What are guidelines for filling out Form C1-02/NS deposit slip to the state budget in Vietnam?

What are guidelines for filling out Form C1-02/NS deposit slip to the state budget in Vietnam?

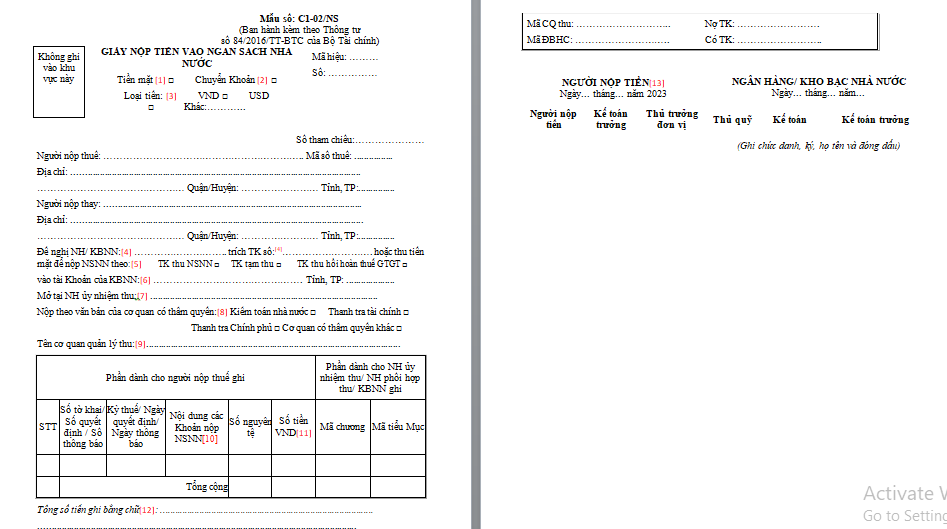

Form C1-02/NS deposit slip to the State Budget is issued alongside Circular 84/2016/TT-BTC, used when taxpayers log into the e-tax payment system on the General Department of Taxation's e-portal with the e-tax transaction account issued by the tax authority to create tax payment documents.

Download Form C1-02/NS deposit slip to the State Budget.

Below are the instructions for completing Form C1-02/NS deposit slip to the State Budget:

[1] If the taxpayer chooses to pay tax by cash, check this box with an X.

[2] If the taxpayer chooses to pay tax by bank transfer, check this box with an X.

[3] The taxpayer checks the "VND" box on the deposit slip if the taxpayer is obligated to pay money into the state budget in Vietnamese Dong.

- The taxpayer checks the "USD" box or records other foreign currency information on the deposit slip if the taxpayer is obliged to pay money into the state budget in US Dollars or another foreign currency as prescribed by law.

[4] The taxpayer fills in bank and account information as per the registered list for e-tax payment.

[5] The taxpayer chooses the box "State Budget Collection Account" or "VAT Refund Account Collection" as follows:

- Choose the "State Budget Collection Account" box when paying taxes, late payment fees, fines, or other contributions to the state budget.

- Choose the "VAT Refund Account Collection" box when repaying the state budget the VAT amount refunded by decision of competent authority or when self-discovered by the taxpayer as refunded wrongly; excluding refund cases due to overpayment.

[6] The taxpayer selects the name of the state treasury accepting the collection from the list of state treasury offices.

[7] Choose the name of the designated collection bank corresponding to the selected state treasury office from the system-provided list.

[8] - The taxpayer fills in payment information per the document issued by a competent authority (if any): Select the corresponding box issued by "State Audit," "Government Inspectorate," "Financial Inspectorate," "Other Competent Authority."

- In cases where tax is paid according to the decision of tax authorities at various levels, choose the "Other Competent Authority" box.

[9] The system will automatically display the name of the tax authority directly managing the taxpayer. If the collection belongs to another tax authority, the taxpayer selects the name of the managing tax authority from the list.

[10] The taxpayer queries the payable amounts on the e-tax payment system and selects one or more payable items from the list displayed. The taxpayer can modify the payment amount information for each item.

If there is a payable item not listed on the system's payable list, the taxpayer selects the suitable item from the "State Budget Payment Items" and provides payment information.

When paying taxes, land levy, registration fees, or other contributions related to asset registration, the taxpayer should declare additional information in the state budget payment content box, such as the property address, plot of land; vehicle type, brand, model number, paint color, frame number, engine number of aircrafts, ships, cars, and motorcycles.

When paying according to a document from a competent authority, the taxpayer declares additional information about the name of the issuing authority.

[11] The taxpayer records the actual payment amount.

[12] If paying by VND, write the total amount in words; for foreign currency, write the total in words specifying the currency.

[13] The taxpayer performs an e-signature in at least one of the three positions for the payer/chief accountant/unit head and sends the deposit slip to the state budget via the e-tax payment system.

This information is for reference purposes only.

What are guidelines for filling out Form C1-02/NS deposit slip to the state budget in Vietnam? (Image from the Internet)

How many e-tax transaction methods are there in Vietnam?

Based on Clause 2, Article 4 of Circular 19/2021/TT-BTC, it stipulates 06 e-tax transaction methods that taxpayers can choose from as follows:

- The e-portal of the General Department of Taxation.

- The National Public Service Portal.

- The e-portal of the Ministry of Finance connected to the e-portal of the General Department of Taxation.

- The e-portal of other competent state agencies (excluding the National Public Service Portal and the Ministry of Finance's e-portal) connected to the General Department of Taxation's portal.

- Service providers of T-VAN approved by the General Department of Taxation for connection with their e-portal.

- e-payment services by banks or intermediary payment service providers for e-tax payment.

What is the procedure for e-tax payment through the General Department of Taxation's e-portal in Vietnam?

Based on Article 20 of Circular 19/2021/TT-BTC, the procedure for e-tax payment through the General Department of Taxation's e-portal is as follows:

(1) The taxpayer prepares e-state budget payment documents as stipulated in Point a, Clause 5, Article 4 of Circular 19/2021/TT-BTC.

- The taxpayer chooses the payment information provided by the e-portal, where the taxpayer created the deposit slip as mentioned in Article 38 of Circular 19/2021/TT-BTC; the taxpayer is only allowed to amend the payment amount. The taxpayer verifies the deposit slip information, digitally signs it, and sends it to the tax authority as per Point a, Clause 5, Article 4 of Circular 19/2021/TT-BTC.

- For payments not listed in the chosen e-portal, the taxpayer must complete full information on the deposit slip, digitally sign it, and send it to the tax authority as per Point a, Clause 5, Article 4 of Circular 19/2021/TT-BTC.

(2) The e-portal of the General Department of Taxation receives, verifies the information on the deposit slip, and sends a notice (following form number 01-1/TB-TDT issued with Circular 19/2021/TT-BTC) to the taxpayer to notify the receipt of the deposit slip or to state reasons for not receiving the deposit slip no later than 15 minutes after receiving the taxpayer's e-deposit slip.

(3) Processing of the deposit slip on the e-portal where the taxpayer created the NSNN deposit slip.

- If the deposit slip is accepted, the e-portal where the taxpayer created the deposit slip automatically generates a "reference number" for the deposit slip and updates it into the receipt notice sent to the taxpayer.

- The General Department of Taxation's e-portal transmits information as per the deposit slip (including: Debt deduction account; state budget payment amount; State Treasury Office benefiting from the revenue; Reference number) to the bank or intermediary payment service provider chosen by the taxpayer for account deduction.

- The General Department of Taxation's e-portal receives notice regarding the handling of deposit slip information and the success/failure of tax payment (following form number 05/TB-TDT issued with Circular 19/2021/TT-BTC) and NSNN deposit slips electronically signed by the bank or intermediary payment organization (if any) and sends them to the taxpayer according to Clause 2, Article 5 of Circular 19/2021/TT-BTC.

(4) The bank or intermediary payment service provider connected to the General Department of Taxation's e-portal processes the taxpayer's account deduction when received from the General Department of Taxation's e-portal:

- Check the conditions for account deduction. No later than 5 minutes after receiving the deposit slip information transmitted by the General Department of Taxation's portal, the bank or intermediary payment service provider shall:

+ In case the taxpayer's account does not meet the deduction conditions, the service provider shall notify of the unsuccessful tax payment (using form number 05/TB-TDT issued with Circular 19/2021/TT-BTC) to the General Department of Taxation's portal for forwarding to the taxpayer per Clause 2, Article 5 of Circular 19/2021/TT-BTC.

+ In case the deposit slip meets deduction criteria, the provider deducts from the taxpayer's account according to the NSNN payment information transmitted by the General Department of Taxation's portal and digitally signs the NSNN deposit slip. The bank or intermediary payment organization sends a notice of successful e-tax payment (following form number 05/TB-TDT issued with Circular 19/2021/TT-BTC) alongside the digitally signed NSNN deposit slip (if any) to the General Department of Taxation's portal for forwarding to the taxpayer per Clause 2, Article 5 of Circular 19/2021/TT-BTC.

- Transfer funds and transmit NSNN deposit slip information (including: Deduction account; NSNN payment amount; State Treasury Office receiving payment; Date of deduction from the taxpayer or replacement payer’s account; Reference number) to the bank where the State Treasury Office has an account for coordination in collection management per Article 38 of Circular 19/2021/TT-BTC.