What are procedures for terminating the effectiveness of TINs for economic organizations and other organizations excluding affiliated units in Vietnam?

What are procedures for terminating the effectiveness of TINs for economic organizations and other organizations excluding affiliated units in Vietnam?

Based on Sub-section 21, section 2, Part 2 of Administrative Procedures issued together with Decision 2589/QD-BTC of 2021, the procedure for terminating the effectiveness of TINs for economic organizations and other organizations excluding affiliated units is stipulated as follows:

Step 1: Economic organizations and other organizations (excluding affiliated units) submit the dossier for termination of the TIN's effectiveness to the directly managing tax authority within 10 working days from the date of the document terminating operation, business activity, or contract end date.

For electronic taxpayer registration dossiers: taxpayers access the electronic portal chosen by the taxpayer (such as the General Department of Taxation's portal, the portal of a competent state authority including the National Public Service Portal, the Ministry's public service portal, the provincial public service portal following the regulations on single-window, inter-agency single-window mechanism in administrative procedure resolution and connected with the General Department of Taxation's portal/the portal of T-VAN service providers) to fill in the declaration form and send attachments as electronic documents (if any), electronically sign, and submit to the tax authority via the chosen electronic portal.

Taxpayers submit the dossier (simultaneously submitting the taxpayer registration dossier along with the business registration dossier according to the single-window mechanism) to the competent state management authority as stipulated. The state management authority sends the received dossier information of the taxpayer to the tax authority via the General Department of Taxation's electronic portal.

Step 2: Tax Authority Reception:

- For paper-based taxpayer registration dossiers:

+ If the dossier is submitted directly at the tax authority: the tax officer receives it, stamps the receipt on the taxpayer registration dossier, noting the date of reception, the number of documents as listed in the dossier inventory, and writes a return appointment slip specifying the processing time for the received dossier.

+ If the taxpayer registration dossier is sent by postal service: the tax officer stamps the receipt, notes the reception date on the dossier, and records the tax authority's dispatch number.

The tax officer inspects the taxpayer registration dossier. If the dossier is incomplete or requires additional explanation or information, the tax authority notifies the taxpayer using Form 01/TB-BSTT-NNT in Appendix 2 issued together with Decree 126/2020/ND-CP within 02 (two) working days from the date of dossier reception.

- For electronic taxpayer registration dossiers:

The tax authority receives the dossier via the General Department of Taxation's electronic portal, inspects and processes the dossier through the electronic data processing system of the tax authority.

+ Reception of the dossier: The General Department of Taxation's electronic portal sends a reception notice to the taxpayer within 15 minutes from receiving the taxpayer's electronic registration dossier through the chosen electronic portal (such as the General Department of Taxation’s portal or the competent state authority’s portal or T-VAN service provider's portal).

+ Inspection and processing of the dossier: The tax authority inspects and processes the taxpayer's dossier as per taxpayer registration law and returns the resolution results through the electronic portal chosen by the taxpayer.

++ If the dossier is complete and procedurally correct, the tax authority sends the dossier resolution results to the chosen electronic portal within the timeframe specified in Circular 105/2020/TT-BTC.

++ If the dossier is incomplete or procedurally incorrect, the tax authority sends a notice of non-acceptance of the dossier to the chosen electronic portal within 02 (two) working days from the date on the reception notice.

What are procedures for terminating the effectiveness of TINs for economic organizations and other organizations excluding affiliated units in Vietnam? (Image from the Internet)

What are procedures for TIN deactivation of economic organizations and other organizations excluding affiliated units in Vietnam?

Based on Sub-section 21, section 2, Part 2 of Administrative Procedures issued together with Decision 2589/QD-BTC of 2021, the following methods are prescribed:

affiliated units may choose to carry out the procedure for TIN deactivation through one of three methods:

- Direct submission at the Tax Authority's office;

- Submission via postal system;

- Electronic submission through the electronic portal of the General Department of Taxation/the portal of a competent state authority including the National Public Service Portal, the Ministry's public service portal, the provincial public service portal following the regulations on the single-window, inter-agency single-window mechanism in administrative procedure resolution and connected with the General Department of Taxation’s portal/the portal of T-VAN service providers.

Where to Download Form No. 24/DK-TCT for application for TIN deactivation in Vietnam?

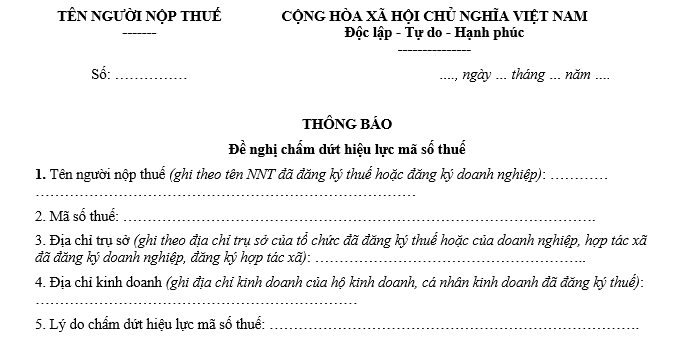

The request form for TIN deactivation, Form No. 24/DK-TCT, is issued together with Circular 105/2020/TT-BTC:

>>Download the request form for TIN deactivation, Form No. 24/DK-TCT: Download