What are guidelines for preparing the latest 2025 surcharge settlement form in Vietnam (Form 02/PTHU-DK)?

Download the 2025 surcharge settlement form (Form 02/PTHU-DK)?

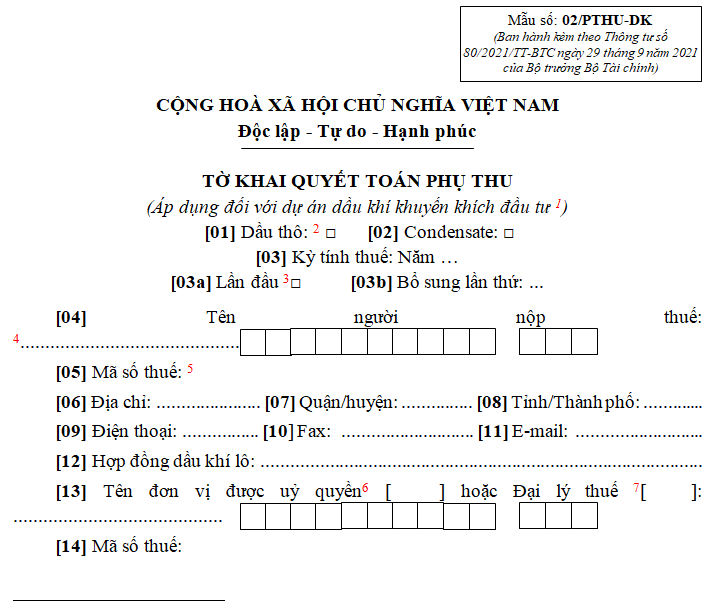

Form 02/PTHU-DK - surcharge settlement form applicable to incentivized investment petroleum projects is stipulated in Section XII of Appendix II issued together with Circular 80/2021/TT-BTC.

DOWNLOAD >>> Form 02/PTHU-DK

What are guidelines for preparing the latest 2025 surcharge settlement form in Vietnam (Form 02/PTHU-DK)?

Below is a guide on how to prepare the surcharge settlement form for incentivized investment petroleum projects according to Form 02/PTHU-DK issued with Circular 80/2021/TT-BTC as follows:

[1] Incentivized investment petroleum projects are those executing petroleum activities in deep water zones, offshore, areas with particularly challenging geographic conditions, complex geology, and other locations based on blocks decided by the Prime Minister (According to Point c Clause 1 Article 6 of Circular 22/2010/TT-BTC).

[2] For [01] and [02]: Tick an X in one of the 2 options, corresponding to the type of petroleum under the incentivized investment project that requires a surcharge settlement.

If a taxpayer exploits both crude oil and condensate simultaneously, they must declare each separately.

[3] Tick an X in this box if the taxpayer is conducting the first surcharge settlement in the tax period; if the taxpayer files an additional declaration, enter the number of supplements in [03b] (Note: fill in only one of [03a] or [03b]).

[4] According to the regulations in Article 2 of Circular 22/2010/TT-BTC, the taxpayer (surcharge payer) includes the following entities:

- The operating entity representing petroleum contractors participating in petroleum contracts in the form of production sharing contracts.

- The joint operating company representing petroleum contractors participating in petroleum contracts in the form of joint operating agreements.

- The joint venture enterprise representing petroleum contractors in petroleum contracts under a joint venture contract.

- Vietnam Oil and Gas Group or General Corporations, Companies under the Vietnam Oil and Gas Group if conducting petroleum activities independently.

[5] Fully fill in the taxpayer's tax identification number (surcharge payer).

[6] Complete all information of the authorized unit if the taxpayer has authorized another entity to conduct the surcharge settlement on their behalf from [13] to [22].

[7] Complete all information of the tax agent if the taxpayer has a contract with a tax agent to conduct surcharge settlement on their behalf from [13] to [22].

[8] USD: United States Dollar; VND: Vietnamese Dong.

[9] The base price for the tax period (corresponding year's base price) is the projected price in the approved field development plan for the respective year (More details can be found in Point b Clause 1 Article 6 Circular 22/2010/TT-BTC).

[10] The average crude oil selling price per quarter is the price calculated independently by the contractor based on the daily actual selling price statistics for each quarter. Specifically:

- Quarter I: from January 1 to March 31.

- Quarter II: from April 1 to June 30.

- Quarter III: from July 1 to September 30.

- Quarter IV: from October 1 to December 31.

(According to Point a Clause 1 Article 6 Circular 22/2010/TT-BTC).

[11] For [33] to [36]: The surcharge due per quarter is 30% of the profit oil share per quarter of the contractor when the actual average crude oil selling price per quarter exceeds the corresponding year's base price by more than 20%, determined as follows:

Quarterly surcharge = 30% x [(Average quarterly crude oil selling price - 1.2) x Corresponding year's base price] x Quarterly profit oil share of the contractor

(According to Clause 1 Article 6 Circular 22/2010/TT-BTC).

What are guidelines for preparing the latest 2025 surcharge settlement form in Vietnam (Form 02/PTHU-DK)? (Image from the Internet)

What is the subject to surcharge in Vietnam?

The subject to surcharge is defined in Article 5 of Circular 22/2010/TT-BTC as follows:

The entire profit oil share per quarter of the contractor is subject to surcharge. Specifically:

[1] Profit oil is the remaining crude oil after deducting resource tax oil and cost recovery oil from the actual oil production as per the Petroleum Law. If the petroleum contract does not specify a cost recovery rate, the recovery rate for determining profit oil as stipulated in this clause is 35%, excluding fields that continue to be exploited after the end of the petroleum contract.

[2] Profit oil share per quarter of the contractor is the share of profit oil as defined in [1] allocated to the petroleum contractor under the signed petroleum contract.

[3] For Vietnam Oil and Gas Group or General Corporations, Companies under the Vietnam Oil and Gas Group conducting petroleum activities independently, the subject to surcharge is the entire profit oil obtained per quarter by Vietnam Oil and Gas Group or General Corporations, Companies under it.