What are regulations on electronic sales invoice in Vietnam according to the Decree 123?

What are regulations on electronic sales invoice in Vietnam according to the Decree 123?

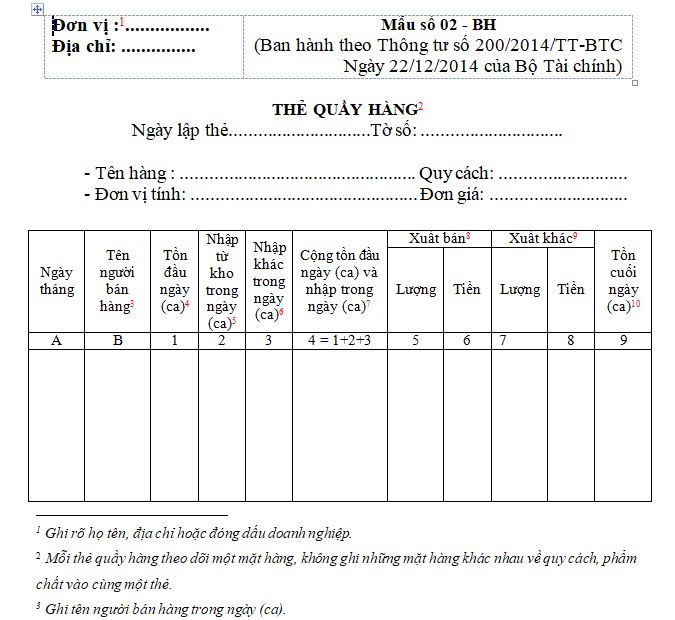

Form 02/BH - Electronic Sales Invoice (used for organizations, individuals declaring value-added tax by direct method) is issued with Appendix 3 of Decree 123/2020/ND-CP.

Form 02/BH - Electronic Sales Invoice: Download

What are regulations on electronic sales invoice in Vietnam according to the Decree 123? (Image from the Internet)

What entities may use electronic sales invoices in Vietnam?

According to clause 2, Article 8 of Decree 123/2020/ND-CP, the following regulations apply:

Types of Invoices

The invoices stipulated in this Decree include the following types:

1. Value-added tax invoice is for organizations declaring value-added tax by the deduction method used for activities:

a) Sale of goods, provision of services domestically;

b) International transportation activities;

c) Export to non-tariff areas and cases considered as export;

d) Export of goods, provision of services abroad.

2. Sales invoice is meant for the following organizations, individuals:

a) Organizations, individuals declaring and calculating value-added tax by the direct method used for activities:

- Sale of goods, provision of services domestically;

- International transportation activities;

- Export to non-tariff areas and cases considered as export;

- Export of goods, provision of services abroad.

b) Organizations, individuals in non-tariff areas when selling goods, providing services domestically and when selling goods, providing services between organizations, individuals within non-tariff areas, exporting goods, providing services abroad, the invoice clearly states "For organizations, individuals in non-tariff areas".

The sales invoice is intended for the following organizations, individuals:

(1) Organizations, individuals declaring and calculating value-added tax by the direct method used for activities:

- Sale of goods, provision of services domestically;

- International transportation activities;

- Export to non-tariff areas and cases considered as export;

- Export of goods, provision of services abroad.

(2) Organizations, individuals in non-tariff areas when selling goods, providing services domestically and when selling goods, providing services between organizations, individuals within non-tariff areas, exporting goods, providing services abroad, on the invoice clearly states “For organizations, individuals in non-tariff areas”.

What are regulations on storage and retention of invoices and records in Vietnam?

Based on Article 6 of Decree 123/2020/ND-CP, the regulations are as follows:

Storage and retention of Invoices and records

1. Invoices, records must be stored and retained ensuring:

a) Safety, security, integrity, completeness, not altered, distorted during the retention period;

b) Proper and sufficient retention duration as per the accounting law regulations.

2. Electronic invoices, electronic records are stored and retained by electronic means. Agencies, organizations, individuals have the right to choose and apply forms of Storage and retention of electronic invoices, electronic records suitable to the nature of the activities and technology application capacity. Electronic invoices, electronic records must be ready for printing on paper or retrievable when requested.

3. Invoices printed by the tax authority, records printed, self-printed must be stored, retained according to the following requirements:

a) Invoices, records not yet made must be retained, stored in warehouses according to retention and Storage policies for valuable records.

b) Invoices, records already made in accounting units must be retained as per accounting record retention regulations.

c) Invoices, records already made in organizations, households, individuals not being accounting units are retained and stored as private assets of those organizations, households, individuals.

Thus, the Storage and retention of invoices and records are implemented as follows:

- Invoices, records are stored and retained ensuring:

+ Safety, security, integrity, completeness, not altered, distorted during the retention period;

+ Proper and sufficient retention duration as per the accounting law regulations.

- Electronic invoices, electronic records are stored and retained by electronic means. Agencies, organizations, individuals have the right to choose and apply forms of Storage and retention of electronic invoices, electronic records suitable to the nature of the activities and technology application capacity. Electronic invoices, electronic records must be ready for printing on paper or retrievable when requested.

- Invoices printed by the tax authority, records printed, self-printed must be stored, retained according to the following requirements:

+ Invoices, records not yet made must be retained, stored in warehouses according to retention and Storage policies for valuable records.

+ Invoices, records already made in accounting units must be retained as per accounting record retention regulations.

+ Invoices, records already made in organizations, households, individuals not being accounting units are retained and stored as private assets of those organizations, households, individuals.