What are regulations on declaration of personal income tax for income from inheritance and gifts in Vietnam?

What are regulations on declaration of personal income tax for income from inheritance and gifts in Vietnam?

Based on Clause 6, Article 26 of Circular 111/2013/TT-BTC, the declaration of personal income tax for income from inheritance and gifts is as follows:

- Individuals with income from inheritance and gifts must declare taxes for each occurrence, even if exempt from tax.

- State management agencies and related organizations shall only proceed with the procedures for transferring ownership or usage rights of real estate, securities, capital contribution, and other assets that require registration of ownership or usage rights to the inheritor or gift recipient when they have tax payment receipts or confirmation from the tax authority regarding the income from tax-exempt real estate inheritance or gifts.

What are regulations on declaration of personal income tax for income from inheritance and gifts in Vietnam? (Image from the Internet)

Is it necessary to settle personal income tax on income from inheritance and gifts annually in Vietnam?

According to Point d, Clause 6, Article 8 of Decree 126/2020/ND-CP:

Types of taxes declared monthly, quarterly, annually, for each occurrence of tax obligations and tax finalization

...

6. Types of taxes and collections subject to annual tax finalization and finalization up to the time of dissolution, bankruptcy, termination of operations, termination of contracts, or reorganization of enterprises. In the case of business conversion types (excluding the equitization of state enterprises) where the converted enterprise inherits all tax obligations of the transformed enterprise, tax finalization does not need to be declared up to the time there is a decision on business conversion; the enterprise declares the final tax settlement at year-end. To be specific:

...

d) Personal income tax for organizations and individuals paying taxable income from salaries and wages; individuals with income from salaries and wages authorizing organizations and individuals paying income to finalize tax; individuals with income from salaries and wages directly finalizing tax with the tax authority. To be specific: as follows:

d.1) Organizations and individuals paying income from salaries and wages are responsible for declaring and finalizing taxes and finalizing taxes on behalf of individuals who authorize them, regardless of whether tax withholding occurs. Organizations or individuals not incurring income do not have to declare personal income tax finalization. In the case of employees being transferred from the old organization to the new organization due to merger, consolidation, division, separation, business type transformation, or within the same system, the new organization is responsible for finalizing tax on behalf of individuals for income paid by the old organization and recollecting tax withholding receipts issued by the old organization if any.

d.2) Resident individuals with income from salaries and wages authorizing organizations and individuals paying income to finalize tax. To be specific:

...

d.3) Resident individuals with income from salaries and wages directly declaring personal income tax finalization with the tax authority in the following cases:

...

Thus, personal income tax finalization on an annual basis only applies to income from salaries and wages for taxable personal income. There is no need to finalize personal income tax annually for income from inheritance and gifts.

What is the personal income tax rate on income from inheritance and gifts in Vietnam?

According to Article 23 of the Personal Income Tax Law 2007 (amended by Clause 7, Article 2 of the Law on Amendments and Supplements to Various Tax Laws 2014):

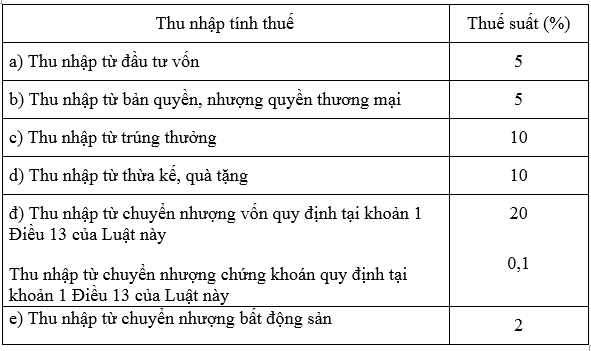

Full tax rate schedule

The full tax rate schedule applies to taxable income as prescribed in Clause 2, Article 21 of this Law.

The full tax rate schedule is specified as follows:

Therefore, the personal income tax rate on income from inheritance and gifts is applied under the full tax rate schedule with a rate of 10%.

Additionally, based on Clause 4, Article 16 of Circular 111/2013/TT-BTC, the calculation of personal income tax for inheritance and gifts is as follows:

| Personal Income Tax Payable | = | Taxable Income | x | Tax Rate 10% |

* In which:

Taxable income from inheritance and gifts is the portion of asset value received as inheritance or gifts exceeding VND 10 million each time received. The value of assets received as inheritance or gifts is determined for each case. To be specific:

- For inheritance and gifts that are securities: The value of assets received as inheritance is the portion of the asset value received as inheritance or gifts exceeding VND 10 million calculated on the entire codes of securities received without any costs deducted at the time of registration for transfer of ownership rights. To be specific: as follows:

+ For securities traded on the Stock Exchange: The value of securities is based on the reference price on the Stock Exchange at the time of registration of ownership.

+ For securities not covered by the above: The value of securities is based on the book value of the issuing company's accounts at the nearest time of compiling financial statements according to legal accounting regulations before the time of registration of ownership.

- For inheritance and gifts that are capital contributions in economic organizations and business establishments: The taxable income is the value of the capital contribution determined based on the accounting book value of the company at the nearest time before the registration of capital contribution ownership.

- For properties received as inheritance and gifts that are real estates: The value of the real estate is determined as follows:

+ For real estate which is the value of land use rights: The value of land use rights is determined based on the Land Price Table issued by the provincial People's Committee at the time of registration of land use rights.

+ For real estate which includes houses and architectural works on land: The value of the real estate is determined based on the regulations of competent state management agencies regarding the classification of house value; regulations on construction standards and norms by competent state management agencies; the residual value of houses and architectural works at the time of registration of ownership.

In case it is not determined according to the above regulations, it is based on the registration fee valuation by the provincial People's Committee.

- For inheritance and gifts that are other assets requiring registration of ownership or usage rights with state management agencies: The asset value is determined based on the registration fee valuation by the provincial People's Committee at the time of registration of ownership, rights to use inherited assets, and gifts.

In cases where individuals receiving inheritance or gifts must pay related taxes on the importation of assets, the value of assets as a basis for calculating personal income tax for inheritance and gifts is the registration fee valuation by the provincial People's Committee at the time of registration of ownership, rights to use assets minus (-) importation taxes paid by the individual as required.