What are guidelines on filling in the latest tax accounting book in Vietnam for 2024? What is the tax accounting book?

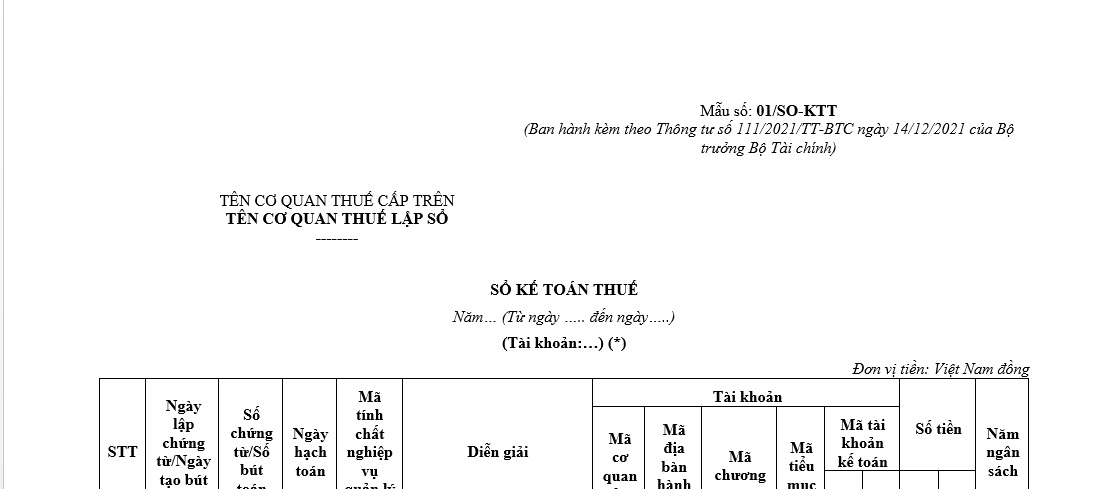

What is the latest template of the tax accounting book in Vietnam?

The newest template of the tax accounting book for 2024 is template No. 01/SO-KTT, issued in Annex 4 of Circular 111/2021/TT-BTC.

Below is the latest tax accounting book template for 2024:

Download the latest tax accounting book template ...Download

What are guidelines on filling in the latest tax accounting book in Vietnam for 2024?

Based on the guidelines in Section 3, Annex 4 issued with Circular 111/2021/TT-BTC, the method for filling in the tax accounting book is prescribed as follows:

(1) Content:

- Based on the automatically generated accounting entries according to the process of collecting input intemplateation of tax accounting as prescribed in Article 12 of Circular 111/2021/TT-BTC, incurred in chronological order and recorded in the period.

- Based on the tax accounting documents prepared and recorded by the tax accounting department during the period.

(2) How to record:

- Column 1: Serial number of the Tax Accounting Book.

- Columns 2, 3: Date of entry creation and entry number automatically generated by the system when recording in the Tax Accounting Book or the date of creating accounting documents and the number of documents prepared by the accounting department according to the provisions in Circular 111/2021/TT-BTC.

- Column 4: The date of accounting determined according to the provisions in point a, clause 2, Article 8 of Circular 111/2021/TT-BTC.

- Column 5: The nature code of tax management operations as prescribed in clause 1, Article 13, and Annex 1 issued with Circular 111/2021/TT-BTC. This column is allowed to record one or more codes with similar operational nature.

- Column 6: Record the description of each entry/document in the Tax Accounting Book taken from the column "Content Reflected" in Annex 1 issued with Circular 111/2021/TT-BTC.

- Columns 7, 8, 9, 10, 11, 12: Tax authority code, administrative area code, program code, sub-item code, debit accounting account code, credit accounting account code corresponding to each entry/document recorded in the Tax Accounting Book.

- Columns 13, 14: The amount corresponding to each entry/document.

- Column 15: Fiscal year with the value "01", only recorded in case of adjusting the accounting errors of previous years during this year as prescribed in point d, clause 3, Article 8 of Circular 111/2021/TT-BTC.

- In the case of choosing to print the Tax Accounting Book according to the account system of the accounting accounts prescribed in Article 24 of Circular 111/2021/TT-BTC, the Tax Accounting Book creates additional lines as follows:

Line "Beginning Balance": The beginning balance of the accounting account recorded in the Tax Accounting Book.

Line "Transactions during the Period": List of transactions in the accounting account recorded in the Tax Accounting Book for each tax authority code, administrative area code, program code, sub-item code, and corresponding contra-account during the period.

Line "Total Transactions during the Period": Total transactions during the period of the accounting account recorded in the Tax Accounting Book.

Line "Ending Balance": The ending balance of the accounting account recorded in the Tax Accounting Book.

- In the case of not choosing to print the Tax Accounting Book according to the account system of the accounting accounts prescribed in Article 24 of Circular 111/2021/TT-BTC, the Tax Accounting Book only records the content of tax management operations incurred of all accounting accounts in chronological order.

What are guidelines on filling in the latest tax accounting book in Vietnam for 2024? (Image from Internet)

What is the tax accounting book in Vietnam?

According to Article 25 of Circular 111/2021/TT-BTC, the tax accounting book is regulated as follows:

- The tax accounting book is a type of data established in the tax accounting subsystem.

- The tax accounting book is used to record, reflect, and store systematically all amounts of tax due, collected, outstanding, refundable, refunded, outstanding refunds, exempted, reduced, deferred, and written off during the tax management operations of tax authorities at various levels.

- Intemplateation in the tax accounting book must ensure to accurately, promptly, honestly, continuously, and systematically reflect all tax management activities of the tax authority.

The tax accounting department of the tax authority is not allowed to exclude from the tax accounting book any amount that the tax authority must collect, collected, outstanding, refundable, refunded, outstanding refunds, exempted, reduced, deferred, or written off.

- The tax accounting book in the template of data in the tax accounting subsystem reflects intemplateation of tax accounting created and stored electronically on the tax accounting data basis, established according to the standard procedures of the Tax Management Application System, storing all tax management activities incurred by business content and in chronological order related to tax accounting.

The tax accounting book in the template of electronic data can be printed out on paper for use as required by tax accounting work.

- The tax accounting data must be recorded and stored in accordance with the requirements of the Accounting Law, Electronic Transactions Law, Decree No. 174/2016/ND-CP, other guiding documents for the implementation of the Accounting Law, and in compliance with the regulations in Circular 111/2021/TT-BTC.