What are the 6 groups of criteria for assessment of the tax law compliance of taxpayers in Vietnam?

In the procedures for applying risk management in Vietnam, which step is the assessment of compliance with the law?

Based on Article 6 of Circular 31/2021/TT-BTC regulating the sequence of application of tax risk management as follows:

Step 1. assess the situation, identify goals and risk management requirements

The tax authority reviews the risks and common violations of taxpayers in implementing the provisions of Article 17 of the Law on Tax Administration 2019 or current regulations to identify major risks that need to be addressed, high-risk taxpayers, and handling direction.

Step 2. Organize the collection and processing of risk management information

Risk management information is collected and processed according to the regulations in Chapter II of this Circular.

In case incorrect or incomplete information is detected during the risk analysis process, the taxpayer is responsible for providing, explaining, or supplementing information and documents as required and within the time limit notified by the tax authority to ensure the accurate assessment of tax law compliance and risk classification of taxpayers.

Step 3. Establish and update indicators to analyze and assess tax law compliance and classify the level of taxpayer risk

Based on the results of situation assessment, goal identification, and risk management requirements as prescribed in Clause 1, Article 6 of Circular 31/2021/TT-BTC, risk management information, and information technology applications to establish and update criteria and weights used to assess and classify tax compliance levels and taxpayer risk levels.

Step 4. Analyze and assess tax law compliance; determine taxpayer risk levels; identify tax management operation risk levels; manage risk files for focused monitoring cases

Taxpayers are segmented according to conditions suitable for the tax management requirements in each period when performing the analysis and assessment of tax law compliance and taxpayer risk levels.

The implementation of the analysis and classification of tax compliance levels and taxpayer risk levels is conducted using the methods prescribed in Article 5 of Circular 31/2021/TT-BTC.

Step 5. Based on the results of determining the risk levels and assessment of the tax law compliance of taxpayers to apply tax management measures and develop an overall compliance enhancement plan for taxpayers.

Step 6. Monitor, update, and assess feedback information on the results of implementing tax management measures.

Step 7. Collect, process, use, and store information; direct and guide adjustments and supplements to risk management application to ensure effective tax management.

Thus, in the procedures for applying risk management, the step of assessing compliance with the law is step number 4.

What are the 6 groups of criteria for assessment of the tax law compliance of taxpayers in Vietnam? (Image from the Internet)

What are the 6 groups of criteria for assessment of the tax law compliance of taxpayers in Vietnam?

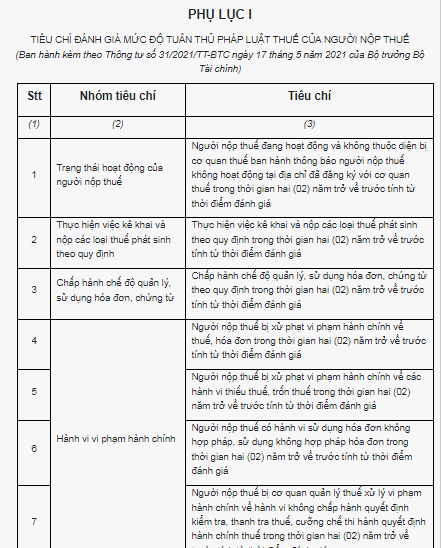

Based on Appendix 1 of the table of criteria for assessment of the tax law compliance of taxpayers, issued together with Circular 31/2021/TT-BTC, the 6 groups of criteria for assessment of the tax law compliance of taxpayers include:

Group 1: Taxpayer's operational status.

>>> Requirement: The taxpayer is active and not subject to a notice from the tax authority that they are not operating at the registered address within the two (02) years prior to the evaluation date.

Group 2: Compliance with tax declaration and payment regulations.

>>> Requirement: Compliance with tax declaration and payment regulations within the two (02) years prior to the evaluation date.

Group 3: Compliance with invoice and document management policies.

>>> Requirement: Compliance with invoice and document management policies within the two (02) years prior to the evaluation date.

Group 4: Administrative violation behavior.

>>> Requirement: The taxpayer was penalized for administrative violations related to tax and invoices within the two (02) years prior to the evaluation date.

The taxpayer was penalized for administrative violations related to tax shortages and evasion within the two (02) years prior to the evaluation date.

The taxpayer exhibited behavior involving the illegal use of invoices and documents within the two (02) years prior to the evaluation date.

The taxpayer was subject to administrative penalties by the tax authority for failing to comply with tax inspection and audit decisions and for enforcement measures within the two (02) years prior to the evaluation date.

Group 5: Tax debt status.

>>> Requirement: The amount of tax debt and the number of days of delayed payment of tax debts at the evaluation date.

Group 6: Other criteria.

>>> Requirement: Other criteria as prescribed by relevant legal documents.

What is the table of criteria for assessment of the tax law compliance of taxpayers in Vietnam?

Based on Appendix 1 of the table of criteria for assessment of the tax law compliance of taxpayers, issued together with Circular 31/2021/TT-BTC, the table of criteria for assessment of the tax law compliance of taxpayers is as follows:

Download Table of criteria for assessment of the tax law compliance of taxpayers.