What are regulations on deductions of excise tax on biofuel in Vietnam?

What are regulations on deductions of excise tax on biofuel in Vietnam?

Pursuant to Clause 1, Article 7 of Decree 108/2015/ND-CP, as amended by Clause 3, Article 1 of Decree 14/2019/ND-CP, the deduction of excise tax on biofuel is as follows:

- Taxpayers producing goods subject to excise tax using materials subject to such tax shall deduct the excise tax already paid on imported materials (including taxes paid under tax assessment decisions by customs authorities, except in cases where customs authorities impose penalties for fraud or tax evasion) or paid on materials purchased directly from domestic manufacturers when determining the payable excise tax.

The amount of deductible excise tax corresponds to the excise tax on materials used to produce goods sold that are subject to excise tax.

>>> Specifically for biofuel: The deductible excise tax for the tax declaration period is based on the excise tax paid or incurred on a unit of materials purchased in the previous adjacent tax declaration period of mineral oil used for producing biofuel.

For enterprises allowed to produce and blend biofuel, the declaration and deduction of excise tax are performed at the local tax authority where the enterprise's headquarters is located. The undeducted excise tax on mineral oil used for producing or blending biofuel (including undeducted tax incurred since the tax declaration period of January 2016) is to be offset against the excise tax payable on other goods and services arisen in the period. If, after offsetting, there is still an undeducted balance of excise tax on mineral oil used for producing or blending biofuel, it will be carried forward to the next period or refunded.

The dossier, procedures, and authority for handling the refund of excise tax are as follows:

- Biofuel production and blending facilities prepare a request for refund of state budget revenue to offset other payable taxes (if any) - Form 01a/DNHT attached to this Decree.

- Biofuel production and blending facilities submit a dossier for refund of undeducted excise tax to the local tax office where the enterprise's headquarters is located to be processed according to regulations.

- The tax authority's responsibility in handling refund dossiers of excise tax is implemented as stipulated in Article 60 of the Law on Tax Administration and amended, supplemented laws and documents (if any).

- Based on the tax refund order of the tax agency, the State Treasury will make a refund of excise tax on mineral oil used for producing or blending biofuel. The refund of excise tax is sourced from the central government budget receipts on excise tax.

What are regulations on deductions of excise tax on biofuel in Vietnam? (Image from Internet)

What are 2 conditions for the deduction of excise tax in Vietnam?

According to Clause 3, Article 7 of Decree 108/2015/ND-CP (amended by Clause 3, Article 1 of Decree 14/2019/ND-CP), the conditions for the deduction of excise tax are specifically stipulated as follows:

(1) For the case of importing materials subject to excise tax to produce goods subject to excise tax, and the case of importing goods subject to excise tax, the documents for the deduction of excise tax are the documents proving payment of excise tax at the importation stage.

(2) For purchasing materials directly from domestic manufacturers:

- The sales contract must show that the goods are produced directly by the seller; a copy of the Business Registration Certificate of the seller (signed and stamped by the seller).

- Bank payment documentation.

- The document for the deduction of excise tax is the value-added tax invoice when purchasing goods.

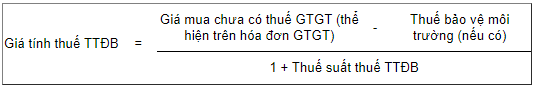

The excise tax paid by the purchasing unit when buying materials is determined = taxable price multiplied by the excise tax rate; where:

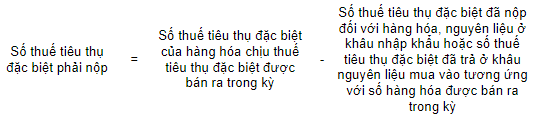

The deduction of excise tax is executed when declaring excise tax, and the payable excise tax is determined according to the following formula:

*Note: If the exact amount of excise tax paid (or incurred) on the equivalent materials for the products consumed in the period cannot be accurately determined, previous period data may be used to compute the deductible excise tax and will be determined based on actual data at the end of the quarter or year.

In any case, the maximum allowable deductible excise tax does not exceed the excise tax calculated on the materials based on the technical and economic norms of the product.

Shall the excise tax be refundable when the paid excise tax is higher than excise tax payable in Vietnam?

Pursuant to Clause 4, Article 7 of Circular 195/2015/TT-BTC as follows:

Tax Refund

...

4. Refund of excise tax in the Following Cases:

a) Refund according to the decision of the competent authority as prescribed by law.

b) Refund according to international treaties to which the Socialist Republic of Vietnam is a member.

c) Refund when the paid excise tax exceeds the due excise tax as stipulated.

Procedures, dossiers, order, and authority for settling excise tax refunds as specified in Clause 3, Clause 4 of this Article are implemented according to the provisions of the Law on Tax Administration and guiding documents.

According to regulations, a refund of excise tax is possible in the following cases:

- Refund according to the decision of the competent authority as prescribed by law.

- Refund according to international treaties to which the Socialist Republic of Vietnam is a member.

- Refund when the paid excise tax exceeds the due excise tax as stipulated.

Therefore, if the paid excise tax exceeds the due excise tax as prescribed, a refund of excise tax will be granted.