What are procedures for TIN deactivation for an affiliated entity in Vietnam?

What are procedures for TIN deactivation for an affiliated entity in Vietnam?

Based on Subsection 22, Section 2, Part 2 of Administrative Procedures issued with Decision 2589/QD-BTC of 2021 regarding the procedure for TIN deactivation for an affiliated entity. To be specific:

Step 1: The affiliated entity of an economic organization or another organization submits the TIN deactivation dossier to the directly managing tax authority within 10 working days from the date of the document terminating the operation.

- For the case of electronic taxpayer registration dossier: The taxpayer accesses the electronic information portal chosen by the taxpayer (The General Department of Taxation’s electronic information portal/the electronic information portal of a competent state agency including the national public service portal, Ministry-level public service portal, provincial-level public service portal according to the regulations on one-stop, interconnected one-stop mechanism in handling administrative procedures and connected with the General Department of Taxation’s electronic information portal/The information portal of the T-VAN service provider organization) to fill in the declaration, attach required documents in electronic form (if any), digitally sign, and send to the tax authority via the chosen electronic information portal.

taxpayer submits the dossier (taxpayer registration dossier concurrently with business registration dossier under the unified one-stop mechanism) to the competent state authority as prescribed. The competent state authority forwards taxpayer's received dossier information to the tax authority via the General Department of Taxation’s electronic information portal.

Step 2: The tax authority receives:

- For paper-based taxpayer registration information change dossier:

+ If the dossier is submitted directly at the tax authority: The tax officer receives and stamps the receipt on the taxpayer registration dossier, clearly noting the reception date, the number of documents according to the document list for cases where the taxpayer registration dossier is submitted directly at the tax authority. The tax officer writes a receipt for the dossier processing result return date.

+ If the taxpayer registration dossier is sent by post: The tax officer stamps the receipt, notes the receipt date on the dossier, and assigns a reference number of the tax authority.

The tax officer checks the taxpayer registration dossier. If the dossier is incomplete or requires explanation, additional information, or documents, the tax authority informs the taxpayer following form No. 01/TB-BSTT-taxpayer in Appendix 2 issued together with Decree 126/2020/ND-CP within 2 working days from the date of dossier receipt.

- For the case of electronic taxpayer registration dossier:

The tax authority receives the dossier via the General Department of Taxation’s electronic information portal and processes the dossier through the tax authority's electronic data processing system.

+ Receiving the dossier: The General Department of Taxation's electronic information portal sends a receipt notification to the taxpayer via the chosen electronic information portal for creating and submitting the dossier (The General Department of Taxation’s electronic information portal/the electronic information portal of a competent state agency or T-VAN service provider) no later than 15 minutes from receiving the taxpayer's electronic taxpayer registration dossier.

+ Checking and processing the dossier: The tax authority checks and processes the taxpayer's dossier according to legal regulations on taxpayer registration and returns the processing result via the chosen electronic information portal for creating and submitting the dossier.

++ If the dossier is complete and meets the prescribed procedures and needs to return results: The tax authority sends the dossier processing result to the chosen electronic information portal for creating and submitting the dossier within the prescribed deadline according to Circular 105/2020/TT-BTC.

++ If the dossier is incomplete or does not meet the prescribed procedures, the tax authority sends a notification of dossier rejection via the chosen electronic information portal for creating and submitting the dossier within 2 working days from the date noted on the Receipt Notification.

What are procedures for TIN deactivation for an affiliated entity in Vietnam? (Image from the Internet)

How can an affiliated entity execute the procedure for TIN deactivation in Vietnam?

Based on Subsection 22, Section 2, Part 2 of Administrative Procedures issued with Decision 2589/QD-BTC of 2021:

an affiliated entity can choose to execute the procedure for TIN deactivation through one of the three following methods:

- Direct submission at the tax authority's office;

- Through the postal system;

- Or electronically via the General Department of Taxation’s electronic information portal/the electronic information portal of a competent state agency including the national public service portal, Ministry-level public service portal, provincial-level public service portal according to the regulations on the one-stop, interconnected one-stop mechanism in handling administrative procedures and connected with the General Department of Taxation’s electronic information portal/The information portal of the T-VAN service provider organization.

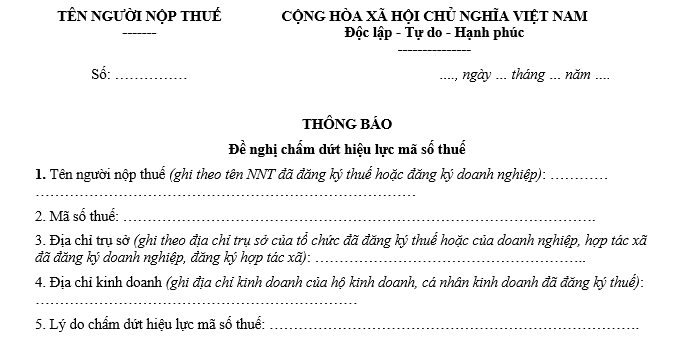

Vietnam: Where to download the TIN deactivation request Form No. 24/DK-TCT?

The TIN deactivation request form No. 24/DK-TCT is issued together with Circular 105/2020/TT-BTC:

Download the TIN deactivation request Form No. 24/DK-TCT: Download