What are procedures for tax liability imposition on exports and imports in Vietnam? Which entities have the tax liability imposition authority in Vietnam?

What are procedures for tax liability imposition on exports and imports in Vietnam?

Pursuant to Clause 5, Article 17 of Decree 126/2020/ND-CP, the specific procedure for tax liability imposition on exports and imports is as follows:

[1] Determine the goods subject to tax liability imposition as stipulated in Clause 4, Article 17 of Decree 126/2020/ND-CP.

[2] Calculate the assessed tax amount:

- The assessed tax amount is based on the name, quantity, type, code, origin, value, tax rate, exchange rate for tax calculation, and tax calculation method.

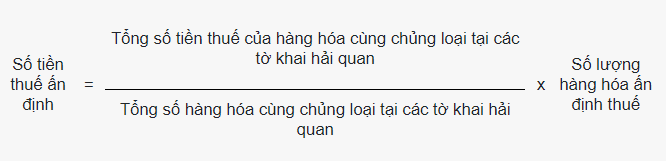

- In cases where tax is assessed on a part of the total goods of the same type belonging to different customs declarations, and the tax amount has been determined on the initial export or import declarations, the assessed tax amount is the average tax determined according to the following formula:

- In cases where the first import customs declaration involves goods not subject to tax, lacking data on tax amounts, or the customs declaration has been canceled according to the customs law or there is no customs declaration, the customs authorities will base their tax liability imposition on similar goods’ name, type, value, code, origin, tax rate, and tax method recorded in the customs database. The exchange rate for tax calculation applies at the time of issuing the tax liability imposition decision.

[3] Determine the tax difference between the payable tax amount and the tax amount declared by the taxpayer.

[4] Identify the tax payment deadline.

[5] Prepare a record to serve as the basis for tax liability imposition, excluding the following cases where no record is prepared:

- The taxpayer fails to self-calculate the payable tax amount; the customs authorities carry out tax liability imposition according to the conclusions of inspection, audit, or other authorized bodies after audits at the taxpayer's headquarters, and the conclusion has accurately identified the payable assessed tax amount; imported goods exempt from tax or those not subject to tax are collateral for loans per Point m, Clause 4, Article 17 of Decree 126/2020/ND-CP; imported goods not completing customs procedures are listed for auction sale according to authorized decisions or court judgments requiring tax payment as stipulated in Point 1, Clause 4, Article 17 of Decree 126/2020/ND-CP.

[6] Issue a written notice using Form No. 01/TBXNK in Annex II attached to Decree 126/2020/ND-CP to the taxpayer, the taxpayer's authorized representative, guarantor, or the person paying tax on behalf of the taxpayer, regarding the legal basis for tax liability imposition, the tax calculation method, detailed assessed tax amount per type of tax, the deadline for paying the assessed tax, and penalties for late payment.

- If the customs authorities carry out the tax liability imposition based on the conclusion of an authorized body as provided in Point h, Clause 1, Article 52 of the Tax Administration Law, Point n, Clause 4, Article 17 of Decree 126/2020/ND-CP, the notice to the taxpayer must specify the reason for tax liability imposition as per the authorized body's conclusions, the assessed tax amount, and its payment deadline.

- If the customs authorities assess taxes based on inspection, post-clearance inspection at the taxpayer's headquarters, the tax liability imposition reasons, legal basis, and payment deadline stated in the inspection or audit report, no further notice is required.

[7] Issue a tax liability imposition decision using Form No. 01/QDADT/TXNK in Annex III attached to Decree 126/2020/ND-CP, and send it to the taxpayer as per Point k of this Clause. The tax liability imposition decision must clearly state the reason, legal basis, assessed tax amount, payment deadline, and late payment calculation deadline.

[8] If the tax liability imposition decision is incomplete or inaccurate, the customs authorities issue an amended or supplementary tax liability imposition decision using Form No. 01/QDADT/TXNK in Annex III attached to Decree 126/2020/ND-CP.

- If the issued tax liability imposition decision does not comply with legal regulations, the customs authorities will issue a decision to annul the tax liability imposition using Form No. 02/QDHADT/TXNK in Annex III of Decree 126/2020/ND-CP.

[9] The tax amount, late payment interest, or penalty that the taxpayer has paid according to the tax liability imposition decision, but which is subject to amendments, supplements, cancellations or is greater than the amount due, will be refunded by the customs authorities to the taxpayer for the discrepancy in accordance with Article 60 of Tax Administration Law 2019.

[10] Notify the reasons for tax liability imposition, tax liability imposition decision, amended or supplementary tax liability imposition decision, or decision to annul tax liability imposition to the entities specified in Point e of this Clause within 08 working hours from the time of signing.

What are procedures for tax liability imposition on exports and imports in Vietnam? Which entities have the tax liability imposition authority in Vietnam? (Image from Internet)

Which entities have the tax liability imposition authority in Vietnam?

Pursuant to Clause 1, Article 16 of Decree 126/2020/ND-CP, the specific authorization, procedures, and decision for tax liability imposition are as follows:

- General Director of the General Department of Taxation

- Director of the Tax Department

- Head of the Tax Sub-Department

When is tax liability imposition on exports and imports carried out in Vietnam?

Pursuant to Clause 2, Article 17 of Decree 126/2020/ND-CP, the specific provisions for tax liability imposition on exports and imports are as follows:

tax liability imposition on exports and imports

...

- tax liability imposition on exported, imported goods is conducted during the customs clearance process, for goods that have already been cleared or released as specified in Clause 4 of this Article.

Thus, according to the above provisions, the timing for tax liability imposition on exports and imports occurs in one of the following instances:

- During the customs clearance process for goods that have been approved

- Release of goods as regulated in Clause 4, Article 17 of Decree 126/2020/ND-CP.