What are procedures for environmental protection tax declaration in Vietnam?

What are procedures for environmental protection tax declaration in Vietnam?

Pursuant to sub-section 21, Section 2 of the Administrative Procedures issued with Decision 1462/QD-BTC of 2022, the guidance for filing the environmental protection tax is as follows:

Step 1: The taxpayer prepares data, completes the tax declaration form, and submits it to the tax authority no later than the 20th day of the month following the month of occurrence. Specifically:

- The taxpayer submits the environmental protection tax declaration dossier at the place of production of goods subject to the environmental protection tax, place of production, or business of coal, except for the environmental protection tax of gasoline and oil business activities (stipulated at point a, clause 4, Article 11, Decree 126/2020/ND-CP), and the environmental protection tax for coal extraction and domestic consumption (stipulated at point b, clause 4, Article 11, Decree 126/2020/ND-CP).

- For gasoline and oil business activities:

+ The leading trader who directly imports, produces, or blends gasoline and oil submits the tax declaration to the directly managing tax authority for the quantity of gasoline and oil directly exported, sold, or used internally by the leading trader, sold for product exchange, returned for entrusted import, sold to other organizations or individuals not considered subsidiaries or branches under the Law on Enterprise of the leading trader; excluding the quantity of gasoline and oil foreign depot sale and entrusted importation for other leading traders.

+ Subsidiaries under the Law on Enterprise of the leading trader or dependent units of the subsidiaries, dependent units of the leading trader submit the tax declaration dossier to the directly managing tax authority for the gasoline and oil exported, sold to organizations or individuals other than the subsidiary under the Law on Enterprise of the leading trader and dependent unit of the subsidiary.

+ Leading traders or subsidiaries under the Law on Enterprise of the leading trader with a dependent unit operating in a different province or centrally-run city from where the leading trader or subsidiary of the leading trader is headquartered but the dependent unit does not account independently to declare the environmental protection tax separately; the leading trader or subsidiary of the leading trader executes the environmental protection tax declaration to the directly managing tax authority; calculates tax and allocates payable tax obligations for each locality where the dependent unit is headquartered according to the regulations of the Minister of Finance.

- For domestically extracted and consumed coal:

Enterprises involved in extracting and consuming domestic coal through management forms and delegating subsidiary companies or dependent units to extract, process, and consume will submit the tax declaration for the total environmental protection tax arising from coal extraction subject to tax and submit the declaration dossier to the direct managing tax authority, accompanied by a table determining the payable tax amount for each locality where coal extraction companies are headquartered as regulated by the Minister of Finance.

Step 2: Tax Authority Processing:

- The tax management authority receives the tax declaration, notifies the receipt of the tax declaration; in the case of illegal, incomplete, or incorrect form of dossiers, it will notify the taxpayer within 03 working days from the date of receiving the dossier.

- In the case of electronic receipt of dossiers via the General Department of Taxation's Portal, the tax authority proceeds with receiving, checking, and resolving the dossier via the electronic data processing system of the tax authority:

+ The General Department of Taxation's Portal sends a notice acknowledging the taxpayer's submission of the dossier or the reason for not accepting the dossier through the electronic portal chosen by the taxpayer to prepare and submit the dossier (the General Department of Taxation's Portal/another competent State's electronic portal or T-VAN service provider organization) no later than 15 minutes from when receiving the taxpayer's electronic tax declaration.

+ The tax authority performs checks, and resolves tax declarations of the taxpayer as per the Tax Administration Law and guiding documents, sending an acceptance/non-acceptance notice to the electronic portal chosen by the taxpayer to prepare and submit the dossier no later than 01 working day from the date indicated on the receipt notice of the electronic tax declaration.

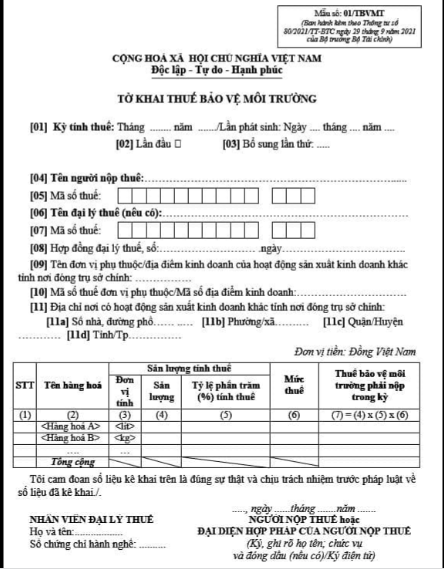

What are procedures for environmental protection tax declaration in Vietnam? (Image from the Internet)

When is the timing of calculating the environmental protection tax in Vietnam?

According to Article 6 of Circular 152/2011/TT-BTC on determining the tax calculation point as follows:

Timing of Tax Calculation

1. For goods produced and sold, exchanged, donated, given as promotional or advertising items, the timing of tax calculation is the moment of transfer of ownership or use rights of the goods.

2. For goods produced and consumed internally, the timing of tax calculation is the point of entering the goods into use.

3. For imported goods, the timing of tax calculation is the customs declaration registration time, excluding imported gasoline and oil for sale as stated in clause 4 of this article.

4. For gasoline and oil produced or imported for sale, the timing of tax calculation is when the leading business in gasoline and oil sells them.

The specific timing of calculating the environmental protection tax is as follows:

- For goods produced and sold, exchanged, donated, given as promotional or advertising items, the tax calculation point is when ownership or use rights transfer.

- For goods produced and used internally, the tax calculation point is when the goods are put into use.

- For imported goods, the tax calculation is when the customs declaration is registered, excluding oil and gasoline for sale.

- For gasoline and oil produced or imported for sale, the timing is when the leading business in gasoline and oil sells them.

What is the environmental protection tax declaration form in Vietnam according to Circular 80?

The Environmental Protection Tax Declaration Form is Form 01/TBVMT Appendix 2 issued with Circular 80/2021/TT-BTC:

Download the Environmental Protection Tax Declaration Form for 2024.