What are the 7 issues regarding licensing fees in Vietnam in 2025?

What is a licensing fee?

Previously, the licensing fee was referred to as a business license tax. The business license tax was initially mentioned in Resolution 200-NQ/TVQH regarding the imposition of industrial and commercial tax for cooperatives, cooperative organizations, and individual households engaged in industry and commerce in 1966; clearly stipulated in Ordinance 10-LCT/HDNN7 amending certain provisions on industrial and commercial tax in 1983 issued by the State Council.

From January 1, 2017, the Government of Vietnam enacted Decree 139/2016/ND-CP prescribing the licensing fee, wherein the term "business license tax" was replaced by "licensing fee".

Currently, there is no document specifically defining the term "licensing fee". However, based on Clause 2, Article 3 of the 2015 Law on Fees and Charges, a fee is a specified amount an organization or individual must pay when a State agency provides public services or facilitates State management tasks. Thus, it can be understood that a licensing fee is the amount that organizations and individuals engaged in the production, trading of goods, and service activities must pay to engage in these activities.

Therefore, a licensing fee is the amount of money that organizations and individuals engaged in the production, trading of goods, and service activities must pay to meet the conditions for production and trading; the licensing fee is paid annually.

What are the 7 issues regarding licensing fees in Vietnam in 2025?

The licensing fee is one of the key taxes that businesses need to thoroughly understand to comply with the law and avoid unnecessary risks. Notably, in 2025 there might be significant changes or updates related to this fee.

Below is the most detailed summary of 7 issues regarding the licensing fee in 2025:

(1) Who is required to pay the licensing fee in 2025?

According to Article 2 of Decree 139/2016/ND-CP, the subjects required to pay the 2025 licensing fee are organizations and individuals engaging in the production and trading of goods and services (except for the cases specified in Article 3 of Decree 139/2016/ND-CP) for the cases exempted from the licensing fee, including:

- Enterprises established under the law.

- Organizations established under the Cooperative Law.

- Public service units established according to legal provisions.

- Economic organizations of political organizations, socio-political organizations, social organizations, occupational organizations, and people's armed units.

- Other organizations engaging in production and business activities.

- Branches, representative offices, and business locations of the above organizations (if any).

- Individuals, groups of individuals, and households engaging in production and business activities.

(2) Which cases are exempt from licensing fees in 2025?

According to Article 3 of Decree 139/2016/ND-CP (supplemented by Clause 1, Article 1 of Decree 22/2020/ND-CP), the cases exempt from the 2025 licensing fee include:

- Individuals, groups of individuals, households engaging in production and business activities with an annual revenue of 100 million VND or less.

- Individuals, groups of individuals, households engaging in irregular production and business activities; without permanent locations as guided by the Ministry of Finance.

- Individuals, groups of individuals, households engaged in salt production.

- Organizations, individuals, groups of individuals, households engaged in aquaculture, fishing, and fishery ancillary services.

- Commune cultural post offices; press agencies (printed newspapers, radio, television, electronic newspapers).

- Cooperatives, cooperative federations (including branches, representative offices, and business locations) engaged in agriculture as stipulated by the legal provisions on agricultural cooperatives.

- People's credit funds; branches, representative offices, business locations of cooperatives, cooperative federations, and private enterprises operating in mountain areas. The mountainous areas are determined according to regulations by the Committee for Ethnic Minority Affairs.

- Exempt from the licensing fee in the first year of establishment or business operation (from January 01 to December 31) for:

+ Newly established organizations (granted new tax identification numbers, new enterprise codes).

+ Households, individuals, groups of individuals first engaging in production and business activities.

+ During the period exempt from the licensing fee, if organizations, households, individuals, groups of individuals establish branches, representative offices, business locations, these entities are exempt from the licensing fee as long as the main entity is exempt.

- Small and medium enterprises transitioning from household businesses are exempt from the licensing fee for 3 years from the date of initial enterprise registration certificate issuance.

+ During the exemption period, if small and medium enterprises establish branches, representative offices, or business locations, these entities are exempt from the licensing fee during the period of exemption granted to small and medium enterprises.

+ Branches, representative offices, business locations of small and medium enterprises (eligible for licensing fee exemption under Article 16 of the 2017 Law on Support for Small and Medium Enterprises) established before this Decree came into effect, the exemption period is calculated from the date this Decree takes effect to the end of the licensing fee exemption period for small and medium enterprises.

+ Small and medium enterprises transitioning from household businesses prior to this Decree taking effect shall follow the licensing fee exemption according to Articles 16 and 35 of the 2017 Law on Support for Small and Medium Enterprises.

- Public primary educational institutions and public preschool educational institutions.

(3) What is the licensing fee rate in 2025?

According to Article 4 of Decree 139/2016/ND-CP (amended and supplemented by Clause 2, Article 1 of Decree 22/2020/ND-CP), the rates for the licensing fee in 2025 are as follows:

licensing fee rates for organizations engaged in the production and business of goods and services are as follows:

+ Organizations with charter capital or investment capital over 10 billion VND: 3,000,000 VND/year;+ Organizations with charter capital or investment capital of 10 billion VND or less: 2,000,000 VND/year;+ Branches, representative offices, business locations, public service providers, other economic organizations: 1,000,000 VND/year.

The licensing fee for organizations with charter capital or investment capital over 10 billion VND and organizations with charter capital or investment capital of 10 billion VND or less is based on the charter capital stated in the business registration certificate; in the absence of charter capital, it is based on the investment capital stated in the investment registration certificate.

licensing fee rates for individuals, households engaged in the production and business of goods and services are as follows:

+ Individuals, groups of individuals, households with revenue over 500 million VND/year: 1,000,000 VND/year;+ Individuals, groups of individuals, households with revenue over 300 million to 500 million VND/year: 500,000 VND/year;+ Individuals, groups of individuals, households with revenue over 100 million to 300 million VND/year: 300,000 VND/year.

+ Revenue for determining the licensing fee rate for individuals, groups of individuals, households follows the guidance of the Ministry of Finance.

Small and medium enterprises transitioning from household businesses (including branches, representative offices, business locations) after the exemption period (fourth year from the date of enterprise establishment): if ending in the first six months of the year, the full annual licensing fee is paid; if ending in the last six months, 50% of the full annual licensing fee is paid.

Households, individuals, groups of individuals that have dissolved but resume production and business activities within the first six months of the year pay the full annual licensing fee; if resuming in the last six months, 50% of the full annual licensing fee is paid.

Note:

- For organizations with charter capital or investment capital over 10 billion VND and organizations with charter capital or investment capital of 10 billion VND or less that undergo changes in charter capital or investment capital, the basis for determining the licensing fee rate is the charter capital or investment capital of the previous year.

In cases where charter capital or investment capital is recorded in foreign currency in the business registration certificate or investment registration certificate, it must be converted to Vietnamese dong based on the buying exchange rate of the commercial bank or credit institution where the licensing fee payer holds an account at the time the fee is paid into the state budget.

- licensing fee payers that are still operational must send a written notice to their tax authority regarding the temporary suspension of production and business activities within the calendar year to be exempt from the licensing fee for the suspension year, provided the notification is submitted before the fee due date (January 30 annually) and the licensing fee for the year of suspension has not been paid.

If the temporary suspension of production and business activities does not meet the above conditions, then the full annual licensing fee must be paid.

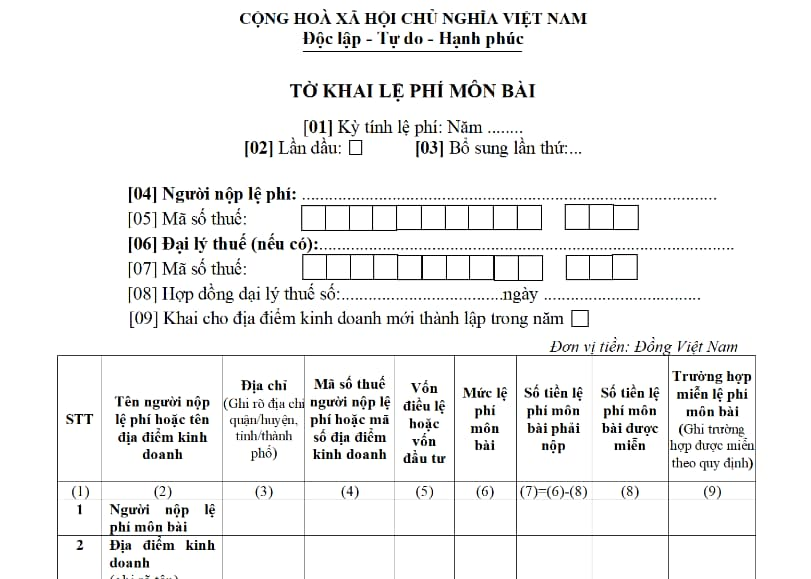

(4) What is the latest licensing fee declaration form for 2025?

Based on the Appendix issued with Circular 80/2021/TT-BTC, Form 01/LPMB is the prescribed form for the licensing fee declaration.

The latest 2025 licensing fee declaration form 01/LPMB is as follows:

Download Form 01/LPMB licensing fee Declaration: Here

(5) Guidance on how to fill in the 2025 licensing fee declaration form?

Below is guidance on how to fill in the latest 2025 licensing fee declaration form:

[1] Declare the year for which the licensing fee is calculated.

[2] Select only for the first declaration.

[3] Fill only in cases where a taxpayer has already submitted the declaration but then discovers changes in declaration obligations and resubmits the information for the declared period.

Note, the taxpayer must select only one of either item [02] or [03], not both at the same time.

[4] Fill in information according to the taxpayer registration of the taxpayer.

[5] Fill in information according to the taxpayer registration of the taxpayer.

[6] Fill in information of the tax agent (if any).

[7] Fill in information of the tax agent (if any).

[8] Fill in information of the tax agent (if any).

[9] Select only in cases where the taxpayer has declared the licensing fee and subsequently establishes a new business location.

(6) When is the deadline for submitting the 2025 licensing fee?

Based on Clause 9, Article 18 of Decree 126/2020/ND-CP, the deadline for submitting the 2025 licensing fee is as follows:

Deadline for tax payments for amounts owed to the state budget from land, water resource exploitation rights, mineral resource rights, the use of marine areas, registration fees, and licensing fees:

...

9. licensing fee:

a) The deadline for submitting the licensing fee is no later than January 30 each year.

b) For small and medium enterprises transitioning from household businesses (including dependent units and business locations of the enterprise) when the exemption period ends (the fourth year since the enterprise's establishment), the licensing fee deadline is:

...

Furthermore, based on Article 86 of Circular 80/2021/TT-BTC regarding the deadline for submitting tax returns and tax payments is as follows:

Deadline for submitting tax returns and tax payments

The deadline for submitting tax returns follows the provisions of Clauses 1, 2, 3, 4, 5 of Article 44 of the Law on Tax Administration and Article 10 of Decree No. 126/2020/ND-CP. The deadline for tax payment is implemented according to the provisions of Clauses 1, 2, 3 of Article 55 of the Law on Tax Administration and Article 18 of Decree No. 126/2020/ND-CP. If the deadline for submitting tax returns and tax payments coincides with a day off, the deadline is the next working day following the day off according to the provisions of the Civil Code.

Thus, the deadline for submitting the 2025 licensing fee falls on January 30, 2025. However, January 30, 2025, coincides with the 2025 Lunar New Year holiday (Second Day of the Lunar New Year, 2025), so the deadline for the 2025 licensing fee will move to the next working day, February 3, 2025.

Note:

- For small and medium enterprises transitioning from household businesses (including dependent units and business locations of the enterprise) when the exemption period ends (the fourth year since the enterprise's establishment), the licensing fee deadline is:

+ If the exemption period ends in the first six months of the year, the licensing fee must be submitted no later than July 30 of the exemption-ending year.

+ If the exemption period ends in the last six months of the year, the licensing fee must be submitted no later than January 30 of the following year.

- For household businesses, individual businesses that have ceased production and business activities but later resume, the licensing fee deadline is:

+ If resuming in the first six months of the year: No later than July 30 of the resumption year.

+ If resuming in the last six months of the year: No later than January 30 of the following year.

(7) How much is the late payment penalty for enterprises not paying the licensing fee?

According to Clause 2, Article 59 of the 2019 Law on Tax Administration, penalties for late tax payments are regulated as follows:

Handling late tax payments

...

- The calculation of penalties for late payments and the duration of penalty calculation are prescribed as follows:

a) The penalty rate for late payments is 0.03%/day calculated on the outstanding tax amount;

b) The duration for calculating late payment penalties is continuous from the day following the date of the late payment's occurrence specified in Clause 1 of this Article until the day before the outstanding tax amount, tax refund recovery, additional tax, imposed tax, deferred tax are fully paid to the state budget.

...

Therefore, according to this regulation, enterprises delaying the licensing fee payments are penalized according to the following calculation formula:

Late payment amount = Outstanding licensing fee x 0.03% x Number of late daysNote: The late payment interest is calculated continuously from the day following the day on which the late payment occurs, as stipulated in Clause 1, Article 59 of the Law on Tax Administration 2019, until the day immediately preceding the day on which the tax debt, recovered tax refund, increased tax amount, assessed tax, and late transfer tax have been paid into the state budget.

What are the 7 issues regarding licensing fees in Vietnam in 2025? (Image from the Internet)

Is the licensing fee declared monthly, quarterly, or annually in Vietnam?

Based on Clause 3, Article 8 of Decree 126/2020/ND-CP which regulates the types of taxes declared monthly, quarterly, annually, upon each tax obligation occurrence, and at the time of finalizing the tax settlement as follows:

Types of taxes declared monthly, quarterly, annually, upon the occurrence of tax obligations, and tax settlement finalization

...

3. Types of taxes and other collections belonging to the state budget declared annually, include:

a) licensing fees.

b) Personal income tax for individuals acting as lottery agents, insurance agents, or multi-level marketers who have not been withheld during the year because they did not reach the taxable threshold, but by the end of the year, it is determined they are liable for tax.

...

Thus, the licensing fee is a type of tax declared annually.