What are guidelines for preparing the Cash Flow Statement in Vietnam according to Circular 200?

Cash Flow Statement in Vietnam according to Circular 200

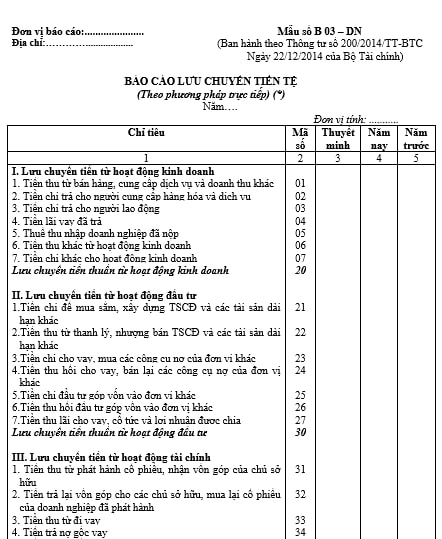

The current cash flow statement template used in enterprises is Form B03-DN issued with Circular 200/2014/TT-BTC.

Download the Cash Flow Statement Template according to Circular 200

What are guidelines for preparing the Cash Flow Statement in Vietnam according to Circular 200?

What are guidelines for preparing the Cash Flow Statement in Vietnam according to Circular 200?

The preparation of cash flow statements in business activities must adhere to the principles specified in Clause 1, Article 114 of Circular 200/2014/TT-BTC. To be specific:

Firstly, the preparation and presentation of cash flow statements annually and for interim periods must comply with the standards of the accounting norms "Cash Flow Statement" and the accounting norms "Interim Financial Statements".

The method of preparing the Cash Flow Statement is guided for the most common transactions, and enterprises can present cash flows appropriately based on the nature of each transaction if there are no specific guidelines in Circular 200/2014/TT-BTC.

Indicators without data do not need to be presented, enterprises can renumber the order but cannot change the code numbers of the indicators.

Secondly, short-term investments considered as cash equivalents presented on the cash flow statement only include short-term investments with a recovery or maturity period not exceeding three months, which can be easily convertible to a fixed amount of cash and carry no risk in converting to cash from the purchase date of the investment at the reporting period.

Examples include bank savings certificates, treasury bills, certificates of deposit, etc., with recovery or maturity periods not exceeding three months from the date of purchase.

Thirdly, enterprises must present cash flows on the Cash Flow Statement according to three types of activities: Operating activities, investing activities, and financing activities as regulated by the norm "Cash Flow Statement":

- Cash flows from operating activities are cash flows generated from the primary revenue-generating activities of the enterprise and other activities that are not investing or financing activities;

- Cash flows from investing activities are cash flows generated from the acquisition, construction, disposal, and sale of long-term assets and other investments that are not classified as cash equivalents;

- Cash flows from financing activities are cash flows generated from activities that result in changes in the size and composition of the equity and borrowings of the enterprise.

Fourthly, enterprises may present cash flows from operating activities, investing activities, and financing activities in the most suitable manner based on the business characteristics of the enterprise.

Fifthly, cash flows arising from the following operating activities, investing activities, and financing activities are reported on a net basis:

- Collection and payment of cash on behalf of a client like rent collection, payments, and reimbursements for asset owners;

- Collection and payment of cash for transactions with quick turnover, short maturity periods such as: foreign currency transactions; buying and selling investments; short-term borrowing or lending with terms not exceeding three months.

Sixthly, cash flows arising from transactions in foreign currencies must be converted to the official currency used in bookkeeping and the preparation of financial statements at the exchange rate at the transaction time.

Seventhly, investment and financing transactions not directly involving cash or cash equivalents are not presented in the Cash Flow Statement. Examples include:

- Acquiring assets through receiving related debt or through finance leases;

- Acquiring a business through stock issuance;

- Debt-to-equity conversions.

Eighthly, opening and closing balances of cash and cash equivalents, the effect of exchange rate changes on cash and cash equivalents in foreign currency at the end of the period must be presented as separate items in the Cash Flow Statement to reconcile with corresponding items on the Balance Sheet.

Ninthly, enterprises must present the value and reasons for any cash and cash equivalents held at the end of the period that are not usable due to legal restrictions or other binding conditions that the enterprise must comply with.

Tenthly, if an enterprise borrows money to pay directly to contractors or suppliers (with the loan transferred directly from the lender to the contractor or supplier without passing through the enterprise's account), the enterprise must still present it in the cash flow statement, specifically:

- The borrowed money is presented as a cash inflow from financing activities;

- Payments made to suppliers or contractors are presented as cash outflows from operating or investing activities, depending on each transaction.

Eleventhly, in case the enterprise has reciprocal settlements with the same party, the presentation of the cash flow statement follows the principle:

- If the reciprocal settlement relates to transactions classified in the same cash flow, it is presented on a net basis (e.g., swap transactions...);

- If the reciprocal settlement relates to transactions classified in different cash flows, the enterprise may not present them on a net basis but must separately present the value of each transaction (e.g., offset receivables from sales with loans...).

Twelfthly, for cash flows from transactions of buying and selling back government bonds and REPO securities: The seller presents them as cash flows from financing activities; the buyer presents them as cash flows from investing activities.

What are bases for the cash flow statement in Vietnam?

According to Clause 2, Article 114 of Circular 200/2014/TT-BTC, the preparation of the Cash Flow Statement is based on:

- Balance Sheet;

- Income statement of business operations;

- Explanatory Notes to the Financial Statements;

- Cash Flow Statement of the previous period;

- Other accounting documents, such as: General ledger, detailed accounting for accounts "Cash", "Bank Deposits", "Cash in transit"; General ledger and detailed accounts of other related accounts, calculation, and allocation statements of fixed asset depreciation, and other detailed accounting documents...