What are regulations on submission location for tax declaration dossier of environment protection tax on petroleum for gas station in Vietnam?

What are regulations on submission location for tax declaration dossier of environment protection tax on petroleum for gas station in Vietnam?

Based on Clause 4, Article 11 of Decree 126/2020/ND-CP, amended by Clause 6, Article 1 of Decree 91/2022/ND-CP, the location for submitting the tax declaration dossier is specified as follows:

Location for Submitting tax declaration dossier

Taxpayers shall comply with the provisions regarding the location for submitting tax declaration dossiers as stipulated in Clauses 1, 2, and 3 of Article 45 of the Law on Tax Administration and the following provisions:

...

4. Location for submitting the tax declaration dossier of environment protection tax on petroleum products, coal exploitation, and domestic coal consumption.

a) For petroleum products:

a.1) Primary traders who directly import, produce, and mix petroleum products shall submit the tax declaration dossier to the tax authority that directly manages them for the quantity of petroleum products they directly export, sell, including those exported for internal consumption, exchanged for other goods, returned under consignment import, sold to other organizations, individuals not being dependent units, subsidiary companies as prescribed by the Law on Enterprises of primary traders; except for the quantity of petroleum products exported and imported under consignment for other primary traders.

Subsidiary companies as prescribed by the Law on Enterprises of primary traders or dependent units of subsidiary companies, dependent units of primary traders shall submit the tax declaration dossier to the tax authority that directly manages them for the quantity of petroleum products exported, sold to other organizations, individuals not being subsidiary companies as prescribed by the Law on Enterprises of primary traders and dependent units of the subsidiary.

a.2) Primary traders or subsidiary companies as prescribed by the Law on Enterprises of primary traders having dependent units operating in different localities from the province, centrally-run city where the primary trader, subsidiary company of the primary trader is headquartered and the dependent unit does not separately account for environmental protection tax, shall have the primary trader, subsidiary company of the primary trader declare environmental protection tax to the tax authority directly managing it; calculate tax, allocate tax obligations to be paid for each locality where the dependent unit is headquartered according to the regulations of the Minister of Finance.

b) For coal exploitation and domestic consumption:

Enterprises engaged in the exploitation and domestic consumption of coal through management forms and entrusted to subsidiaries or dependent units for exploitation, processing, and consumption shall have the unit in charge of coal consumption declare tax for the total amount of environmental protection tax arising on taxed coal, and submit the tax declaration dossier to the tax authority directly managing it, accompanied by the Table of tax payable determination for each locality where the coal exploitation company is headquartered according to the regulations of the Minister of Finance.

...

According to the above regulations, gas stations incurring environmental protection tax submit tax declaration dossiers at the following location:

[1] For gas stations that are primary traders directly importing, producing, and mixing petroleum products, they shall submit tax declaration dossiers to the tax authority directly managing them for the quantity of petroleum products the primary traders directly export, sell; except for the quantity of petroleum products exported and imported under consignment for other primary traders.

For gas stations that are subsidiary companies of primary traders or dependent units of subsidiary companies, dependent units of primary traders, they shall submit tax declaration dossiers to the tax authority directly managing them for the quantity of petroleum products exported, sold to other organizations, individuals not being subsidiary companies of primary traders and dependent units of the subsidiary.

[2] For gas stations that are primary traders or subsidiary companies of primary traders with dependent units operating in different localities from where the primary trader, subsidiary company of the primary trader is headquartered and the dependent unit does not separately account for environmental protection tax, the primary trader, subsidiary company of the primary trader shall declare environmental protection tax to the tax authority directly managing it.

What are regulations on submission location for tax declaration dossier of environment protection tax on petroleum for gas station in Vietnam? (Image from the Internet)

What goods and services are subject to environmental protection tax in Vietnam?

Based on Article 3 of the 2010 Law on Environmental Protection Tax which specifies the goods and services subject to environmental protection tax, including:

- Gasoline, oils, lubricants, including:

+ Gasoline, excluding ethanol

+ Jet fuel

+ Diesel oil

+ Kerosene

+ Fuel oil

+ Lubricating oil

+ Grease

- Coal, including:

+ Lignite

+ Anthracite (Anthracite)

+ Coking coal

+ Other types of coal

- Hydro-chloro-fluoro-carbon (HCFC) solution

- Plastic bags subject to tax

- Pesticides restricted for use

- Termite control chemicals restricted for use

- Timber preservatives restricted for use

- Warehouse disinfectants restricted for use

Additionally, should there be a necessity to supplement other taxable goods and services suitable for each period, the Standing Committee of the National Assembly will consider and regulate.

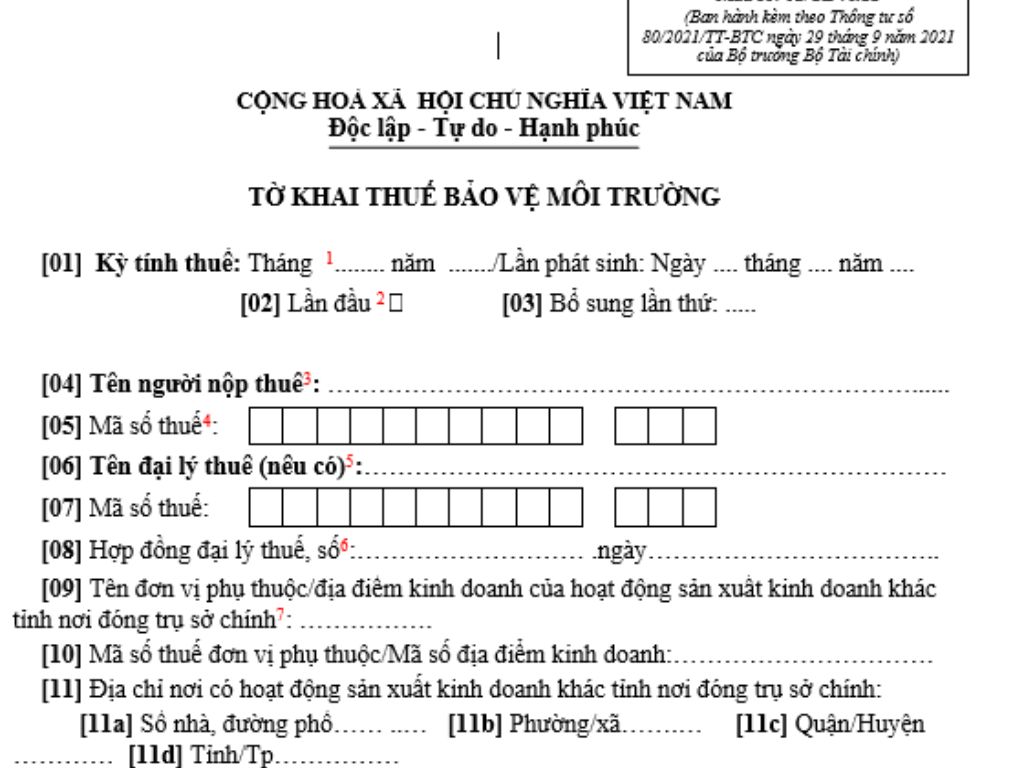

What is the latest environmental protection tax declaration form in Vietnam?

The latest Environmental Protection Tax Declaration Form is Form 01/TBVMT issued with Circular 80/2021/TT-BTC as follows:

>>Latest Environmental Protection Tax Declaration Form Download