What are guidelines on how to read XML files of e-invoices using the iTaxViewer application from the General Department of Taxation of Vietnam?

What are guidelines on how to read XML files of e-invoices using the iTaxViewer application from the General Department of Taxation of Vietnam?

iTaxViewer is an application that supports reading and verifying tax declarations and notices in XML format issued by the General Department of Taxation of Vietnam. It assists in reading personal income tax settlement declarations, corporate income tax settlement declarations, invoice reports, financial statements, and monthly, quarterly tax declarations and notices. Additionally, iTaxViewer allows users to review declaration contents and electronic signatures.

Below is guidance on how to read XML files of e-invoices using the iTaxViewer application from the General Department of Taxation of Vietnam:

- Step 1: Download the iTaxViewer application and install it on your computer.

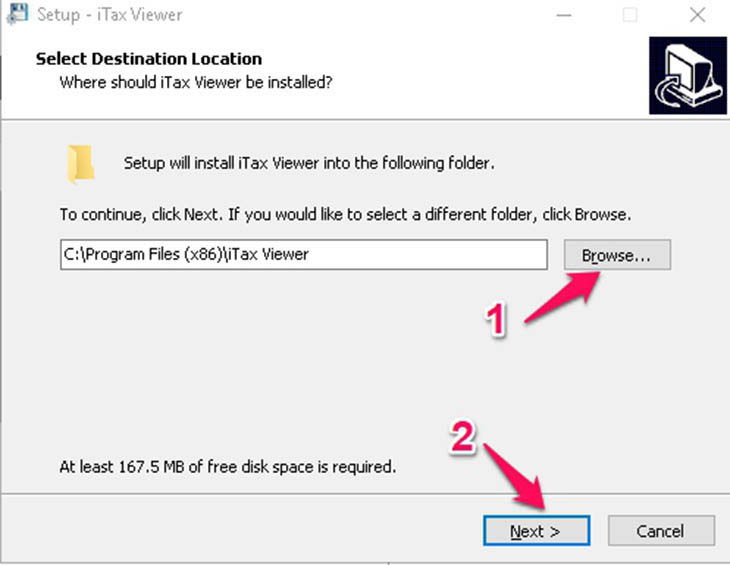

- Step 2: Select “Browse” to choose the storage folder, click next twice to proceed to icon creation.

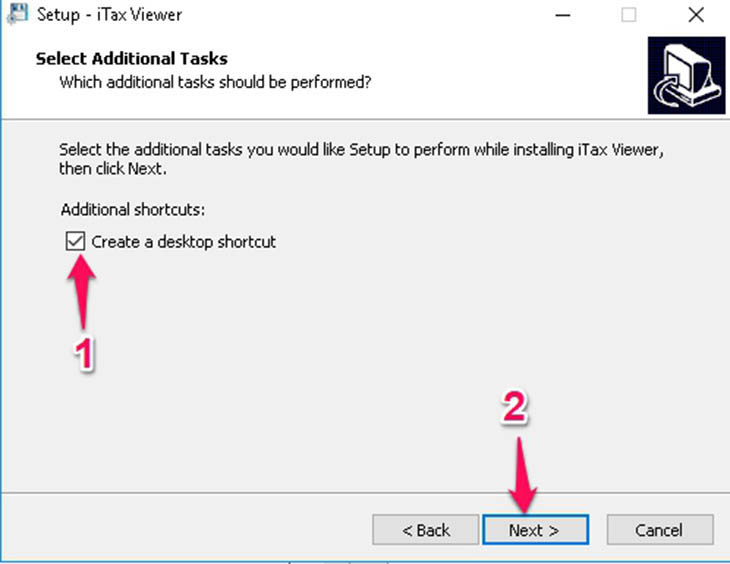

- Step 3: Check the box “Create a desktop shortcut” to create an icon for iTaxViewer and continue by clicking Next.

- Step 4: Click Install to proceed with the software installation.

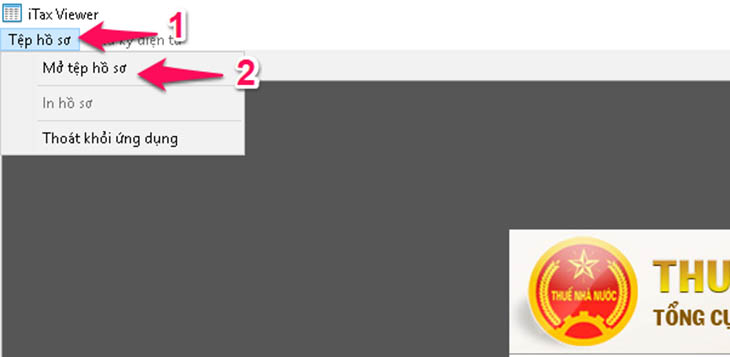

- Step 5: After the installation, open the software and then click on the File option to open the XML file you need to read.

Note: The content "Guidance on How to Read XML Files of e-invoices Using the iTaxViewer Application from the General Department of Taxation of Vietnam?" is for reference purposes only.

What is the format of e-invoices in Vietnam?

Based on Clauses 1 and 2 of Article 12 Decree 123/2020/ND-CP, the regulations regarding the format of e-invoices are as follows:

- The format of e-invoices is a technical standard that defines the data type, data length of information fields for the transmission, storage, and display of e-invoices.

- The format of e-invoices uses the markup language XML ("XML" stands for "eXtensible Markup Language" intended for sharing electronic data between information technology systems).

- The format of e-invoices includes two components:

+ A component containing the business data of the e-invoice.

+ A component containing the digital signature data.

For e-invoices with a tax authority code, there is an additional component containing data related to the tax authority code.

What are requirements for retention of e-invoices in Vietnam?

Based on Clauses 1 and 2 of Article 6 Decree 123/2020/ND-CP, retention of e-invoices must meet the following requirements:

- Safety, security, integrity, and completeness without alteration or distortion throughout the storage period;

- Stored in full and according to the duration stipulated by accounting law.

- e-invoices are stored using electronic means. Agencies, organizations, and individuals have the right to choose and apply the suitable format for storing e-invoices according to the nature of their activities and the capability of technology application.

- e-invoices and electronic documents must be ready to be printed on paper or retrieved upon request.

What are cases of suspension of use of e-invoices in Vietnam?

Based on Clause 1 of Article 16 Decree 123/2020/ND-CP, businesses, economic organizations, other organizations, households, and individual businesses cease using authenticated e-invoices or unauthenticated e-invoicess in the following cases:

- Businesses, economic organizations, other organizations, households, and individual businesses have their tax identification number terminated;

- Businesses, economic organizations, other organizations, households, and individual businesses have been verified and announced by tax authorities as not operating at the registered address;

- Businesses, economic organizations, other organizations, households, and individual businesses notify the competent state management authority of a temporary business suspension;

- Businesses, economic organizations, other organizations, households, and individual businesses receive notices from tax authorities to cease using e-invoices for tax debt enforcement;

- Engaging in using e-invoices for the sale of smuggled goods, banned goods, counterfeit goods, or infringing intellectual property rights, discovered and reported to tax authorities by competent agencies;

- Engaging in issuing e-invoices for the purpose of fraudulent sales of goods or services to embezzle funds from organizations or individuals, detected and reported by competent agencies to tax authorities;

- Business registration offices or competent state authorities require businesses to temporarily suspend conditional business lines upon discovering businesses do not meet the legal business conditions;

- Based on inspection and examination results, if tax authorities determine that businesses were established to engage in illegal trade or usage of e-invoices or use e-invoices illegally to evade taxes, tax authorities will issue decisions to discontinue the use of e-invoices and subject businesses to legal actions according to law.