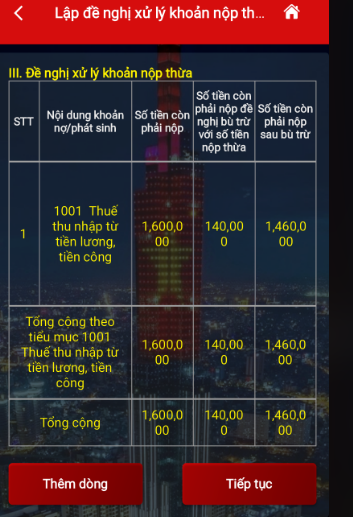

Step 7: Verify the information on the requested handling of the overpaid amount -> Select "Continue"

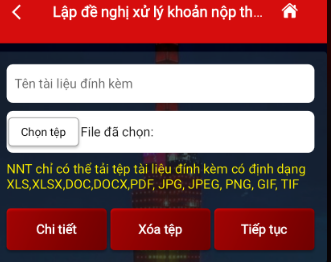

Step 8: Name the attached document and select the tax refund request form -> Select "Continue"

Select the declaration form: 02/QTT-TNCN - Annual personal income tax finalization declaration (Circular 80/2021)

Download form 02/QTT-TNCN - Annual personal income tax finalization declaration: DOWNLOAD

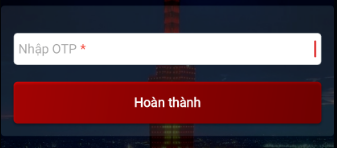

Step 9: Enter the OTP code sent to the taxpayer's phone number -> Select "Complete"

What are the online procedures for PIT refund in 2024 via Tax Mobile in Vietnam? (Image from Internet)

What is the time limit for PIT refund in Vietnam?

Under Article 75 of the Tax Administration Law 2019:

Time limits for processing tax refund claims

1. In case a claim is eligible for refund before inspection, within 06 working days from the day on which the tax authority issues the notice of receipt of the claim, the tax authority shall decide whether to provide the refund, demand inspection before refund in the cases mentioned in Clause 2 Article 73 of this Law, or reject the claim if it is unqualified.

In case information on the tax refund claim is different from that of the tax authority, the tax authority shall request the taxpayer in writing to provide explanation and additional information. The time needed for providing explanation and additional information shall not be included in the time limit for processing tax refund claims.

2. In case a claim is subject to inspection before refund, within 40 working days from the day on which the tax authority issues the notice of receipt of the claim, the tax authority shall decide whether to provide the refund or reject the claim.

3. If the tax authority fails to issue the tax refund decision by the deadline specified in Clause 1 and Clause 2 of this Article, the tax authority shall pay an interest at 0,03% per day on the refundable and the number of days late. The interest shall be paid by central government budget in accordance with regulations of law on state budget.

Thus, the time limit for PIT refund is stipulated as follows:

- For applications subject to tax refund before inspection, no later than 6 working days from the date the tax authority issues a notification of acceptance of the application and the processing time.

- For applications subject to inspection before the tax refund, no later than 40 days from the date the tax authority issues a written notification of acceptance of the application and the processing time.

What documents are included in the PIT refund application for income from salaries and remunerations in Vietnam?

According to Clause 1, Article 42 of Circular 80/2021/TT-BTC, the PIT refund application for income from salaries and remunerations in Vietnam includes:

- For organizations or individuals paying income from salaries and remunerations conducting finalization for individuals with authorization:

The application includes:

+ A document requesting the processing of excess tax, late payment interest, and fines according to Form 01/DNXLNT, enclosed in Appendix I of this Circular;

+ A power of attorney as per legal regulations if the taxpayer does not personally handle the refund procedure, except for tax agents submitting refund applications under a signed contract with the taxpayer;

+ A list of tax payment vouchers according to Form 02-1/HT, enclosed in Appendix I of this Circular (applies to income-paying organizations and individuals).

- No separate refund application is required for individuals with income from salaries and remunerations who directly finalize taxes with the tax authority with excess tax payment and request a refund on the PIT finalization declaration form.

The tax authority processes the refund based on the PIT finalization application and refunds the excess payment to the taxpayer as regulated.

Download Form 01/DNXLNT here.

Download Form 02-1/HT here.