What are procedures for reissuance of taxpayer registration certificate in Vietnam?

What are procedures for reissuance of taxpayer registration certificate in Vietnam?

According to Sub-section 18, Section 2, Part 2 of the Procedures issued with Decision 2589/QD-BTC in 2021, the procedures for reissuing a torn taxpayer registration certificate are as follows:

Step 1.

- When a taxpayer loses, tears, damages, or burns the taxpayer registration certificate, taxpayer registration certificate for individuals, tax identification number notification, or dependent tax identification number notification, they must submit a dossier requesting reissuance of the taxpayer registration certificate or tax identification number Notification to the tax authority directly managing them;

- For electronic taxpayer registration dossiers: The taxpayer accesses the electronic portal chosen by the taxpayer to fill out the declaration form and attach electronic files as required (if any), digitally signs, and sends it to the tax authority through the electronic portal chosen by the taxpayer;

The taxpayer submits the dossier (the taxpayer registration dossier simultaneously with the business registration dossier under the one-stop-shop mechanism) to the competent state authority as prescribed. The competent state authority sends the received dossier information of the taxpayer to the tax authority through the General Department of Taxation's electronic portal.

Step 2. Tax authority reception:

- For paper-based taxpayer registration dossiers:

+ In the case of direct submissions at the tax authority: The tax officer receives and stamps the taxpayer registration dossier, indicating the receipt date, the number of documents according to the checklist in the case of direct submission. The tax officer issues an appointment slip indicating the result return date and the processing time of the received dossier;

+ In the case of submission by postal service: The tax officer stamps, records the receipt date on the dossier, and records the tax authority's document number;

The tax officer checks the taxpayer registration dossier. If the dossier is incomplete and requires explanation or additional information, the tax authority notifies the taxpayer using form 01/TB-BSTT-taxpayer within 02 (two) working days from the receipt date of the dossier.

- For electronic taxpayer registration dossiers:

The tax authority processes the dossier through the General Department of Taxation's electronic portal, checks, and processes the dossier via the tax authority's electronic data processing system:

+ Reception of the dossier: The General Department of Taxation's electronic portal sends a notification of receipt to the taxpayer within 15 minutes from receiving the taxpayer's electronic registration dossier;

+ Checking and processing the dossier: The tax authority reviews, processes the taxpayer's dossier as per the regulation on taxpayer registration, and returns the result through the electronic portal chosen by the taxpayer:

++ If the dossier is complete, accurate, and results need to be returned: The tax authority sends the dossier processing result to the electronic portal chosen by the taxpayer within the stipulated time.

++ If the dossier is incomplete or incorrect as per the regulations, the tax authority sends a notice of non-acceptance through the electronic portal chosen by the taxpayer within 02 (two) working days from the date on the Notice of receipt of the dossier.

What are procedures for reissuance of taxpayer registration certificate in Vietnam? (Image from the Internet)

What are methods for submission of the application for reissuance of taxpayer registration certificate in Vietnam?

According to Sub-section 18, Section 2, Part 2 of the Procedures issued with Decision 2589/QD-BTC in 2021, the reissuance of the taxpayer registration certificate is carried out by submitting the dossier in the following ways:

- Direct submission at the Tax Authority's headquarters;

- Via postal service;

- Electronically through the General Department of Taxation’s electronic portal/ the competent state authority’s electronic portal including the National Public Service Portal, ministerial-level, and provincial-level public service portals, following the one-stop-shop, inter-agency one-stop-shop mechanism and connected with the General Department of Taxation’s electronic portal/service provider T-VAN's information portal.

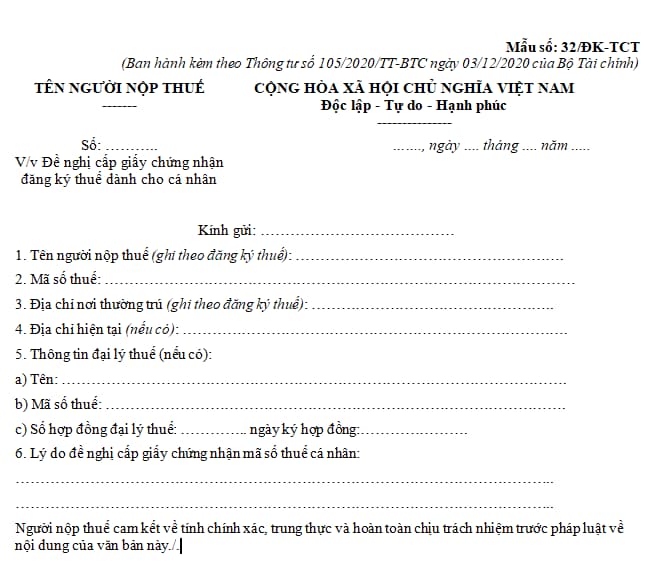

Wha is the application for taxpayer registration certificate for individuals - Form 32/DK-TCT in Vietnam?

The application for the taxpayer registration certificate for individuals - Form 32/DK-TCT in Vietnam, is issued together with Circular 105/2020/TT-BTC:

>> Download the application for taxpayer registration certificate for individuals - Form 32/DK-TCT