What are the instrcutions for logging in to the eTax Mobile application in Vietnam?

What are the instrcutions for logging in to the eTax Mobile application in Vietnam?

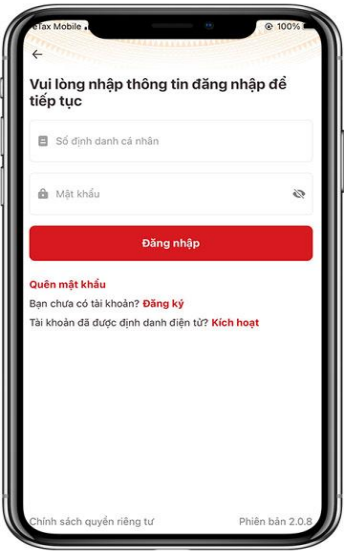

* Case 1: Logging in with a password

- Step 1:

On the login screen, enter the correct TIN and login password (account registered on the Electronic Tax system - module for individuals), then click Login.

- Step 2:

In the case of logging in on a new device for the first time, the system displays the OTP verification code entry screen (the OTP code is sent to the phone number registered on the Electronic Tax system - module for individuals)

- Step 3:

User enters the correct OTP code, clicks Agree. The system displays the home screen allowing the user to use the application's functions.

* Case 2: Logging in with fingerprint/FaceID (a condition that the user has registered fingerprint/FaceID on the eTax mobile application)

On the login screen, enter the TIN then select the fingerprint icon. The system displays the fingerprint check screen to log in.

* Case 3: Logging in with an electronic identity account

- Step 1:

On the login screen, click the icon for logging in with an Electronic Identity account.

- Step 2.1:

In case the user has not downloaded the VNeID app, the app VNeID is displayed on the App Store or CH Play. The user downloads the VNeID app to their phone.

- Step 2.2:

In case the user has downloaded the VNeID app, the login screen of the VNeID app is displayed. The user enters their Personal Identification Number, and password, and clicks Login.

- Step 3.1:

In case the user is an individual not engaged in business, the system automatically displays the home screen interface of the eTax Mobile application.

- Step 3.2:

In case the user is an individual engaged in business with multiple business locations (if any), the eTax Mobile interface allows selecting the TIN to log in.

- Step 4:

The user selects the TIN to log in from the list:

- Click Skip: Closes the "Please select TIN" notification screen. Displays login screen.- Click Agree: Displays the eTax Mobile home screen corresponding to the selected TIN.

Where to download the eTax Mobile application?

- For the Android operating system, the eTax Mobile application can be downloaded on CH Play.

- For the iOS operating system, the eTax Mobile application can be downloaded on the App Store.

What are the instrcutions for logging in to the eTax Mobile application in Vietnam? (Image from Internet)

What are the regulations on registration of the e-tax transaction method in Vietnam?

According to Clause 3, Article 4 of Circular 19/2021/TT-BTC, an e-tax transaction method shall be registered as follows:

- Any taxpayer that conducts e-tax transactions through the GDT’s web portal shall register e-tax transactions as prescribed in Article 10 of Circular 19/2021/TT-BTC.

- Any taxpayer that conducts e-tax transactions through National Public Service Portal or web portal of the Ministry of Finance connected to the GDT’s web portal shall register e-tax transactions under the guidance of the system administrator.

- Any taxpayer that conducts e-tax transactions through National Public Service Portal or web portal of the Ministry of Finance connected to the GDT’s web portal shall register e-tax transactions under the guidance of the competent authority.

- Any taxpayer that conducts e-tax transactions through a T-VAN service provider accepted by GDT to connect with its web portal shall register e-tax transactions as prescribed in Article 42 of Circular 19/2021/TT-BTC.

Within the same period of time, the taxpayer may only select to register to implement one of the tax administrative procedures specified in Point a Clause 1 Article 1 of Circular 19/2021/TT-BTC via the GDT’s web portal, National Public Service Portal, web portal of the Ministry of Finance or a T-VAN service provider (except for the case specified in Article 9 of Circular 19/2021/TT-BTC).

- Any taxpayer that selects to pay tax electronically through the e-payment service of a bank or IPSP shall carry out registration under the guidance of such bank or IPSP.

- Any taxpayer that has registered transactions with the tax authority by electronic means shall conduct transactions with such tax authority according to Clause 1 Article 1 of Circular 19/2021/TT-BTC by electronic means, except for the cases in Article 9 of Circular 19/2021/TT-BTC.

What are the methods of conducting e-tax transactions in Vietnam?

According to Clause 2, Article 4 of Circular 19/2021/TT-BTC, taxpayers may conduct e-tax transactions through:

- The GDT’s web portal.

- The National Public Service Portal or web portal of the Ministry of Finance connected to the GDT’s web portal.

- Web portals of other competent authorities (except for those in Point b of this Clause) connected to the GDT’s web portal.

- T-VAN service providers accepted by GDT to connect with its web portal.

- E-payment services of banks or IPSPs for the purpose of e-tax payment.