What are guidelines for completing Form 05-DK-TCT tax registration application for non-business individuals who register tax directly in Vietnam in 2025?

What are guidelines for completing Form 05-DK-TCT tax registration application for non-business individuals who register tax directly in Vietnam in 2025?

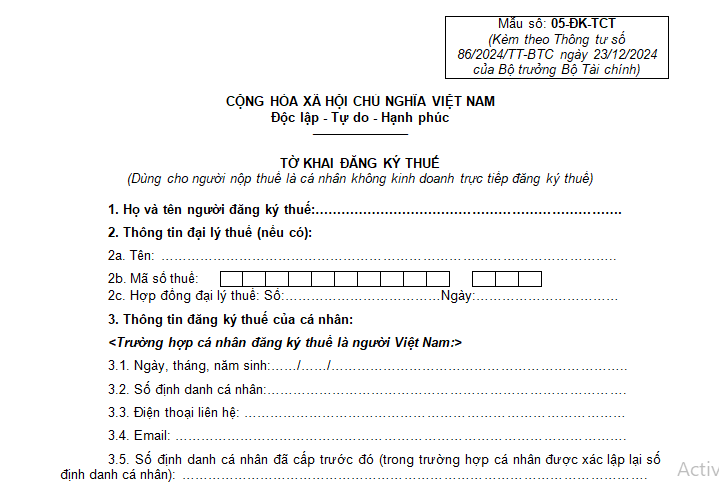

Based on sub-point c.2 point c clause 1, sub-point c.2 point c clause 2 Article 22 of Circular 86/2024/TT-BTC (effective February 6, 2025), the tax registration application for non-business individuals who register tax directly is form number 05-DK-TCT issued in Appendix 2 attached to Circular 86/2024/TT-BTC.

Specifically, Form 05-DK-TCT tax registration application for non-business individuals who register tax directly is as follows:

Download Form 05-DK-TCT tax registration application for non-business individuals who register tax directly.

Below is the Guide for Completing Form 05-DK-TCT tax registration application for non-business individuals who register tax directly.

[1] Full name: Clearly and fully write the individual's name for taxpayer registration in capital letters.

[2] Tax agent information: Fully write the tax agent's information in case the tax agent has a contract with the taxpayer to carry out the taxpayer registration procedures on behalf of the taxpayer as prescribed in the Tax Administration Law.

[3] Personal taxpayer registration information

* Case where the individual is a Vietnamese citizen, declare in fields 3.1 to 3.4 below:

3.1. Date of birth: Clearly write the date of birth of the individual taxpayer registration.

3.2. Personal identification number: Enter the personal identification number of the individual taxpayer registration.

Note: Individuals must declare their personal information, date of birth, personal identification number accurately compared to the information stored in the national population database.

3.3. Contact phone: Accurately enter the individual's phone number.

3.4. Email: Accurately enter the individual's email address.

* In cases where the individual is a foreign national or a Vietnamese national living abroad without a personal identification number, declare in fields 3.1 to 3.8 below:

3.1. Date of birth: Clearly write the date of birth of the individual taxpayer registration.

3.2. Gender: Check one of the boxes for Male or Female.

3.3. Nationality: Clearly state the individual's nationality for taxpayer registration.

3.4. Legal documents: Select one of the legal documents passport/laissez-passer/border ID card/other valid personal identification documents and record the number, issuance date, and "place of issuance" information which only states the province or city of issuance.

3.5. Permanent address: Fill in all the details of the individual’s permanent residential address.

3.6. Current address: Fill in all the details of the individual’s current residential address (only state if this address is different from the permanent address).

3.7. Provide the individual's phone number for taxpayer registration.

3.8. Provide the individual's email address for taxpayer registration (if available).

The taxpayer must declare complete and accurate email information. This email address is used as an electronic transaction account with the tax authority for electronic taxpayer registration documentation.

* Section for the taxpayer's signature, clearly state the full name: The individual taxpayer registration must sign and clearly write their full name in this section.

* Tax agent employee: If the tax agent makes declarations on behalf of the taxpayer, this information must be declared.

What are guidelines for completing Form 05-DK-TCT tax registration application for non-business individuals who register tax directly in Vietnam in 2025? (Image from the Internet)

Where is the submission place for application for initial tax registration for non-business individuals who register tax directly in Vietnam?

Pursuant to clause c point 1, point c clause 2 Article 22 of Circular 86/2024/TT-BTC (effective February 6, 2025), regulations on the location for submitting the application for initial tax registration for non-business individual’s direct taxpayer registrations are as follows:

(1) In cases where the individual uses a personal identification number instead of a TIN

- At the Tax Department where the individual works in the case of a resident individual having income from salaries or wages paid by international organizations, embassies, consulates in Vietnam, but these organizations have not conducted tax withholding.

- At the Department of Taxation where the work arises in Vietnam for individuals earning income from salaries or wages paid by organizations or individuals from abroad.

- At the District Tax Department, Regional Tax Department where the individual resides in other cases.

(2) In cases where the individual is issued a TIN by the tax authority

- At the Tax Department where the individual works for a resident individual with income from salaries or wages paid by international organizations, embassies, consulates in Vietnam, but these organizations have not conducted tax withholding.

- At the Department of Taxation where the work arises in Vietnam for individuals with income from salaries or wages paid by organizations or individuals from abroad.

How to handle the application for initial tax registration for non-business individuals who register tax directly in Vietnam?

Pursuant to clause 2 Article 23 of Circular 86/2024/TT-BTC (effective February 6, 2025) governing the handling of the application for initial tax registration qualified for non-business individuals who register tax directly as follows:

- "Personal TIN Notification" form number 14-MST issued with Circular 86/2024/TT-BTC is notified by the tax authority to individuals who conduct taxpayer registration.

- The tax authority processes the dossier and returns the result as "Personal TIN Notification" to the taxpayer via the General Department of Taxation's electronic portal within 3 (three) working days from the date the tax authority receives the complete dossier from the taxpayer as stipulated at clause 3 Article 22 of Circular 86/2024/TT-BTC. In cases where the taxpayer registers to receive results directly at the tax authority or via postal service, the tax authority is responsible for sending the results through the tax authority's one-stop-shop department or public postal service to the address registered by the taxpayer.