What are regulations on bonus regime according to statutory pay rate for Vietnamese officials and public employees under Decree 73? Are bonuses for Vietnamese officials and public employees subject to PIT?

What are regulations on bonus regime according to statutory pay rate for Vietnamese officials and public employees under Decree 73?

Based on Clause 2, Article 3 of Decree 73/2024/ND-CP regulating the statutory pay rate for public employees as follows:

Statutory Pay Rate

...

- From July 1, 2024, the statutory pay rate is 2,340,000 VND/month.

...

Simultaneously, based on Article 4 of Decree 73/2024/ND-CP, which stipulates the bonus policies for Vietnamese officials and public employees according to the new statutory pay rate as follows:

Bonus Regime

- Implement bonus policies based on sudden work achievements and annual performance and classification evaluations for the entities specified in Clause 2, Article 2 of this Decree.

- The bonus regime specified in Clause 1 of this Article is used for sudden bonuses based on work achievements and annual bonuses based on performance and classification evaluations for each salary-receiving individual in the agency or unit. The head of the armed forces unit as prescribed by the Ministry of National Defense, the Ministry of Public Security; the head of the agency with authority or delegated authority to manage officials; and the head of the public service provider is responsible for establishing specific regulations to implement the bonus policies applicable to individuals listed in the salary payment of the agency or unit; submitting it to the direct superior management agency for management, inspection, and transparency implementation in the agency or unit.

...

Additionally, based on Clause 4, Article 7 of Decision 786/QD-BNV year 2024 of the Ministry of Home Affairs guiding the implementation regulations for the bonus policies, the bonus amount for the criteria of sudden work achievement awards is as follows:

Criteria for Award Consideration and Sudden Bonus Amount

...

- Bonus Amount

A bonus for individuals with sudden work achievements based on two levels corresponding to the individual achievement score:

a) Individuals scoring from 05 to 08 points: A bonus equal to 03 times the statutory pay rate/person/one-time bonus.

b) Individuals scoring above 08 to 10 points: A bonus equal to 05 times the statutory pay rate/person/one-time bonus.

Furthermore, based on point c, Clause 2, Article 8 of Decision 786/QD-BNV year 2024 of the Ministry of Home Affairs guiding the implementation regulations for the bonus policies, the bonus amount for the criteria for annual performance and classification evaluations is as follows:

Criteria for Award Consideration and Annual Regular Bonus Amount

...

- Bonus Amount

...

c) Bonus Amount

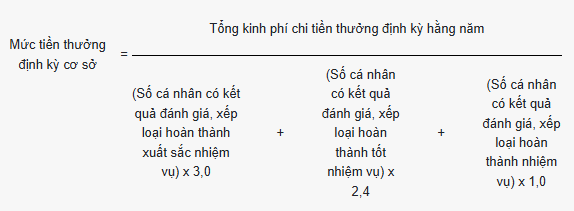

- Level 1 (individual outstandingly completes tasks): A bonus amount equal to 3.0 times the regular base bonus;

- Level 2 (individual satisfactorily completes tasks): A bonus amount equal to 2.4 times the regular base bonus;

- Level 3 (individual completes tasks): A bonus amount equal to 1.0 times the regular base bonus.

Thus, the bonus policies for Vietnamese officials and public employees according to the new statutory pay rate are determined as follows:

- Vietnamese officials and public employees within the entities specified in Clause 2, Article 2 of Decree 73/2024/ND-CP will receive bonus policies based on two criteria:

+ The criteria for sudden work achievement bonuses.

+ The criteria for annual performance and classification evaluations.

- The bonus amount for the sudden work achievement bonus is based on the individual's achievement score with two levels:

+ Scoring from 05 to 08 points: A bonus equal to 03 times the statutory pay rate/person/per occasion (equivalent to 7,020,000 VND).

+ Scoring above 08 to 10 points: A bonus equal to 05 times the statutory pay rate/person/per occasion (equivalent to 11,700,000 VND).

- The bonus amount for criteria for annual performance and classification evaluations with 03 levels:

+ Level 1 (individual outstandingly completes tasks): A bonus amount equal to 3.0 times the regular base bonus;

+ Level 2 (individual satisfactorily completes tasks): A bonus amount equal to 2.4 times the regular base bonus;

+ Level 3 (individual completes tasks): A bonus amount equal to 1.0 times the regular base bonus.

Note: The regular base bonus is determined according to the following formula:

What are regulations on bonus regime according to statutory pay rate for Vietnamese officials and public employees under Decree 73? Are bonuses for Vietnamese officials and public employees subject to PIT? (Image from the Internet)

Are bonuses for Vietnamese officials and public employees subject to PIT?

Based on point e, Clause 2, Article 2 of Circular 111/2013/TT-BTC which stipulates taxable income from bonuses as follows:

Taxable Income Items

According to the provisions of Article 3 of the Personal Income Tax Law and Article 3 of Decree No. 65/2013/ND-CP, taxable income for personal income tax includes:

...

- Income from salaries and wages

...

e) Bonuses in cash or not in cash in any form, including bonuses in securities, except for the following bonuses:

e.1) Bonuses associated with State-conferred titles, including bonuses associated with emulation titles and forms of commendation as prescribed by the law on emulation and commendation, specifically:

e.1.1) Bonuses associated with emulation titles like National Emulation Soldier; Emulation Soldier at the ministry, sector, central agency, province, city directly under the Central Government; grassroots Emulation Soldier, Advanced Laborer, Advanced Soldier.

e.1.2) Bonuses associated with forms of commendation.

e.1.3) Bonuses associated with State-conferred titles.

e.1.4) Bonuses associated with awards granted by Associations, organizations under political organizations, political-socio organizations, socio organizations, socio-professional organizations of central and local levels in line with the organization's regulations and the Law on Emulation and Commendation.

e.1.5) Bonuses associated with the Ho Chi Minh Prize, the State Prize.

e.1.6) Bonuses associated with Commemorative Medals, Insignias.

e.1.7) Bonuses accompanying Certificates of Merit, Certificates of Commendation.

The authority to decide on commendations and the bonus amounts accompanying the mentioned emulation titles and forms of commendation must conform to the provisions of the Law on Emulation and Commendation.

e.2) Bonuses associated with national and international awards recognized by the Vietnamese State.

e.3) Bonuses for technical improvements, inventions, and innovations recognized by competent State agencies.

e.4) Bonuses for detecting and reporting legal violations to competent State agencies.

...

Hence, bonuses for Vietnamese officials and public employees are not among the exceptional bonus cases in determining taxable personal income, thus Vietnamese officials and public employees must pay PIT on the bonuses they receive.

Where is personal income tax payable in Vietnam?

Based on Clause 1, Article 56 of the Law on Tax Administration 2019 stipulating the places for personal income tax payment as follows:

- At the State Treasury;

- At the tax authority where tax declaration documents are submitted;

- Through an organization authorized by the tax authority to collect taxes;

- Through commercial banks, other credit institutions, and service organizations as prescribed by law.