What are specific fees for driving tests in Vietnam according to Circular 37?

What are specific fees for driving tests in Vietnam according to Circular 37?

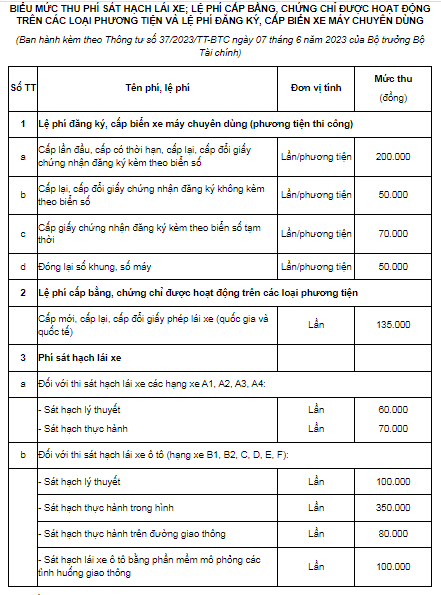

Based on the schedule of fees for driving tests; fees for the issuance of certificates of eligibility to operate various vehicles and registration fees, issuance of specialized vehicle plates as stipulated in Circular 37/2023/TT-BTC as follows:

Therefore, the fees for driving tests according to Circular 37 vary depending on the type of vehicle.

What are specific fees for driving tests in Vietnam according to Circular 37? (Image from the Internet)

What are regulations on payment and statement of fees for driving tests in Vietnam according to Circular 37?

According to Article 4 of Circular 37/2023/TT-BTC, the regulations are as follows:

- Fee and charge payers shall submit fees and charges at the rates stipulated in Article 3 of this Circular to the fee-collecting organizations using the methods prescribed in Circular 74/2022/TT-BTC dated December 22, 2022, by the Minister of Finance, regulating the forms, deadlines for collection, submission, and declaration of fees, charges under the jurisdiction of the Ministry of Finance.

- Periodically, no later than the 5th day of each week, the fee-collecting organization must deposit the fees collected the previous week into the provisional fee account awaiting budget submission opened at the State Treasury. The fee-collecting organization must declare and submit the collected fees and charges into the state budget and settle fees as prescribed in Circular 74/2022/TT-BTC.

- The fee-collecting organizations must submit the collected fees at the rates stipulated in Article 5 of this Circular and 100% of the collected charges into the state budget (central-managed fee-collecting organizations submit to the central budget; local-managed ones submit to the local budget) according to the chapters, sub-categories of the State Budget Table of Contents.

Furthermore, the management and use of fees are regulated by Article 5 of Circular 37/2023/TT-BTC as follows:

- Fee-collecting organizations must submit 100% of the collected fees into the state budget. The cost of providing services, fee collection shall be arranged from the state budget within the estimate of the fee-collecting organization in accordance with state budget expenditure norms and policies as per the law.

- If the fee-collecting organization is provided an expenditure fund from the collected fees per Clause 1, Article 4 of Decree No. 120/2016/ND-CP dated August 23, 2016, of the Government detailing and guiding the implementation of several articles of the Law on Fees and Charges, they may retain 75% of the collected fees to cover service provision and fee collection costs according to Article 5 of Decree No. 120/2016/ND-CP; they must submit 25% of the collected fees into the state budget.

In areas where physical conditions are challenging and suitable examination centers have not been established yet permission for driving tests is granted by the Ministry of Transport at old centers and test sites, the fee-collecting organization can retain 40% of the collected fees to cover service provision and fee collection costs as per Article 5 of Decree No. 120/2016/ND-CP; they must submit 60% of the collected fees into the state budget.

Who are the fee and charge payers for driving tests in Vietnam According to Circular 37?

According to Article 2 of Circular 37/2023/TT-BTC, the regulation is as follows:

Fee and Charge Collecting Organizations and Payers

1. Fee and charge payers are organizations and individuals who file applications requesting the competent agency stated in Clause 2 of this Article to perform the tasks for which fees and charges are collected as follows:

a) Issuance of registration certificates and specialized vehicle plates.

b) Issuance of licenses, certificates of eligibility to operate various vehicles.

c) Testing to obtain a road motor vehicle driving license.

2. The fee and charge collecting organizations specified in this Circular include: the Vietnam Road Administration and the provincial, centrally governed city road management agencies.

Meanwhile, the regulations on fee and charge rates for driving tests according to Circular 3 will be applied following Article 3 of Circular 37/2023/TT-BTC amended by Article 8 of Circular 63/2023/TT-BTC as follows:

- The rate of fees for driving tests; fees for license and certificate issuance on various types of vehicles, and fees for registration and issuance of specialized vehicle plates are specified in the schedule of fees and charges enclosed with this Circular.

- For organizations and individuals filing applications for new, reissued, or exchanged (national and international) driver licenses online:

+ From December 01, 2023, to December 31, 2025, a fee rate of 115,000 VND per issuance is applied.

+ From January 01, 2026, onward, the fee rate specified in the fee schedule attached to this Circular shall be applied.