What are guidelines on how to write the assessment form for Vietnamese official at the end of 2024? Who is a tax officer?

What are guidelines on how to write the assessment form for Vietnamese official at the end of 2024?

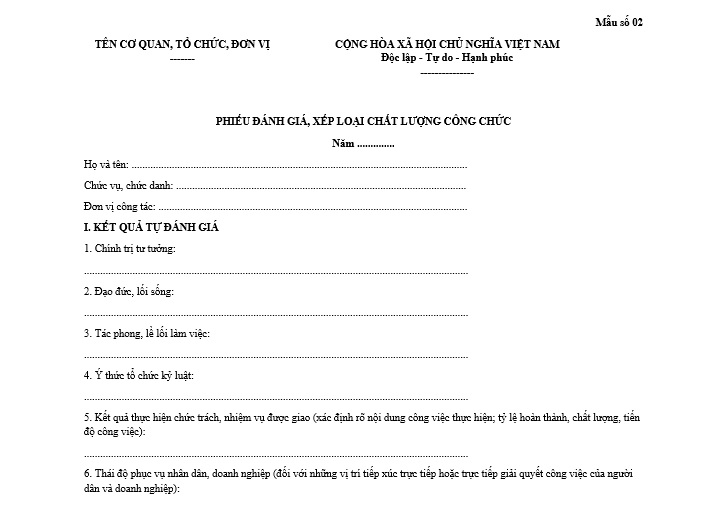

The assessment form for Vietnamese official at the end of 2024 is used according to Form No. 02 issued in conjunction with Decree 90/2020/ND-CP.

The assessment form for Vietnamese official at the end of 2024 is as follows:

Download the assessment form for Vietnamese official at the end of 2024...Download

Below are the guidelines for writing the assessment form for Vietnamese official at the end of 2024:

PERSONAL INFORMATION

- Full name:

- Professional title:

- Work unit

(1) RESULTS OF SELF-EVALUATION

1. Political Ideology:

- Comply with the guidelines, policies, regulations of the Communist Party, policies, and laws of the State, organizational principles, and discipline of the Communist Party, especially the principles of democratic centralism, self-criticism, and criticism.

- Have a firm political stance; steadfast in principles; not swayed by difficulties or challenges.

- Place the interests of the Communist Party, nation - people, the collective above personal interests.

- Be conscious of studying, applying Marxism-Leninism, Ho Chi Minh’s thoughts, resolutions, directives, decisions, and documents of the Communist Party.

- Always participate fully in political activities and political theory classes organized by the unit and higher levels.

2. Ethics, Lifestyle:

- Live simply, friendly, maintain harmonious relationships with everyone, without selfish or competitive conduct.

- No embezzlement, corruption, negativity, wastefulness, bureaucracy, opportunism, self-interest, abuse of power.

- No signs of degradation in ethics or lifestyle.

- Live honestly, humbly, sincerely, transparently, and simply.

- Have a spirit of solidarity, build a clean and strong agency, organization, unit.

3. Conduct, Working Style:

- Responsible at work; dynamic, creative, dare to think, dare to do, flexible in task execution.

- Scientific, democratic working methods, adhering to principles.

- Always fully prepare dossiers, documents, and plans before attending important meetings.

- Proactively organize reasonable time to complete assigned tasks well, ensuring deadlines without reminders.

- Possess a spirit of responsibility and cooperation in task execution.

- Appropriate attitude and mannerisms, standard working style, meeting the civil service culture requirements.

4. Organizational Discipline Awareness:

- Comply with the assignment by the Committee, agency, mass organization.

- Implement the rules, regulations, and internal rules of the agency.

- Report fully, accurately, and objectively on matters related to the performance of responsibilities and tasks assigned and activities of the agency, organization, unit to superiors when requested.

5. Performance of Responsibilities, Assigned Tasks (clearly identify the tasks accomplished; completion rate, quality, progress of tasks):

- In performing tasks, always uphold democratic centralism principles, comply with the guidelines and policies of the Communist Party, state laws. Always show responsibility, and dedication to work.

- Successfully completed all professional tasks: processed 100% of the administrative documents assigned in 2024 without any errors.

- Performance of tasks according to law regulations, set plans, or specific tasks assigned; volume, progress, quality of task execution.

6. Attitude in Serving People, Businesses (for positions dealing directly with or handling citizens' and businesses' work):

- Appropriate conduct and rationally resolve all situations, persuasive without causing trouble.

- When meeting with citizens, always listen and respond thoroughly, with no negative feedback about work attitude from citizens.

- Completed 100% of business document processing requests within the specified time, without causing trouble or unnecessary paperwork requests.

SECTION FOR TAX ADMINISTRATION OFFICIALS

7. Performance of the agency, organization, unit assigned for management, leadership:

8. Leadership, Management Capacity:

9. Ability to gather, unite:

(2) SELF-REMARKS, QUALITY CLASSIFICATION

1. Self-assessment of Strengths, Weaknesses:

- Regarding strengths

+ Always maintain perspective, principles, political bravery in the face of difficulties, challenges in work, life.

+ Always calm to strive to overcome difficulties. Never shirk or evade, creative in work.

+ Always conscious of self-study, self-improvement, humble, learn in work to elevate professional competence.

+ Possess a sense of organizational discipline, straightforwardness, honesty.

+ Have a spirit of responsibility and enthusiasm, proactive in work.

- Regarding weaknesses

+ Not yet proficient in using information technology, need improvement to meet digital transformation demands.

+ Sometimes face challenges in handling multiple tasks simultaneously, need to improve time management skills.

+ Occasionally passive in cooperating with other departments, need to enhance proactive spirit.

+ Excessively focused on details, leading to extended task execution time.

2. Self-quality classification:

(Completed outstandingly; well completed tasks; completed tasks; did not complete tasks).

(3) COMMENTS, EVALUATION

Section for the leader of the constituent unit (if any)

(4) EVALUATION RESULTS, QUALITY CLASSIFICATION FOR OFFICIALS (Section for competent authority evaluation)

1. Remarks on strengths, weaknesses:

2. Evaluation results, quality classification:

3. Remarks on the trend, development prospects of the official:

Note: Information is for reference only!

What are guidelines on how to write the assessment form for Vietnamese official at the end of 2024? (Image from the Internet)

Who are the tax administration officials in Vietnam?

Based on Article 2 of the Law on Tax Administration 2019, the regulations are as follows:

Subjects of application

- Taxpayers include:

a) Organizations, households, business households, and individuals who pay taxes according to tax law regulations;

b) Organizations, households, business households, and individuals paying other amounts belonging to the state budget;

c) Organizations, individuals deducting tax.

- Tax administration agencies include:

a) Tax authorities including the General Department of Taxation, Provincial Tax Departments, District Tax Offices, Inter-local Tax Offices;

b) Customs agencies including the General Department of Customs, Provincial Customs Departments, Post-clearance Audit Department, District Customs Offices.

3. Tax administration officials include tax officials and customs officials.

- Related state agencies, organizations, individuals.

Thus, tax administration officials include tax officials and customs officials.

Who is a tax officer in Vietnam?

Based on Clause 1, Article 13 of Circular 29/2022/TT-BTC, it is stipulated as follows:

Tax Officer (code 06.040)

1. Responsibilities

A tax officer is an executive official, performing simple tasks related to the professional duties of the tax sector; directly performing part of the tax administration duties as assigned by the unit.

…

Accordingly, under the above regulation, a tax officer is an executive official, performing simple tasks related to the professional duties of the tax sector; directly handling part of the tax administration duties as assigned by the unit.