What are procedures for direct payment to the state budget of Vietnam?

What does the dossier for direct payment to the state budget of Vietnam include?

Based on Clause 5, Article 4 of Decree 11/2020/ND-CP, the dossier for direct payment to the state budget is stipulated as follows:

Procedure for payment to the state budget

...

5. Composition and quantity of the dossier:

a) Dossier composition:

Voucher for payment to the state budget or a document from a competent state agency requesting the payer to submit payment to the state budget.

b) Quantity of dossier:

In the case of direct payment to the state budget: 01 original voucher for payment to the state budget. However, for those paying at banks that do not yet cooperate in budget collection with financial industry agencies, it is required to prepare 02 original copies or 01 original and 01 photocopy of the document from a competent state agency requesting the payer to submit payment to the state budget.

For electronic payment to the state budget: 01 voucher created using application programs at the tax authority's electronic portal, National Public Service Portal, or the bank's electronic payment application system, or intermediary payment service providers.

The dossier for payment to the state budget includes:

- Voucher for payment to the state budget

- Or a document from a competent state agency requesting the payer to submit payment to the state budget.

Note:

- If paying to the state budget directly, prepare 01 original voucher for payment.

For those paying at banks that do not yet cooperate in budget collection with financial industry agencies, prepare 02 original vouchers or 01 original and 01 photocopy of the document from a competent state agency requesting the payer to submit payment to the state budget.

- If paying to the state budget electronically: 01 voucher created using application programs at the tax authority's electronic portal, National Public Service Portal, or the bank's electronic payment application system, or intermediary payment service providers.

What are procedures for direct payment to the state budget of Vietnam? (Image from the Internet)

What are procedures for direct payment to the state budget of Vietnam?

Based on Clause 3, Article 4 of Decree 11/2020/ND-CP, the procedure for direct payment to the state budget is stipulated as follows:

- The taxpayer prepares a voucher for payment to the state budget or directly sends documents from competent state agencies requesting payment to the state budget to the State Treasury, bank, or tax authority to complete the payment procedure.

- The State Treasury or tax authority where the taxpayer completes the payment procedure checks the legality and validity of the payment voucher or documents from competent state agencies requesting payment to the state budget, as well as the account balance of the taxpayer (if any). Then, they conduct the procedure to collect cash or process payments through non-cash methods used by the payer for the state budget; simultaneously, issue a payment voucher to the taxpayer.

The bank where the taxpayer completes the payment procedure checks the account balance information (in the case of account debiting). Then, they conduct the procedure to collect cash or process payments through non-cash methods used by the payer for the state budget; simultaneously, issue a payment voucher to the taxpayer.

- In the case where the taxpayer's account balance is insufficient for the payment to the state budget, the State Treasury, bank, or tax authority (where the taxpayer completes the payment procedure) will notify the taxpayer to re-establish a payment voucher to conduct payment to the state budget according to the above procedure.

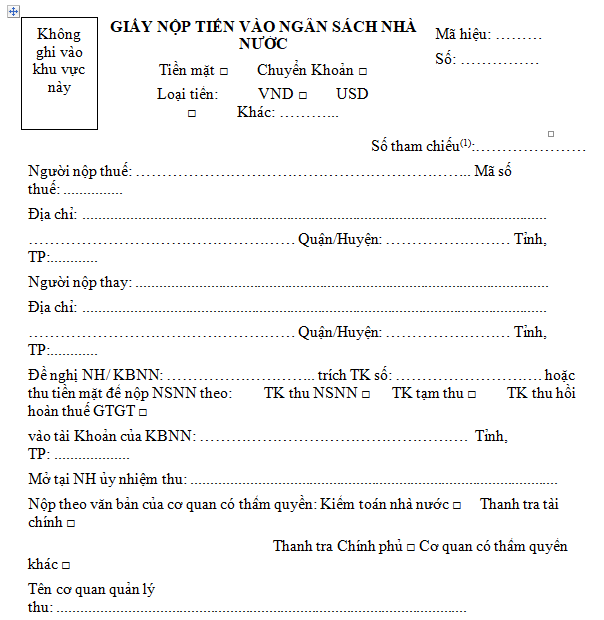

What is the Form C1-02/NS on state budget payment receipt in Vietnam?

Based on form number C1-02/NS issued together with Circular 84/2016/TT-BTC, the state budget payment receipt is regulated as follows:

Download Form C1-02/NS on state budget payment receipt here.