What are the cases in which employees may authorize PIT finalization in Vietnam?

What are the cases in which employees may authorize PIT finalization in Vietnam?

According to the provisions at point d, clause 6, Article 8 of Decree 126/2020/ND-CP, residents with income from salaries and remunerations can authorize the PIT finalization to income payers if they fall into the following cases:

- The salary earner has an employment contract with duration of at least 03 months and is working for the salary payer in reality when the tax is finalized by the salary payer, even if the salary earner has not worked for full 12 months in the year.

In case the salary earner is reassigned to a new organization after acquiring, consolidating, dividing or converting the old organization, he/she may authorize the new organization to finalize tax.

- The salary earner has an employment contract with a duration of at least 03 months and is working for the salary payer in reality when tax is finalized by the salary payer, even if the salary earner has not worked for full 12 months in the year, and earns an average monthly irregular income not exceeding 10 million VND which on which 10% personal income tax has been deducted and does not wish to have this income included in the tax finalization dossier.

- Individuals who are foreign nationals ending their working contracts in Vietnam must declare tax finalization with the tax authorities before leaving the country.

In case the individual has not completed the tax finalization procedures with the tax authorities, they must authorize the imcome payer or another organization or individual to finalize the tax according to the regulations on tax finalization for individuals.

In case the imcome payer, another organization or individual receives the authorization to finalize the tax, they must take responsibility for the additional personal income tax to be paid or the refund of excessive tax paid by the individual.

What are the cases in which employees may authorize PIT finalization in Vietnam? (Image from the Internet)

What is the authorization letter form for PIT finalization in Vietnam?

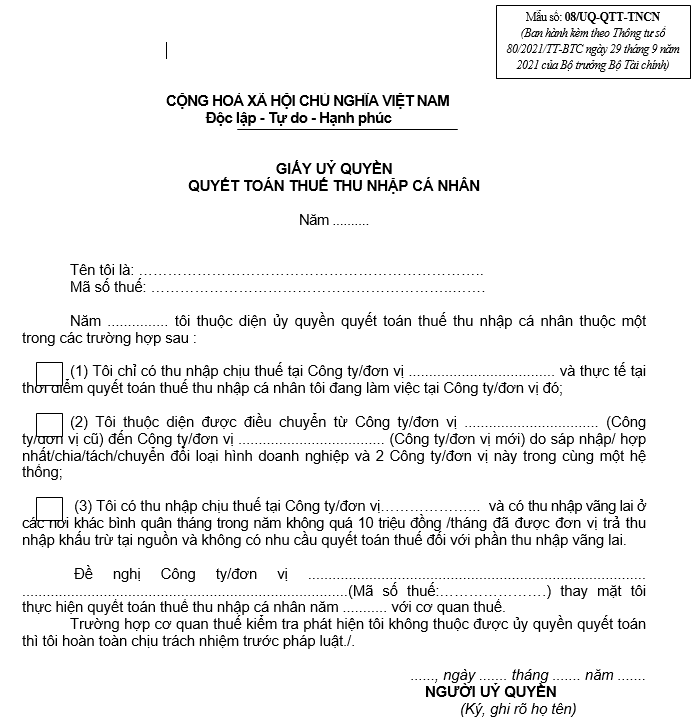

The authorization letter form for PIT finalization is Form 08/UQ-QTT-TNCN issued with Circular 80/2021/TT-BTC as follows:

Download the authorization letter form for PIT finalization: Here

How to fill out the authorization letter form for PIT finalization:

+ Year: Fill in the year for authorizing the PIT finalization;

+ My name is: Enter the full name;

+ Tax code: Enter your tax code;

+ Year… I belong to…: Enter the year for authorizing the PIT finalization.

+ Square box: Choose 01 of the 3 boxes corresponding to the following cases:

If you only have income from 1 company or unit, choose the first box;

If you belong to the case of being transferred from the previous company/unit to a new company/unit due to merger/consolidation/division/separation/conversion of the type of business and these two companies/units are part of the same system, choose the second box;

If you have income from the place authorizing the tax finalization and have occasional income from other places with an average monthly income not exceeding 10 million VND/month, which has been withheld at source by the income-paying unit and you do not wish to finalize the tax for the occasional income, then choose the third box.

+ Request the company/unit: Clearly state the name of the company/unit (place authorizing the tax finalization).

+ (Tax code:.....): Enter the tax code of the name of the company/unit (place authorizing the tax finalization).

+ I finalize the personal income tax for the year ........... with the tax authorities: Enter the year for the authorized personal income tax finalization.

+ Date/month/year: Enter the date/month/year of making the authorization form for personal income tax finalization.

What are the procedures for authorizing the PIT finalization in Vietnam?

To authorize the PIT finalization, the taxpayer needs to follow the following 02 steps:

- Step 1: Prepare the authorization letter form for tax finalization.

To authorize the income payer to finalize the tax on behalf of the taxpayer, download and fully fill in the information according to the authorization letter form for personal income tax finalization (form 08/UQ-QTT-TNCN issued together with Circular 80/2021/TT-BTC).

- Step 2: Send the fully completed authorization letter form to the income payer.