What are taxable income from real estate transfer in Vietnam?

What are taxable income from real estate transfer in Vietnam?

Based on Clause 5, Article 2 of Circular 111/2013/TT-BTC, taxable personal income from the transfer of real estate is the income received from the transfer of real estate, including:

- Income from the transfer of land use rights.

- Income from the transfer of land use rights and assets attached to the land. Assets attached to the land include:

+ Residential houses, including future houses.

+ Infrastructure and construction works attached to the land, including future construction works.

+ Other assets attached to the land, including agricultural, forestry, fishery products (such as plants and animals).

- Income from the transfer of housing ownership rights, including future houses.

- Income from the transfer of land rental rights, water body rental rights.

- Income from contributing capital with real estate to establish a business or increase business production capital according to the provisions of the law.

- Income from authorizing the management of real estate where the authorized person has the right to transfer real estate or has rights similar to the real estate owner according to the provisions of the law.

- Other incomes received from real estate transfers in any form.

Note: The regulations on residential houses and construction works formed in the future mentioned above are implemented according to the laws on real estate business.

What are taxable income from real estate transfer in Vietnam? (Image from the Internet)

What is the personal income tax rate on incomes from real estate transfer in Vietnam?

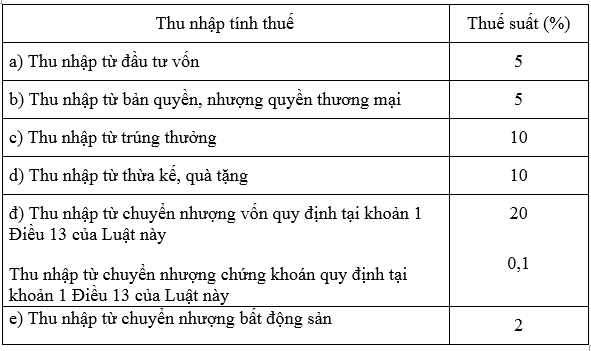

Based on Article 23 of the Law on Personal Income Tax 2007 amended by Clause 7, Article 2 of the Law amending various Tax Laws 2014, it is stipulated as follows:

Flat Tax Rates

- The flat tax rate is applied to the taxable income specified in Clause 2, Article 21 of this Law.

- The flat tax rate is specified as follows:

Thus, the personal income tax rate for real estate transfer is applied according to the flat tax rate of 2%.

How to calculate taxable income from real estate transfer? When is the time to calculate?

Based on Clause 1, Article 14 of the Law on Personal Income Tax 2007 amended by Clause 6, Article 2 of the Law amending various Tax Laws 2014, and further amended by Article 247 of the Land Law 2024, it is stipulated as follows:

Taxable income from real estate transfer

- Taxable income from the real estate transfer is determined as the transfer price each time; in the case of transferring land use rights, taxable income is calculated according to the land price in the land price list.

- The government of Vietnam specifies principles and methods for determining the transfer price of real estate.

- The time for determining taxable income from real estate transfer is when the transfer contract takes effect as prescribed by law.

Thus, taxable personal income from real estate transfer is determined as the transfer price each time. In the case of transferring land use rights, taxable personal income is calculated according to the land price in the land price list.

The time for determining taxable personal income from real estate transfer is when the transfer contract takes effect as prescribed by law.

Is income from real estate transfer between parents and children exempt from personal income tax?

Based on Clause 1, Article 4 of the Law on Personal Income Tax 2007, it is stipulated that tax-exempt income includes:

Tax-exempt income

1. Income from the transfer of real estate between spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; grandparents and grandchildren; siblings.

- Income from the transfer of residential houses, residential land use rights, and assets attached to residential land in cases where individuals possess only one residential house, one residential land plot.

- Income from the value of land use rights granted by the state to individuals.

- Income from inheritance, gifts being real estate between spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; grandparents and grandchildren; siblings.

- Income of households and individuals directly engaged in agricultural, forestry, salt production, aquaculture, and fishery activities, which have not been processed into other products or have only been subjected to normal preliminary processing.

...

Thus, income from the transfer of real estate between parents and children, including biological parents and children, adoptive parents and adopted children, parents-in-law and daughters-in-law, parents-in-law and sons-in-law is exempt from personal income tax.