What are guidelines for searching the Chapter for licensing fee payment in Vietnam in 2025?

What are guidelines for searching the Chapter for licensing fee payment in Vietnam in 2025?

Below are the steps to search for the code for licensing fee 2025:

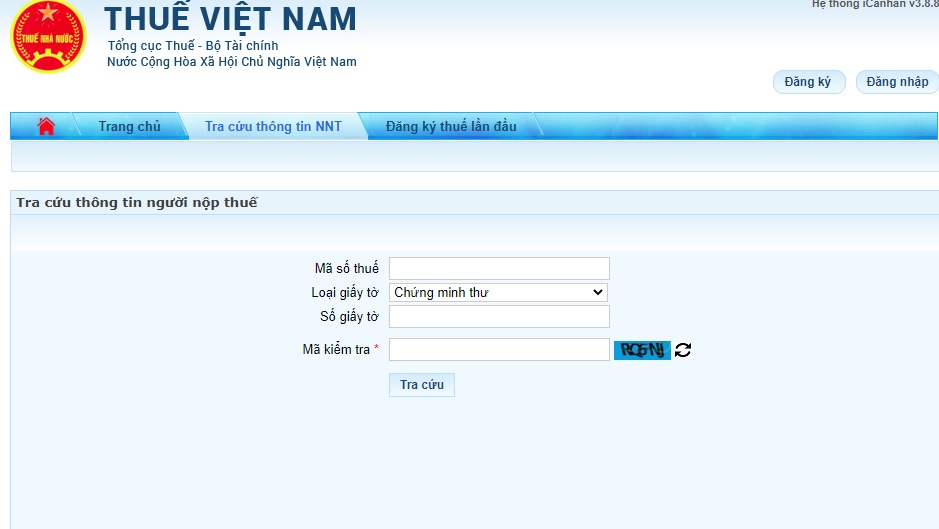

Step 1: Access the website of the Electronic Tax Service Portal

https://thuedientu.gdt.gov.vn

Step 2: Select the "Taxpayer Information" section >> Enter the enterprise Chapter >> Enter the verification code >> Click search.

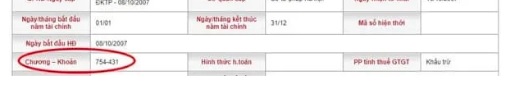

Step 3: Once the search is completed, the screen will display as shown below and show the enterprise code (the first 03 digits of the “Chapter - Section” part).

Additionally, if you wish to search for the sub-item code for the licensing fee 2025, follow these steps:

Step 1: Login to HTKK software -> "Fees - Charges" -> "Annual License Fee Declaration (01/LPMB) (Circular 80/2021)"

Step 2: Click print and preview

Step 3: View the sub-item code for the licensing fee at the bottom left corner of the license fee declaration form.

What are guidelines for searching the Chapter for licensing fee payment in Vietnam in 2025? (Image from the Internet)

What is the Chapter for licensing fee in Vietnam in 2025?

According to Clause 1, Article 2 of Circular 324/2016/TT-BTC, a Chapter is defined for classifying state budget revenue and expenditure based on the organizational system of agencies and organizations directly under a level of government (collectively referred to as the managing agency) with independent budget management.

Each budget level arranges a special Chapter (Other budget relations) to reflect revenue and expenditure items not allocated in the estimates for agencies and organizations.

The list of Chapters is specified in detail in Appendix I issued with Circular 324/2016/TT-BTC. The Department of Finance guides the coding of Chapters in the locality to suit the actual organization in the locality; no different codes are issued from this Circular.

According to the regulations in Appendix I issued with Circular 324/2016/TT-BTC (amended in Circular 93/2019/TT-BTC), the code for the licensing fee 2025 is regulated as follows:

(1) The code is digitized into 03 characters according to each management level:

| Management Level | Chapter |

| Central agency | 001 - 399 |

| Provincial agency | 400 - 599 |

| District agency | 600 - 799 |

| Commune agency | 800 - 989 |

In simple terms, the code for the licensing fee is the code of enterprises classified by the tax management agency.

(2) The code for the licensing fee 2025 is specified as follows:

| Chapter | Name | Management Level |

| 151 | Economic units with 100% foreign investment in Vietnam | Central |

| 152 | Units with foreign investment from 51% to less than 100% of charter capital or have a majority of general partners who are foreign individuals for partnership companies | Central |

| 153 | Vietnamese economic units with overseas investments | Central |

| 154 | Mixed economy outside state-owned enterprises | Central |

| 158 | Mixed economic units with state capital over 50% to less than 100% of charter capital | Central |

| 159 | Units with state capital up to 50% of charter capital | Central |

| 160 | Other budget relations | Central |

| 161 | Foreign main contractors | Central |

| 162 | Foreign subcontractors | Central |

| 551 | Units with 100% foreign investment in Vietnam | Provincial |

| 552 | Units with foreign investment from 51% to less than 100% of charter capital or have a majority of general partners who are foreign individuals for partnership companies | Provincial |

| 553 | Economic units with overseas investments | Provincial |

| 554 | Mixed economy outside state-owned enterprises | Provincial |

| 555 | Private enterprises | Provincial |

| 556 | Cooperatives | Provincial |

| 557 | Households, individuals | Provincial |

| 558 | Mixed economic units with state capital over 50% to less than 100% of charter capital | Provincial |

| 559 | Units with state capital up to 50% of charter capital | Provincial |

| 560 | Other budget relations | Provincial |

| 561 | Foreign main contractors | Provincial |

| 562 | Foreign subcontractors | Provincial |

| 563 | Local General Corporations management | Provincial |

| 564 | Units where the state holds 100% of charter capital (not belonging to managing agencies, Group or Corporation Chapters) | Provincial |

| 754 | Mixed economy outside state-owned enterprises (limited liability company, joint-stock company) | District |

| 755 | Private enterprises | District |

| 756 | Cooperatives | District |

| 757 | Households, individuals | District |

| 758 | Mixed economic units with state capital over 50% to less than 100% of charter capital | District |

| 759 | Units with state capital up to 50% of charter capital | District |

Typically, enterprises will be managed by the Tax Department with codes for licensing fee from 754 - 759.

What are regulations on Sub-item for the licensing fee in Vietnam in 2025?

According to point b, Clause 1, Article 4 of Circular 324/2016/TT-BTC, a Sub-item is a detailed classification of an Item, used for detailed classification of state budget revenue and expenditure by management objects within each Item. The Item is used for classifying state budget revenue and expenditure based on economic content according to state budget policies and regulations.

The latest sub-item for licensing fee 2025 is shown in Item 2850, sub-group 0114, Appendix 3 issued with Circular 324/2016/TT-BTC as follows:

| Level | Sub-item | Registered Charter Capital/Investment | Tax Rate (Clause 1, Article 4 of Decree 139/2016/ND-CP) |

| 1 | 2862 | Over 10 billion VND | 3 million VND/year |

| 2 | 2863 | 10 billion VND or less | 2 million VND/year |

| 3 | 2864 | Branch, representative office, business location | 1 million VND/year |