What are the first 6 characters of a value-added tax invoice in Vietnam?

What are the first 6 characters of a value-added tax invoice in Vietnam?

Based on Clause 2, Article 4 of Circular 78/2021/TT-BTC which stipulates the symbols for invoices printed by the Tax Department as follows:

Form number, reference number, names of copies of an invoice

...

2. Invoices printed by the Tax Department

a) The form number for invoices printed by the Tax Department is a group of 11 characters representing information about: the type of invoice, the number of duplicates, the order number of the form within an invoice type (an invoice type can have multiple forms). Specifically:

- The first six (06) characters represent the type of invoice:

+ 01GTKT: Value-added tax invoice;

+ 02GTTT: Sales invoice;

+ 07KPTQ: Sales invoice for organizations and individuals in the non-tariff zone;

+ 03XKNB: Internal transport voucher;

+ 04HGDL: Delivery note for consignment sales to the agent.

- One (01) following character is the natural numbers 1, 2, 3 indicating the number of duplicates of the invoice;

- One (01) following character is “/” as a separator;

- Three (03) following characters are the order number of the form within a type of invoice, starting from 001 to a maximum of 999.

b) The symbol of the invoice printed by the Tax Department comprises a group of 08 characters indicating information about: the Tax Department printing the invoice; the year of printing the invoice; the invoice symbol defined by the tax authority based on management needs. Specifically:

- The first two (02) characters indicate the code of the Tax Department printing the invoice and are determined according to Appendix I.A issued together with this Circular;

- The following two (02) characters are two uppercase letters among 20 letters of the Vietnamese alphabet including: A, B, C, D, E, G, H, K, L, M, N, P, Q, R, S, T, U, V, X, Y representing the invoice symbol defined by the tax authority based on management needs;

- One (01) following character is “/” as a separator;

- The last three (03) characters include the first two (02) characters as Arabic numerals representing the year the Tax Department printed the invoice, determined according to the last 02 digits of the calendar year, and one (01) character is the letter P representing the invoice printed by the Tax Department. Example: if the Tax Department prints the invoice in 2022, it is represented as 22P; if the Tax Department prints the invoice in 2023, it is shown as 23P;

- Example illustrating the characters of the form symbol of the invoice printed by the Tax Department and the invoice symbol printed by the Tax Department:

form invoice symbol “01GTKT3/001”, Invoice symbol “01AA/22P”: is understood as form number 001 of the value-added tax invoice with 3 duplicates printed by the Tax Department of Hanoi city in 2022.

c) Invoices printed by the Tax Department consist of sheets within the same invoice number. Each invoice number has 3 duplicates in which:

- Duplicate 1: Retained;

- Duplicate 2: Given to the buyer;

- Duplicate 3: Internal.

d) The form number for invoices such as stamps, tickets, cards printed by the Tax Department consists of 03 characters to distinguish whether the stamp, ticket, card belongs to the value-added invoice or the sales invoice as follows:

- Symbol 01/: for stamps, tickets, cards belonging to the VAT invoice type;

- Symbol 02/: for stamps, tickets, cards belonging to the sales invoice type.

Thus, it can be seen that the first 6 characters representing a value-added tax invoice are 01GTKT.

What are the first 6 characters of a value-added tax invoice in Vietnam? (Image from the Internet)

Can international transportation activities use value-added tax invoices?

Based on Clause 1, Article 8 of Decree 123/2020/ND-CP which stipulates the types of invoices as follows:

Type of invoice

Invoices stipulated in this Decree include the following types:

1. The value-added tax invoice is intended for organizations declaring value-added tax according to the deduction method for activities such as:

a) Sales of goods and provision of services domestically;

b) International transportation activities;

c) Export into the non-tariff zone and cases deemed as export;

d) Export of goods, provision of services abroad.

2. The sales invoice is for organizations and individuals such as:

a) Organizations and individuals declaring and calculating value-added tax according to the direct method for activities such as:

- Sales of goods and provision of services domestically;

- International transportation activities;

- Export into the non-tariff zone and cases deemed as export;

- Export of goods, provision of services abroad.

b) Organizations and individuals in the non-tariff zone when selling goods, providing services domestically, and when selling goods, providing services between organizations and individuals in the non-tariff zone with each other, providing services abroad, the invoice notes “For organizations and individuals in the non-tariff zone.”

3. The electronic invoice for selling public assets is used when selling the following assets:

a) Public assets at agencies, organizations, units (including state-owned housing);

b) Infrastructure assets;

c) Public assets managed by enterprises without considering them part of state capital in the enterprise;

d) Assets of projects using state capital;

đ) Assets assigned ownership to the whole people;

e) Public assets confiscated under a decision by competent authorities;

g) Supplies and materials reclaimed from handling public assets.

4. The electronic invoice for selling national reserve goods is used when state reserve agencies or units sell national reserve goods according to legal regulations.

5. Other types of invoices include:

a) Stamps, tickets, cards with the form and content prescribed in this Decree;

b) Receipts of international transport service fees; receipts of bank service fees, except for those prescribed in point a of this clause, with form and content established according to international practice and relevant legal regulations.

6. Documents printed, issued, used, and managed like invoices including internal transport vouchers, delivery notes for consignment sales to agents.

7. The Ministry of Finance guides the display forms of various types of invoices for the subjects referred to in Article 2 of this Decree to refer to during implementation.

Thus, based on the provisions, international transportation activities; are among the activities that will use value-added tax invoices when organizations declare value-added tax according to the deduction method.

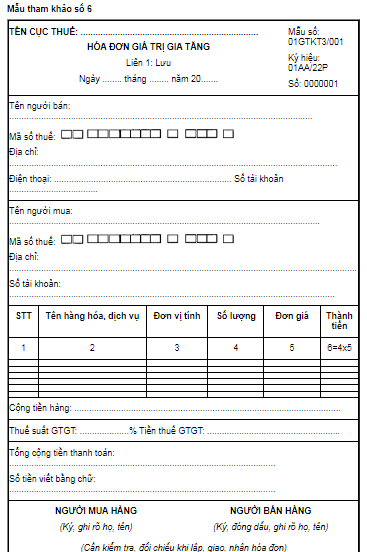

Which value-added tax invoice form is issued by the Tax Department of Vietnam?

Based on Appendix 2, The forms of electronic invoices/receipts for reference display issued together with Circular 78/2021/TT-BTC is Reference form No. 6 as follows:

Download the full value-added tax invoice form issued by the Tax Department