What are regulations on handling of errors in invoices purchased from tax authorities in Vietnam?

What are regulations on handling of errors in invoices purchased from tax authorities in Vietnam?

According to Article 26 of Decree 123/2020/ND-CP stipulating the handling of errors in paper invoices purchased from tax authorities as follows:

- In cases where an invoice has been issued but not yet delivered to the buyer, if errors are detected, the seller should cross out all copies and retain the erroneous invoice.

- In cases where the issued invoice contains errors in the buyer's name or address but correctly lists the buyer's tax identification number, the parties shall prepare an adjustment record and do not need to issue an adjustment invoice.

- In cases where the invoice has been issued and delivered to the buyer, but goods or services have not yet been provided, or the invoice has been issued and delivered to the buyer, and neither the seller nor the buyer has declared tax yet, any detected errors must be canceled. The seller and the buyer shall prepare a record to retrieve copies of the erroneous invoice. The record must indicate the reasons for invoice retrieval. The seller shall cross out all copies, retain the erroneous invoice, and issue a new invoice in accordance with regulations.

- In cases where the invoice has been issued and delivered to the buyer, goods have been delivered, services provided, and both seller and buyer have declared taxes, if errors are subsequently detected, the seller shall issue an adjustment invoice for the errors. The invoice must clearly indicate adjustments (increase or decrease) in the quantity of goods, selling price, value-added tax rate, and value-added tax amount for the specified invoice number and symbol. Based on the adjustment invoice, both seller and buyer shall adjust their sales and purchase revenue, output and input taxes. The adjustment invoice should not show negative figures (-).

If the seller and the buyer agree on recording the errors in a memorandum prior to the seller issuing the adjustment invoice, the parties shall prepare a memorandum specifying the errors, after which the seller issues the adjustment invoice for the errors.

What are regulations on handling of errors in invoices purchased from tax authorities in Vietnam? (Image from the Internet)

Which entities shall purchase tax authority-ordered printed invoices in Vietnam?

According to Article 23 of Decree 123/2020/ND-CP regarding the application of tax authority-ordered printed invoices as follows:

Application of tax authority-ordered printed invoices

Local Tax Departments (hereinafter referred to as Tax Departments) print invoices for sale to the following entities:

1. Enterprises, economic organizations, business households, and individuals specified in Clause 1, Article 14 of this Decree when they do not engage in electronic transactions with tax authorities, lack information technology infrastructure, lack accounting software, and lack software for issuing electronic invoices to use electronic invoices and transmit electronic invoice data to buyers and tax authorities.

Businesses, economic organizations, business households, and individuals purchase invoices from tax authorities for a maximum period of 12 months, during which tax authorities provide solutions for gradually transitioning to electronic invoice applications. When switching to electronic invoices, businesses, economic organizations, business households, and individuals shall register to use electronic invoices with a tax code or electronic invoices without a tax code (if eligible) as prescribed in Article 15 of this Decree.

2. Businesses, economic organizations, business households, and individuals during periods when the information technology infrastructure system for tax code issuance encounters problems as stipulated in Clause 2, Article 20 of this Decree.

Thus, based on the above regulations, entities that must purchase tax authority-ordered printed invoices include:

- Enterprises entitled to use electronic invoices with a tax code free of charge for 12 months from the time they initially use electronic invoices, but do not engage in electronic transactions with the tax authorities, lack IT infrastructure, lack accounting software, and lack software for issuing electronic invoices to use electronic invoices and transmit electronic invoice data to buyers and tax authorities.

- Businesses operating during times when the IT infrastructure system for tax code issuance by the tax authorities encounters problems.

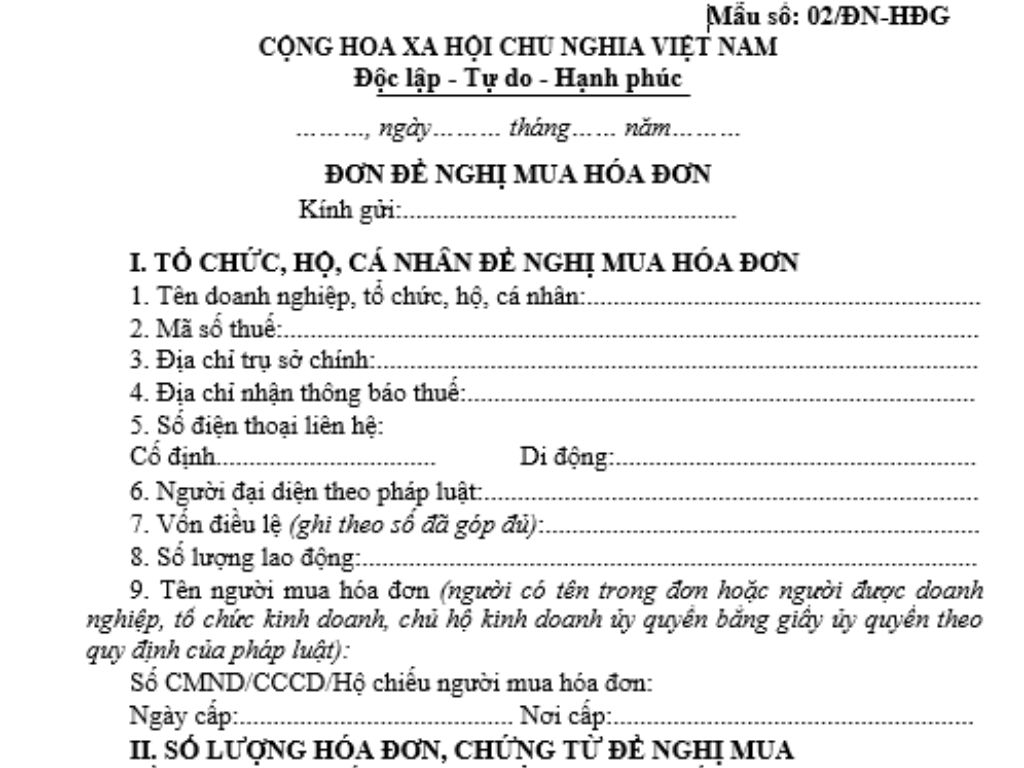

Which form is used for the request to purchase tax authority-ordered printed invoices in Vietnam?

The request for purchasing tax authority-ordered printed invoices is Form No. 02/DN-HDG, Appendix IA, issued together with Decree 123/2020/ND-CP dated October 19, 2020, of the Government of Vietnam. The request form for purchasing tax authority-ordered printed invoices is as follows:

Request to Purchase tax authority-ordered printed invoices Download