What are the newest severance tax declaration and severance tax finalization declaration forms in Vietnam?

What are the newest severance tax declaration and severance tax finalization declaration forms in Vietnam?

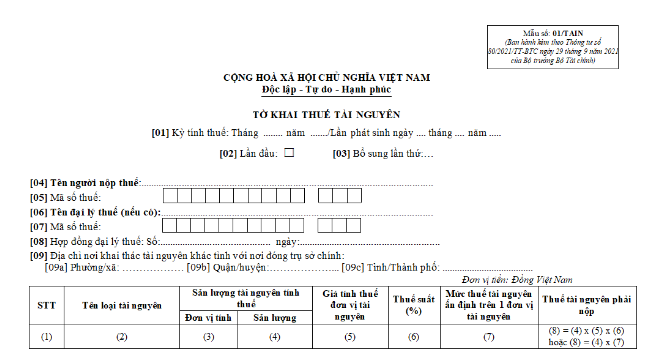

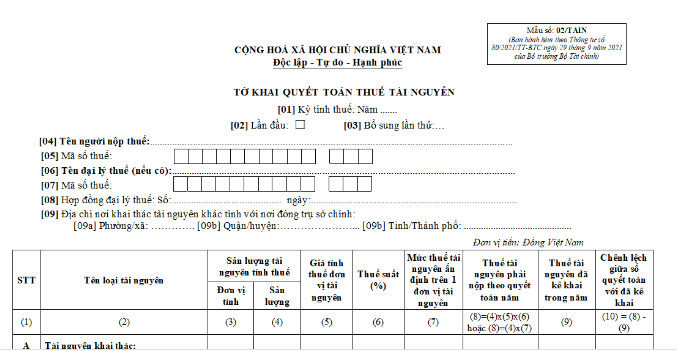

The newest severance tax declaration and severance tax finalization declaration forms are Form No. 01/TAIN and Form 02/TAIN-VSP, as stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC.

>>> Download the severance tax declaration form

>>> Download the severance tax finalization declaration form

What are the newest severance tax declaration and severance tax finalization declaration forms in Vietnam? (Image from the Internet)

What is the formula for determining the severance tax payable in the tax period in Vietnam?

Under Article 4 of the Law on Severance Tax 2009, referenced by the guidance in Article 4 of Circular 152/2015/TT-BTC:

Basis for tax calculation

1. The basis for calculation of severance tax is the taxable extraction quantity of natural resources, taxable price, and tax rate.

2. Severance tax payable in the period

Severance tax payable in the period

=

Taxable extraction quantity of natural resources

x

taxable price

x

Tax rate

In case an authority imposes a certain amount of severance tax on a unit of natural resources extracted, severance tax is calculated as follows:

Severance tax payable in the period

=

Taxable extraction quantity

x

Severance tax on a unit of natural resources extracted

Imposition of severance tax must be based on the database of tax authorities and conform to regulations on tax imposition.

Thus, the formula for determining the severance tax payable in the tax period in Vietnam is as follows:

|

Severance tax payable in the period |

= |

Taxable extraction quantity of natural resources |

x |

taxable price |

x |

Tax rate |

What are the cases for severance tax exemption or reduction in Vietnam?

Article 9 of the Law on severance tax 2009 prescribes cases of severance tax exemption or reduction as follows:

- Severance tax payers that encounter natural disasters, fires or unexpected accidents, causing losses of natural resources for which severance tax have been declared and paid, may be considered for exemption from or reduction of payable severance tax for the lost volumes of natural resources. The paid severance tax amount will be refunded or cleared against the subsequent period's payable severance tax amount.

- Severance tax are exempted for natural aquatic resources.

- Severance tax are exempted for tree branches and tops, firewood and bamboo of all kinds which individuals are permitted to exploit for their daily-life needs.

- Severance tax are exempted for natural water used for hydropower generation by households and individuals for their daily-life needs.

Simultaneously, cases of severance tax exemption and reduction are further detailed in Chapter 4 of Circular 152/2015/TT-BTC as follows:

*Exemption from severance tax (Article 10 of Circular 152/2015/TT-BTC)

The cases of exemption from severance tax are specified in Article 9 of the Law on severance tax and Article 6 of Decree 50/2010/ND-CP, including:

- Entities extracting natural marine organisms.

- Entities extracting branches, firewood, bamboo, rattan, etc. serving everyday life.

- Entities extracting natural water for hydroelectricity generation serving everyday life of households and individuals.

- Natural water extracted by households and individuals serving their everyday life.

- Land areas given/leased out to organizations and individuals and used on the spot; earth used for leveling, construction of security, military works, dykes.

Earth extracted and used on the spot eligible for tax exemption include sand, rock, gravel in the earth without specific substances and is used as is for leveling or construction. If earth is transport elsewhere for use or for sale, severance tax must be paid as prescribed.

- The Ministry of Finance shall cooperate with relevant Ministries and agencies in proposing other cases of exemption from severance tax to the government, which will be considered and decided by Standing Committee of the National Assembly.

*Reduction of severance tax (Article 11 of Circular 152/2015/TT-BTC)

Cases of reduction of severance tax include:

- Taxpayers who suffer from a natural disaster, conflagration, or accident that inflicts damage the declared resources may be given exemption or reduction of severance tax on the amount of damaged resources. If tax has been paid, taxpayers shall receive a refund or have it offset against severance tax payable in the next period.

- The Ministry of Finance shall cooperate with relevant Ministries and agencies in proposing other cases of severance tax reduction to the government, which will be considered and decided by Standing Committee of the National Assembly.

*Procedures for severance tax exemption and reduction (Article 12 of Circular 152/2015/TT-BTC)

Procedures for exemption, reduction of severance tax, the power to grant exemption, reduction of severance tax shall comply with the Law on Tax administration, the law on the amendments to the law on tax administration, and their instructional documents.