What are guidelines for filling in Item 23 on the Form 01/GTGT - VAT Declaration in Vietnam?

What is the Form 01/GTGT for VAT Declaration in Vietnam under Circular 80?

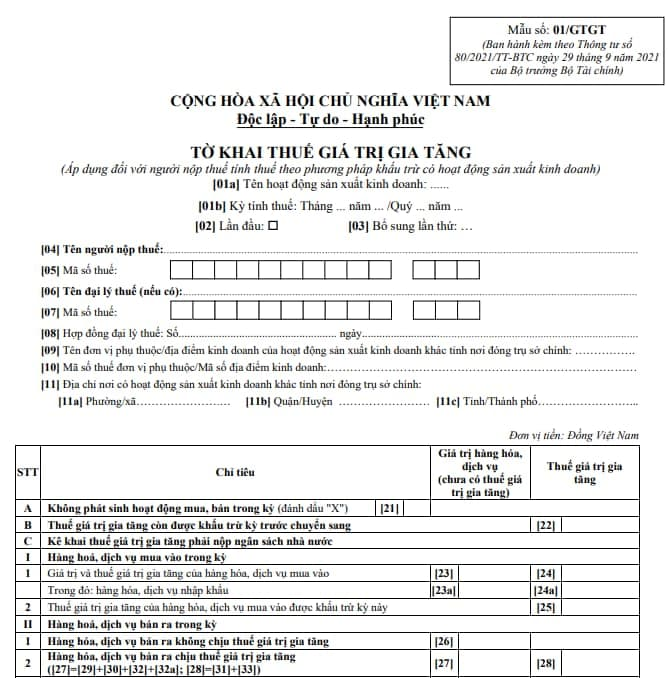

The latest VAT declaration form is stipulated in Form 01/GTGT in Appendix 2 issued along with Circular 80/2021/TT-BTC as follows:

Download VAT Declaration Form 01/GTGT: Here

What are guidelines for filling in Item 23 on the Form 01/GTGT - VAT Declaration in Vietnam? (Image from the Internet)

What are guidelines for filling in Item 23 on the Form 01/GTGT - VAT Declaration in Vietnam?

When preparing the VAT declaration according to Form 01/GTGT stipulated in the Appendix issued along with Circular 80/2021/TT-BTC, Item 23 is filled in as follows:

Item 23: It represents the total value of goods and services purchased during the reporting period without VAT.

Vietnam: What are detailed instructions for filling in other items on Form 01/GTGT?

Below are the instructions for completing the VAT declaration according to Form 01/GTGT:

General Information Section:

Item [01a] - Name of Business Activity: The taxpayer must select or record one of the following activities:

(1) Ordinary business activities.

(2) Traditional lottery and computerized lottery activities.

(3) Oil and gas exploration and extraction activities.

(4) Infrastructure investment project, house transfer in a different province from the headquarters location.

(5) Power plants in a different province from the headquarters location.

Note:

- This item requires the taxpayer to declare and correctly record the business activities as mentioned above. If the taxpayer does not specify the business activity on the declaration, it is understood as “Ordinary business activities”. Taxpayers performing electronic filing, the Etax system assists taxpayers in selecting from the available options, leaving no blanks.

- If the taxpayer has multiple business activities as mentioned, multiple declarations are to be filed, each reflecting one business activity corresponding to the declared information.

Item [01b] - Tax Period: Declare the tax period as the month when the tax obligation arises. If the taxpayer is approved by the tax authority to declare taxes quarterly or is a newly established taxpayer, then specify the tax period as the quarter when the tax obligation arises.

Items [02], [03]: Check “First Time”. If the taxpayer discovers errors or omissions in the initial tax declaration submitted to the tax authority, supplementary declarations should be filed in sequence.

Note:

- Taxpayers performing electronic filing, the Etax system assists taxpayers in identifying the “First Time” tax declaration corresponding to each business activity under Item [01a].

- From the time the Etax system issues a Notice of Acceptance of the tax declaration for the “First Time”, subsequent tax declarations for the same tax period, same business activity are “Supplementary” declarations. The taxpayer must submit the “Supplementary” declaration in compliance with the regulations for supplementary declarations.

Items [04], [05]: Declare “Taxpayer's Name and Tax Code” according to the registered business information or taxpayer registration.

Note: This is mandatory information. Taxpayers filing electronically, upon accurately completing the “Tax Code”, the Etax system automatically displays the “Taxpayer's Name”.

Items [06], [07], [08]: In cases where a tax agent declares taxes: Declare “Tax Agent Name, Tax Code” and “number, date of tax agent contract”. The tax agent must be in an “Active” taxpayer registration status, and the contract must be valid at the time of tax declaration.

Note: Taxpayers filing electronically, the Etax system automatically displays information about the tax agent, registered tax contracts with tax authorities for taxpayers to choose from when there are multiple tax agents or contracts.

Items [09], [10], [11]: In cases where NNT separately declares VAT for dependent units, business locations in a different locality from the headquarters province for cases prescribed at point b, c clause 1 Article 11 Decree No. 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam (except where the dependent unit directly declares VAT to the tax authority directly managing the dependent unit).

Note:

- If there are multiple dependent units, business locations in multiple districts managed by the Tax Department, choose one unit to represent and declare in this item. If there are multiple dependent units, business locations in multiple districts managed by the regional Tax Sub-Department, choose one unit to represent each district managed by the regional Tax Sub-Department to declare in this item.

- Taxpayers filing electronically, the Etax system automatically displays information about registered dependent units, business locations for taxpayers to choose from.

Declaration of Table Items:

A. No activity purchases, sales occurring during the period:

Item [21]: If no purchase, sale activities arise during the tax period, the taxpayer still must file a tax declaration and submit it to the tax authority (except in cases of temporary cessation of activity or business). On the declaration, the taxpayer marks an “X” in item number [21]. Taxpayers should not enter 0 in items reflecting the value and VAT of goods, services (HHDV) purchased or sold during the period.

B. VAT from the previous period transferred forward

Item [22]: Data entered in this item is the VAT still subject to deduction carried forward to the next period under item number [43] of the VAT declaration form 01/GTGT for the immediately preceding tax period.

C. Declaring VAT payable to the state budget:

I. Goods and services purchased during the period:

- Value and VAT of goods and services purchased: including items [23] and [24] reflect the entire value of HHDV and VAT amount of HHDV that the taxpayer purchased during the period.

Item [23]: Data entered in this item is the total value of HHDV purchased in the period excluding VAT (not including the value of HHDV acquired for investment projects declared in the VAT declaration for investment projects form 02/GTGT) based on invoices, documents, payment documents to the state budget, tax payment receipts. If the taxpayer has fixed assets, HHDV used jointly for the production of goods subject to VAT and non-VAT, which cannot be separately accounted for each type, declare them jointly in this item.

If a purchase invoice is a specific type of invoice, document where the purchase price includes VAT such as stamps, transportation tickets, etc., calculate the sales value net of VAT as follows:

Price net of VAT = Sale Price listed on the invoice / 1 + Tax Rate

Taxpayers may not use illegal invoices, documents, or use invoices, documents illegally for declaration under this item.

Item [24]: Data entered in this item is the total VAT of fixed assets, HHDV purchased on invoices, documents, payment documents to the state budget, tax payment receipts (excluding input VAT used for investment projects declared on the VAT declaration for investment projects form 02/GTGT). Illegal invoices are not to be declared under this item.

Items [23a], [24a]: Data entered under these items is similar to input items [23], [24] but declared separately for the purchase value and VAT of imported goods and services.

- VAT of goods, services purchased that is deductible this period:

Item [25]: Declare the total VAT purchased that has been declared at item [24] eligible for deduction per the law on VAT.

If taxpayers have fixed assets, HHDV purchased for both taxable and non-taxable goods production and cannot separately account for the deductible VAT and non-deductible VAT, they should allocate according to the law on VAT to separately identify the deductible VAT and declare under this item as follows:

Deductible input VAT = (Revenue subject to VAT / Total revenue) x Input VAT used for both taxable and non-taxable HHDV production

II. Goods, services sold during the period

- Goods, services sold non-subject to VAT

Item [26]: Data entered in this item is the value of HHDV sold non-subject to VAT on the VAT invoices sold by the taxpayer during the tax period.

- Goods, services sold subject to VAT:

Item [27] - Value of HHDV sold subject to VAT: determined by the formula [27] = [29] + [30] + [32] + [32a].

Item [28] - VAT of HHDV sold subject to VAT: determined by the formula [28] = [31] + [33].

Item [29] - Value of HHDV sold subject to a 0% tax rate: Data for this item is the value of HHDV sold subject to a 0% VAT rate on the VAT invoices sold by the taxpayer during the tax period.

Item [30] - Value of HHDV sold subject to a 5% tax rate: Data for this item is the value of HHDV sold subject to a 5% VAT rate on the VAT invoices sold by the taxpayer during the tax period.

Item [31] - VAT of HHDV sold subject to a 5% tax rate: Data for this item is the VAT of HHDV sold subject to a 5% VAT rate on the VAT invoices sold by the taxpayer during the tax period.

Item [32] - Value of HHDV sold subject to a 10% tax rate: Data for this item is the value of HHDV sold subject to a 10% VAT rate on the VAT invoices sold by the taxpayer during the tax period.

Item [32a]: Data for this item records the value of HHDV which does not require VAT declaration, calculation under the VAT law regulations.

Item [33] - VAT of HHDV sold subject to a 10% tax rate: Data for this item is the VAT of HHDV sold subject to a 10% VAT rate on the VAT invoices sold by the taxpayer during the tax period.

- Total revenue and VAT of goods, services sold

Item [34] - Total revenue of goods, services sold: determined by the formula [34] = [26] + [27].

Item [35] – VAT of goods, services sold: determined by the formula [35] = [28].

III. VAT arising during the period

Item [36] - VAT arising during the period: determined by the formula [36] = [35] - [25].

IV. Increase, decrease adjustments to VAT carried forward from previous periods

Items [37] and [38]: Data for these items is the deductible tax adjusted increase/decrease at item II on Supplementary Declaration form 01/KHBS. Where tax authorities, competent authorities have issued conclusions, tax decisions with corresponding adjustments for previous tax periods, this is declared in the tax declaration dossier for the tax period receiving the conclusion, decision (no supplementary tax declaration required).

V. Transferred VAT deductible during the period:

Item [39a]: Data entered is the VAT still deductible not requested for refund from an investment project transferred for the taxpayer to continue deducting (is VAT still deductible, not eligible for refund, that the taxpayer has declared a separate tax declaration for investment projects) when the investment project becomes operational or VAT still deductible not requested for refund of production business activity of dependent units when ceasing activities,...

VI. Determination of VAT liability payable during the period:

- VAT payable from business activities during the period:

Item [40a] - VAT payable from business activities during the period: determined by the formula [40a] = ([36] - [22] + [37] - [38] - [39a]) ≥ 0.

Item [40b] - VAT purchased for investment projects offset against outstanding VAT of business activities in the same tax period: Data entered is the total VAT declared under items [28a] and [28b] of the VAT Declarations form 02/GTGT for the same tax period as this declaration.

Item [40] - VAT still payable in the period: determined by the formula [40] = [40a] - [40b].

Item [41] - VAT not fully deducted this period: determined by the formula [41] = ([36] - [22] + [37] - [38] - [39a]) ≤ 0.

Item [42] - VAT requested for refund: Data entered for this item is the VAT eligible for refund according to the law on VAT and tax management law. Data at item [42] must be less than or equal to data at item [41].

Item [43] - VAT still deductible carried forward to the next period: determined by the formula [43] = [41] - [42].

Signature and Seal Section:

The legal representative of the taxpayer or the authorized representative signs, seals, or digitally signs to submit the declaration to the tax authority and is responsible under law for the declared data.

In cases where a tax agent files on behalf of the taxpayer, the legal representative of the tax agent signs, seals or digitally signs on behalf of the taxpayer and additionally records the tax agent staff's name directly conducting the filing and this staff's practice certificate number in the corresponding information.