What are the cases of tax dossier supplementation by enterprises in Vietnam?

What are the cases of tax dossier supplementation by enterprises in Vietnam?

Under Clauses 1, 2, and 3 of Article 47 of the Law on Tax Administration 2019, enterprises must supplement their personal income tax declaration dossiers in the following specific cases:

- In case the tax declaration dossier submitted to the tax authority is erroneous or inadequate, supplementary documents may be provided within 10 years from the deadline for submission of the erroneous or inadequate tax declaration dossier but before the tax authority or a competent authority announces a decision on tax document examination.

- When the tax authority or competent authority has announced the decision on tax inspection or tax audit on the taxpayer’s premises, the taxpayer is still allowed to provide supplementary documents; the tax authority shall impose administrative penalties for:

+ understatement of tax payable or overstatement of tax eligible for refund, remission or cancellation specified in Article 142 of Law on Tax Administration 2019

+ tax evasion specified in Article 143 of Law on Tax Administration 2019.

- After the tax authority or competent authority issues a conclusion or tax decision when the inspection is done:

+ The taxpayer may provide supplementary tax documents if they increase the tax payable or reduce the deductible tax, exempted tax or refundable tax, and shall face administrative penalties for the violations specified in Article 142 and Article 143 of Law on Tax Administration 2019;

+ If the supplementation leads to a decrease in the tax payable or an increase in the deductible tax, exempted tax or refundable tax, the taxpayer shall follow procedures for filing tax-related complaints.

What are the cases of tax dossier supplementation by enterprises in Vietnam? (Image from the Internet)

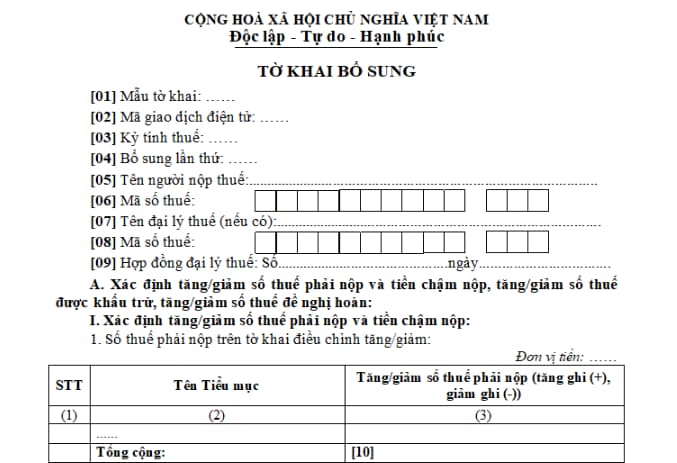

What is the supplementary tax declaration form in Vietnam?

The latest supplementary tax declaration form is Form No. 01/KHBS in Appendix 2 issued together with Circular 80/2021/TT-BTC:

>> Download the latest supplementary tax declaration form: Download

What is the deadline for tax payment in case of tax dossier supplementation in Vietnam?

Under Article 55 of the Law on Tax Administration 2019:

Tax payment deadlines

1. In case tax is calculated by the taxpayer, the tax payment deadline is the deadline for submission of the tax declaration dossier. In case of submission of supplementary tax documents, the tax payment deadline is the deadline for submission of the erroneous tax declaration dossier.

The deadline for paying corporate income tax, which is paid quarterly, is the 30th of the first month of the next quarter.

The deadline for paying resource royalty and corporate income tax on crude oil is 35 days from the date of selling domestically or the date of customs clearance in case of export.

Resource royalty and corporate income tax on natural gas shall be paid monthly.

2. In case tax is calculated by the tax authority, the tax payment deadline shall be specified in the tax authority’s notice.

3. The deadlines for paying other amounts payable to state budget from land, grant of the right to water resource extraction or mineral extraction, registration fees and licensing fees shall be specified by the Government.

4. For taxable exports and imports, deadlines for tax payment are specified in the Law on Export and import duties. In case tax is incurred after customs clearance or conditional customs clearance:

...

For tax dossier supplementation in Vietnam, the tax payment deadline is the deadline for submitting the tax declaration dossier of the tax period in which the error occurred.