What are taxble incomes on incomes from inheritance in Vietnam?

What are taxble incomes on incomes from inheritance in Vietnam?

Pursuant to Clause 9, Article 2 of Circular 111/2013/TT-BTC, personal income from inheritance includes the income that an individual receives according to a will or under the provisions of the law on inheritance. Specifically:

- For inherited securities, this includes: stocks, stock purchase rights, bonds, treasury bills, fund certificates, and other types of securities as stipulated in the Securities Law 2019; individual shares in joint-stock companies accordance with the Enterprise Law 2020.

- For inherited capital in economic organizations and business establishments, this includes: contributed capital in limited liability companies, cooperatives, partnerships, business cooperation contracts; capital in private enterprises, individual business establishments; capital in associations, funds permitted to be established under the law or the entire business establishment if it is a private enterprise, individual business establishment.

- For inherited real estate, this includes: land use rights; land use rights with assets attached to the land; house ownership rights, including future-formed housing; infrastructure and construction works attached to the land, including future-formed construction; land lease rights; water surface lease rights; other income received from inherited real estate in any form; except for income from inherited real estate as directed at Point d, Clause 1, Article 3 of Circular 111/2013/TT-BTC.

- For inherited assets requiring ownership or usage registration with state management agencies such as: automobiles; motorcycles, motorbikes; ships, including barges, canoes, tugboats, pushers; boats, including yachts; aircraft; hunting rifles, sporting guns.

What are taxble incomes on incomes from inheritance in Vietnam? (Image from the Internet)

What is the personal income tax rate on incomes from inheritance in Vietnam?

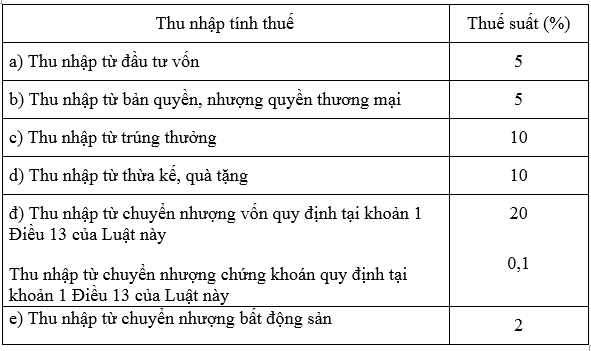

As stipulated in Article 23 of the Personal Income Tax Law 2007, as amended by Clause 7, Article 2 of the Law on Amendments to Tax Laws 2014:

Comprehensive Tax Schedule

- The comprehensive tax schedule is applicable to taxable income specified in Clause 2, Article 21 of this Law.

- The comprehensive tax schedule is specified as follows:

Thus, the personal income tax rate from inheritance is applied according to the comprehensive tax schedule at a rate of 10%.

What are bases for calculating personal income tax on incomes from inheritance in Vietnam?

According to Article 16 of Circular 111/2013/TT-BTC, as amended by Clause 1 and Clause 2, Article 19 of Circular 92/2015/TT-BTC, the basis for calculating personal income tax from inheritance is taxable income and tax rate.

Specifically:

* Taxable income from inheritance is the portion of the asset value received that exceeds VND 10 million each time. The value of the inherited assets is determined in each case. Specifically:

- For inherited securities: the value of the inherited assets is the portion of the asset value received exceeding VND 10 million based on all securities codes received without deducting any expenses at the time of registration for ownership transfer.

Specifically:

+ For securities traded on the Stock Exchange: the value of the securities is based on the reference price on the Stock Exchange at the time of registration for ownership transfer.

+ For securities not in the above case: the value of the securities is based on the book value according to the accounting books of the issuing company at the latest financial report before the time of registration for ownership transfer in accordance with the law on accounting.

- For inherited capital in economic organizations and business establishments: the taxable income is the value of the contributed capital determined based on the accounting books of the company at the latest financial report before the time of registration for ownership transfer.

- For inherited real estate: the value of real estate is determined as follows:

+ For real estate which is land use rights, the value of the land use rights is determined based on the Land Price List issued by the provincial People's Committee at the time the individual completes the procedures for registering land use rights.

+ For real estate which is houses and architectural works on land, the value of the real estate is determined based on the regulations of the competent State management agency on house value classification; regulations on standards, basic construction norms issued by the competent State management agency; the remaining value of the house and construction works at the time of procedures for registering property ownership.

In case it cannot be determined according to the above regulations, it will be based on the registration fee calculation price issued by the provincial People's Committee.

- For inherited assets requiring registration of ownership or use rights with state management agencies: the value of the assets is determined based on the registration fee calculation price lists issued by the provincial People's Committee at the time the individual completes the procedures for registering ownership or use rights of the inherited assets.

In case the individual receives an inherited asset that is imported, and the individual must pay related taxes upon importing the asset, the asset value for calculating personal income tax on inheritance is the registration fee calculation price issued by the provincial People's Committee at the time of registration for ownership or use rights of the inherited asset minus (-) the import taxes that the individual pays by themselves according to the regulations.

* Point of Determining Taxable Income

The point of determining taxable income from inheritance is the time the individual completes the procedures for registering the ownership or use rights of the inherited assets.

* Method of Calculating the Taxable Amount

| Personal income tax payable | = | Taxable income | x | Tax rate 10% |