What are the instructions for retrieving the forgotten password used to log in to the eTax Mobile application in Vietnam?

What are the instructions for retrieving the forgotten password used to log in to the eTax Mobile application in Vietnam?

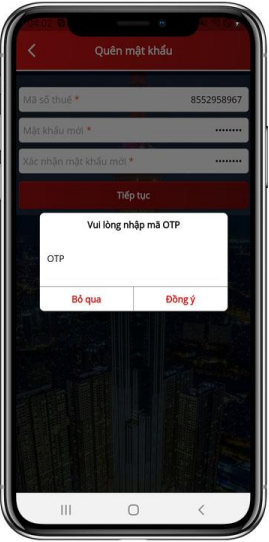

- Step 1: On the login screen, select "forget password". The system will display a screen that allows the user to retrieve the login password, including the following information: Tax Identification Number, New Password, and Confirm New Password.

- Step 2: The user enters all the information: Tax Identification Number, New Password, Confirm New Password, and clicks "Continue". The system will display an OTP authentication code input screen (the OTP code is sent to the phone number registered in the Electronic Tax System - personal module).

- Step 3: The user correctly enters the OTP authentication code and clicks Agree. The system displays a notification screen stating "successful change of password".

Note: The above information is for reference only.

What is the eTax Mobile application in Vietnam?

Currently, legal documents do not define the eTax Mobile application. You may refer to the following definition:

eTax Mobile is an electronic tax application installed on smartphones with IOS or Android operating systems, which allows individuals, business individuals, and households to query tax declarations at any time, anywhere on devices with 3G/4G/WiFi/GPRS connections.

What are the instructions for retrieving the forgotten password used to log in to the eTax Mobile application in Vietnam? (Image from the Internet)

What are the principles of e-tax transactions in Vietnam?

The principles of electronic tax transactions are stipulated in Article 4 of Circular 19/2021/TT-BTC as follows:

- Every taxpayer conducting e-tax transactions has the ability to access and use the Internet; has an email address or digital signature under Article 7 of Circular 19/2021/TT-BTC or a mobile phone number issued by a telecommunications company in Vietnam (in the case of an individual that has yet to be issued a digital certificate) already registered for use in transactions with the tax authority unless the taxpayer pays tax electronically as prescribed in Point dd Clause 2 Article 4 of Circular 19/2021/TT-BTC under regulations of a bank or IPSP.

- Taxpayers may conduct e-tax transactions through:

+ The GDT’s web portal.

+ The National Public Service Portal or web portal of the Ministry of Finance connected to the GDT’s web portal.

+ Web portals of other competent authorities (except for those in Point b of this Clause) connected to the GDT’s web portal.

+ T-VAN service providers accepted by GDT to connect with its web portal.

+ E-payment services of banks or IPSPs for the purpose of e-tax payment.

- An e-tax transaction method shall be registered as follows:

+ Any taxpayer that conducts e-tax transactions through the GDT’s web portal shall register e-tax transactions as prescribed in Article 10 of Circular 19/2021/TT-BTC.

+ Any taxpayer that conducts e-tax transactions through National Public Service Portal or web portal of the Ministry of Finance connected to the GDT’s web portal shall register e-tax transactions under the guidance of the system administrator.

+ Any taxpayer that conducts e-tax transactions through National Public Service Portal or web portal of the Ministry of Finance connected to the GDT’s web portal shall register e-tax transactions under the guidance of the competent authority.

+ Any taxpayer that conducts e-tax transactions through a T-VAN service provider accepted by GDT to connect with its web portal shall register e-tax transactions as prescribed in Article 42 of Circular 19/2021/TT-BTC.

Within the same period of time, the taxpayer may only select to register to implement one of the tax administrative procedures specified in Point a Clause 1 Article 1 of Circular 19/2021/TT-BTC via the GDT’s web portal, National Public Service Portal, web portal of the Ministry of Finance or a T-VAN service provider (except for the case specified in Article 9 of Circular 19/2021/TT-BTC).

dd) Any taxpayer that selects to pay tax electronically through the e-payment service of a bank or IPSP shall carry out registration under the guidance of such bank or IPSP.

+ Any taxpayer that has registered transactions with the tax authority by electronic means shall conduct transactions with such tax authority according to Clause 1 Article 1 of Circular 19/2021/TT-BTC by electronic means, except for the cases in Article 9 of Circular 19/2021/TT-BTC.

- An e-tax transaction method shall be changed as follows:

+ Any taxpayer that has registered the e-tax transaction method as specified in Point b Clause 3, Article 4 of Circular 19/2021/TT-BTC is entitled to conduct e-tax transactions adopting the method mentioned in Point a Clause 2 of this Article without necessarily carrying out the registration as prescribed in Point a Clause 3 of this Article.

+ Any taxpayer that has registered the e-tax transaction method as specified in Point d Clause 3 of Article 4 of Circular 19/2021/TT-BTC shall upon changing the e-tax transaction method specified in Point a or b Clause 2 of this Article unregister from the e-tax transaction method as prescribed in Point d Clause 3 of this Article and register the e-tax transaction method as prescribed in Point a or b Clause 3 of this Article.

+ Any taxpayer that has registered the e-tax transaction method as specified in Point c or d Clause 3 of Article 4 of Circular 19/2021/TT-BTC shall upon changing the e-tax transaction method specified in Point a or b Clause 2 of Article 4 of Circular 19/2021/TT-BTC register the e-tax transaction method as prescribed in Point a or b Clause 3 of Article 4 of Circular 19/2021/TT-BTC.

- Every taxpayer shall prepare and submit e-tax dossiers and e-state budget payment documents by adopting any of the following methods:

+ Prepare an e-tax dossier or e-state budget payment document on the GDT’s web portal/web portal of a competent authority/through a T-VAN service provider:

++ The taxpayer shall access the GDT’s web portal/web portal of a competent authority/web portal of a T-VAN service provider and prepare the e-tax dossier or e-state budget payment document on the web portal selected, e-sign and send them to the tax authority.

++ The T-VAN service provider shall transfer the e-tax dossier or e-state budget payment document to the GDT’s web portal as prescribed in Point b Clause 1 Article 46 of Circular 19/2021/TT-BTC.

+ Regarding a tax declaration dossier, the taxpayer is entitled to select the method of preparing the tax declaration dossier with software or a support tool of the tax authority or that of the taxpayer satisfying data format standards of the tax authority; then accesses the web portal selected, e-sign and send the tax declaration dossier to the tax authority.

+ Where the taxpayer pays tax electronically through e-payment service of a bank or IPSP, such taxpayer shall access the information exchange portal of the bank or IPSP and create the state budget payment document under the guidance of the bank or IPSP. The bank or IPSP shall transfer the information about e-tax payment by the taxpayer to the GDT’s web portal as prescribed in Article 21 of Circular 19/2021/TT-BTC.

- Each taxpayer shall receive notifications and results of processing of their e-tax dossiers from the tax authority by electronic means through the web portal which the taxpayer selected when preparing and sending their e-tax dossiers as prescribed in Clause 5 of Article 4 of Circular 19/2021/TT-BTC, regularly check their email and messages sent to the mobile phone number registered with the tax authority, log into their e-tax transaction account on the GDT’s web portal to search, view and print decisions, notifications and documents already sent by the tax authority to the taxpayer, respond to and comply with the contents and requirements on the decisions, notifications and documents sent by the tax authority by electronic means in the same manner as physical decisions, notifications and documents of the tax authority.

The taxpayer shall bear responsibility for the cases where they fail to check or read tax authority’s notifications and documents at their e-tax transaction account, email address and messages, including where they are cannot enter the GDT’s web portal due to a technical error in the taxpayer’s infrastructure system or equipment or due to an inaccurate email address registered by the taxpayer with the tax authority.

- Taxpayers, tax authorities and other relevant organizations and individuals that have finished making e-tax transactions according to regulations of Circular 19/2021/TT-BTC are not required to apply other transaction methods and are considered having completed the corresponding tax procedures under the Tax Administration Law 2019.