What are procedures for handling the first-time taxpayer registration applications from non-business individuals in Vietnam?

What are forms of receiving taxpayer registration applications from taxpayers in Vietnam?

According to Clause 2, Article 41 of the Law on Tax Administration 2019, the tax authority receives taxpayer registration applications from taxpayers through the following forms:

- Receipt of documents directly at the tax office;

- Receipt of documents sent via postal service;

- Receipt of electronic documents through the electronic transaction portal of the tax authority and from the national information system on business registration, cooperative registration, and business activities registration.

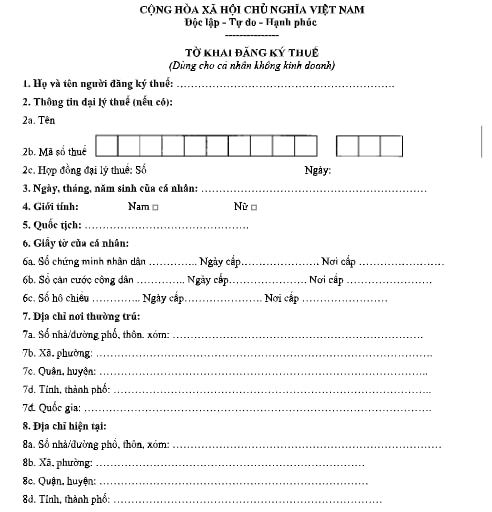

What are procedures for handling the first-time taxpayer registration applications from non-business individuals in Vietnam? (Image from the Internet)

What are procedures for handling the first-time taxpayer registration applications from non-business individuals in Vietnam?

Based on Subsection 2, Section 1, Administrative procedures issued together with Decision 2589/QD-BTC 2021, the Tax Authority handles the first-time taxpayer registration applications from non-business individuals as follows:

- For paper-based taxpayer registration applications:

+ In case the documents are submitted directly at the tax office: The tax official receives, stamps the date of receipt on the taxpayer registration applications, notes the date of receipt, and lists the number of documents as per the document list for cases of direct submission at the tax office. The tax official issues a receipt indicating the date for the results and the deadline for processing the received documents;

+ In case the taxpayer registration applications are sent via postal service: The tax official stamps the date of receipt, notes the receipt date on the documents, and records the tax office’s document number.

The tax official checks the taxpayer registration applications. In cases where the documents are incomplete and need clarification or additional information, the tax authority will notify the taxpayer using Form 01/TB-BSTT-NNT in Appendix 2 issued together with Decree 126/2020/ND-CP within 2 (two) working days from the date of receipt.

- For electronic taxpayer registration applications:

The Tax Authority receives the documents through the electronic portal of the General Department of Taxation, checks and processes the documents through the electronic data processing system of the tax authority:

+ Receipt of documents: The electronic portal of the General Department of Taxation sends a notice of receipt to the taxpayer via the electronic portal chosen by the taxpayer for document submission (the electronic portal of the General Department of Taxation/government agency’s electronic portal or a T-VAN service provider) within a maximum of 15 minutes from the time the taxpayer’s electronic registration documents are received;

+ Check and process documents: The tax authority checks and processes the taxpayer's documents as per the law’s provisions on taxpayer registration applications and sends the results back through the electronic portal chosen by the taxpayer for document submission:

++ If the documents are complete and compliant with regulations and require a result: The tax authority sends the processed documents’ results to the electronic portal chosen by the taxpayer by the deadline stipulated in [Circular 105/2020/TT-BTC](https://lawnet.vn/vb/Thong-tu-105-2020-TT-BTC-huong-dan-dang-ky-thue-702A9.html);

++ If the documents are incomplete or non-compliant with regulations, the tax authority sends a notification of non-acceptance to the electronic portal chosen by the taxpayer for document submission, within 2 (two) working days from the date indicated on the receipt notification.

Where to download Form 05-DK-TCT for taxpayer registration application for non-business individuals in Vietnam?

The current Form for taxpayer registration application for non-business individuals is Form 05-DK-TCT in Appendix 2 issued with Circular 105/2020/TT-BTC:

>> Download Form 05-DK-TCT for taxpayer registration application for non-business individuals: Here

Instructions for filling out the taxpayer registration applications form for non-business individuals according to Form 05-DK-TCT are as follows:

(1) Full name of the person registering: Clearly and fully write in uppercase letters the name of the individual registering.

(2) Tax agent information: Fully write the information of the tax agent in case the tax agent signs a contract with the taxpayer to carry out the registration procedures on behalf of the taxpayer as per the provisions of the Law on Tax Administration.

(3) Date of birth of the individual: Clearly write the date, month, year of birth of the individual registering.

(4) Gender: Check one of the two boxes Male or Female.

(5) Nationality: Clearly write the nationality of the individual registering.

(6) Personal documents: Fully write the information of the personal documents of the individual registering as stipulated in Circular 105/2020/TT-BTC.

(7) Permanent address: Fully write the information on the permanent address of the individual as recorded in the household registration book or in the national population database.

(8) Current address: Fully write the current address information of the individual (only if this address is different from the permanent address).

(9) Contact phone number, email: Write the phone number, email address (if any).

(10) Income paying agency at the time of registration: Write the income paying agency that you are working for at the time of registration (if any).

(11) Tax agent’s employee: In cases where a tax agent declares on behalf of the taxpayer, fill in this information.