What are taxable incomes under the Form 03/TNDN-DK on corporate income tax declaration in Vietnam?

What are taxable incomes under the Form 03/TNDN-DK on corporate income tax declaration in Vietnam?

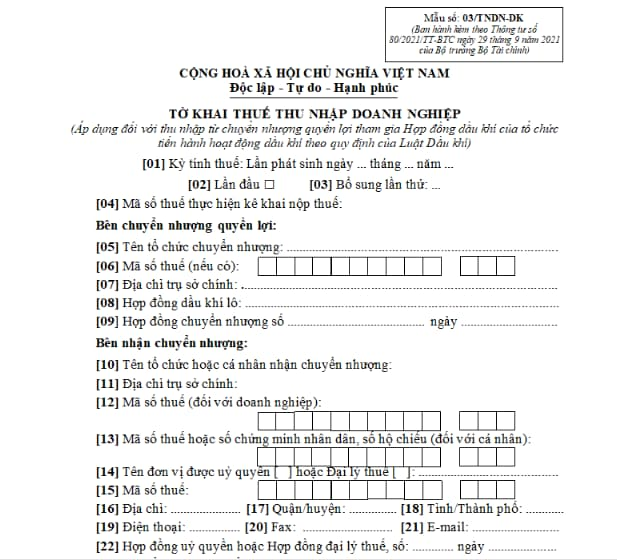

The corporate income tax declaration form applicable to income from the transfer of participation interests in petroleum contracts is Form 03/TNDN-DK as defined in Appendix 2 issued together with Circular 80/2021/TT-BTC, as shown below:

Download Form 03/TNDN-DK corporate income tax declaration Form: Here.

What are taxable incomes under the Form 03/TNDN-DK on corporate income tax declaration in Vietnam? (Image from the Internet)

What documents are required for corporate income tax declaration when transferring the participation interests in petroleum contracts in Vietnam?

Based on sub-item a, Item 14.1 of the appendix issued together with Decree 126/2020/ND-CP, the documents required for corporate income tax declaration for activities involving the transfer of participation interests in petroleum contracts include:

- corporate income tax declaration form (applicable to income from the transfer of participation interests in petroleum contracts) as per Form No. 03/TNDN-DK prescribed in Appendix II issued with Circular 80/2021/TT-BTC.

- Copy of the transfer contract (in English and its Vietnamese translation).

- Certification from the operator, joint operating company, participants of the joint venture, and the Vietnam National Oil and Gas Group on the total costs incurred by the transferor corresponding to the cost of the transferred interest along with supportive documents.

- Original proofs of costs related to the transfer transaction.

- In case the transfer alters the ownership of the contractor holding participation interests in the petroleum contract in Vietnam, the foreign contractor directly participating in the petroleum contract in Vietnam must report and provide the following additional documents:

+ The share structure of the company before and after the transfer.

+ Financial statements for the past 2 years of the foreign company and its subsidiaries/branches directly or indirectly holding participation interests in the petroleum contract in Vietnam.

+ Assets evaluation report and other valuation documents used to determine the transfer value of shares or foreign investment capital under the contract.

+ Report on the corporate income tax payments of the foreign company related to the transfer that changes the ownership of the contractor holding participation interests in the petroleum contract in Vietnam.

+ Report on the relationship between the foreign transferring company and its subsidiaries or branches directly or indirectly holding participation interests in the petroleum contract in Vietnam regarding: capital contribution, business operations, revenue, costs, accounts, assets, personnel.

What is the deadline for submitting the corporate income tax declaration when transferring the participation interests in petroleum contracts in Vietnam?

Pursuant to Article 44 of Tax Administration Law 2019, the regulations are as follows:

Deadline for submission of tax declaration documents

1. The deadline for submitting tax declaration documents for taxes declared monthly or quarterly is as follows:

a) No later than the 20th day of the following month for monthly declarations;

b) No later than the last day of the first month of the following quarter for quarterly declarations.

2. The deadline for submitting tax declaration documents for taxes assessed annually is as follows:

a) No later than the last day of the third month since the end of the calendar year or fiscal year for annual tax finalization documents; no later than the last day of the first month of the calendar year or fiscal year for annual tax declaration documents;

b) No later than the last day of the fourth month since the end of the calendar year for personal income tax finalization documents for individuals directly finalizing their taxes;

c) No later than December 15 of the preceding year for the declaration documents of presumptive tax for business households and individuals paying tax by the presumptive method; in case of new business, the deadline for submitting tax declaration documents is no later than 10 days from the start of business.

3. The deadline for submitting tax declaration documents for taxes declared and paid upon each occurrence of tax obligation is no later than the 10th day from the date the tax obligation arises.

4. The deadline for submitting tax declaration documents in case of cessation of operation, termination of contracts, or business reorganization is no later than the 45th day from the date of the relevant event.

5. the Government of Vietnam regulates the deadlines for submitting tax declaration documents concerning agricultural land use tax; non-agricultural land use tax; land levy; land rent, water surface rent; fees for the right to exploit mineral resources; fees for the right to exploit water resources; registration fee; license fees; and other dues into the state budget in accordance with the laws on management and use of public property; report on multinational profits.

6. The deadline for submitting tax declaration documents for export and import goods is as prescribed by the Customs Law.

7. In case a taxpayer submits tax declarations electronically on the last day of the deadline and the tax authority's electronic portal experiences technical issues, the taxpayer shall submit the tax declaration form and electronic payment documents on the next day when the portal resumes operation.

Thus, the deadline for declaring corporate income tax for the transfer of participation interests in petroleum contracts is no later than the 10th day from the date the tax obligation arises.