What are the latest resignation leter templates in Vietnam in 2025? Is severance pay subject to PIT?

What are the latest resignation leter templates in Vietnam in 2025?

A resignation leter not only reflects the reason you wish to resign but also demonstrates the responsibility and professionalism of the employee. Therefore, regardless of the reason or circumstance, you must write a resignation leter before deciding to leave the company.

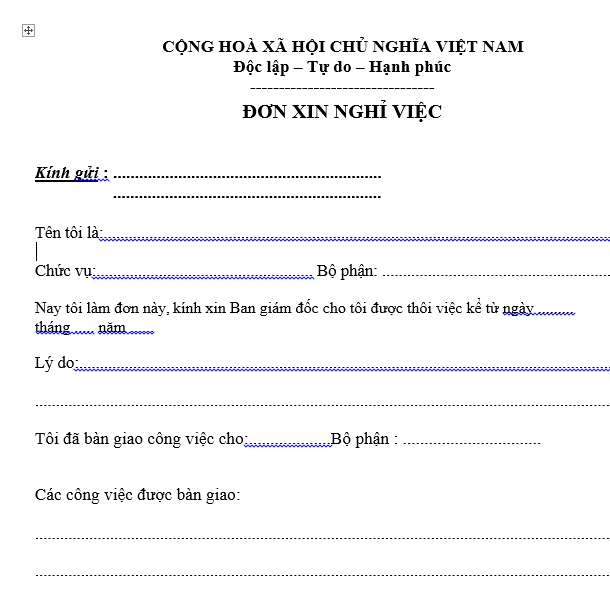

A resignation leter can be handwritten or typed. According to the Labor Code 2019, there is no specific resignation leter template. Thus, employees often use self-drafted templates in Word file templateat.

Below are some standard resignation leter templates you can refer to:

Template No. 1: Latest resignation leter template 2025...download

Template No. 2: Latest resignation leter template 2025...download

Is severance pay subject to personal income tax (PIT) in Vietnam?

Based on Clause 2, Article 2 of Circular 111/2013/TT-BTC, specific provisions on taxable income are as follows:

Taxable Income

...

- Income from salaries and wages

...

b.3) Defense and security allowances; allowances for armed forces.

b.4) Toxic or dangerous allowances for occupations or jobs in workplaces with toxic, dangerous elements.

b.5) Attraction allowances, regional allowances.

b.6) Extraordinary hardship allowances, labor accident allowances, occupational disease allowances, one-time allowances for childbirth or adoption, maternity policy benefits, health recovery benefits after maternity, allowances for reduced labor capacity, one-time retirement allowances, monthly death allowances, severance pay, job loss allowances, unemployment allowances, and other allowances as prescribed by the Labor Code and the Social Insurance Law.

b.7) Allowances for individuals under social protection according to the provisions of law.

b.8) Service allowances for senior leaders.

...

Therefore, according to the above regulation, severance pay is still subject to personal income tax (PIT).

What are the latest resignation leter templates in Vietnam in 2025? Is severance pay subject to PIT? (Image from the Internet)

Which incomes are exempt from personal income tax in Vietnam?

According to Article 4 of the Personal Income Tax Law 2007 supplemented by Clause 3, Article 2 of the Law amending Laws on Taxes 2014 and amended by Clause 2, Article 1 of the Amended Personal Income Tax Law 2012 which stipulates the personal incomes exempt from personal income tax as follows:

- Income from real estate transfer between spouses; biological parents and biological children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; grandparents and grandchildren; siblings.

- Income from the transfer of housing, housing land use rights and assets attached to housing land of individuals in case the individual only has one house or housing land.

- Income from land use rights of individuals allocated by the State.

- Income from inheritance and gifts as real estate between spouses; biological parents and biological children; adoptive parents and adopted children; parents-in-law and children-in-law; grandparents and grandchildren; siblings.

- Income of households and individuals directly producing agriculture, forestry, salt-making, aquaculture, catching seafood not yet processed into products or simply pre-processed.

- Income from changing agricultural land allocated by the State to households and individuals for production.

- Income from interest on deposits at credit institutions, interest from life insurance contracts.

- Income from remittances.

- The portion of night shift salary, overtime work paid higher than the day shift salary as regulated by law.

- Retirement salary paid by the Social Insurance Fund; retirement salary paid monthly by the voluntary pension fund.

- Income from scholarships, including:

+ Scholarships funded from the state budget;

+ Scholarships funded by domestic and foreign organizations under the educational support programs of those organizations.

- Income from compensation of life insurance contracts, non-life insurance, compensation for labor accidents, state compensation, and other compensations as prescribed by law.

- Income received from charitable funds licensed or recognized by competent state agencies, operating for charitable, humanitarian, non-profit purposes.

- Income received from foreign aid for charity and humanitarian purposes in the template of government and non-governmental aid approved by competent state agencies.

- Income from salaries and wages of Vietnamese seafarers working for foreign shipping lines or Vietnamese shipping lines conducting international transportation.

- Income of individuals as ship owners, individuals using ships and individuals working on ships from the direct supply of goods and services to support offshore fishing activities.