What are guidelines for checking eligibility for personal income tax refund in Vietnam in 2025?

What are guidelines for checking eligibility for personal income tax refund in Vietnam in 2025?

Pursuant to Article 21 of the Law on Personal Income Tax 2007 as amended by Clause 5 Article 1 of the Law on Amendments to Tax Laws 2012 and Clause 4 Article 6 of the Law on Amendments to Tax Laws 2014 regarding taxable income for personal income tax.

Additionally, based on Article 1 of Resolution 954/2020/UBTVQH14 which prescribes the deduction levels for family circumstances for personal income taxpayers.

Individuals without dependents are required to pay personal income tax when their taxable income from total wages and salaries minus the compulsory insurance contributions as stipulated and other deductions such as charity and humanitarian contributions exceed 11 million VND per month (132 million VND per year).

In the case that an individual is eligible for a personal income tax refund as prescribed in Clause 2, Article 8 of the Law on Personal Income Tax 2007, the tax already paid for the year will be refunded.

Thus, to determine eligibility for a personal income tax refund, taxpayers need to have the personal income tax withholding documents or income confirmation letters from the paying organization to self-check when finalizing the tax via the Electronic Tax website or the Etax Mobile application.

Below are the guidelines on how to check if one is eligible for a personal income tax refund in 2025:

(1) Check via the Electronic Tax Website:

- Step 1: Access the Electronic Tax website: https://thuedientu.gdt.gov.vn/

- Step 2: Log in by entering the tax code information, enter the verification code to log in or register if the taxpayer does not have an account.

- Step 3: Select "Tax Finalization" >> Select "Online Tax Declaration"

- Step 4: Fill in the online declaration form in fields marked with a * including:

+ Sender's Name

+ Contact Address

+ Email Address

+ Select declaration form: 02/QTT-TNCN – Personal Income Tax Finalization Declaration (Circular 80/2021/TT-BTC)

+ Select the tax finalization office: Choose one of the three cases:

++ Case 1: The taxpayer has only one source of income directly declared during the year from working at international organizations, Embassies, Consulates in Vietnam, or from abroad (not withheld at source).After that, the taxpayer selects the tax authority where they have directly declared during the year in the "Department of Taxation" box where tax was declared.

++ Case 2: The taxpayer declares directly during the year with two or more sources of income including both directly declared income during the year and income paid by an organization that has already withheld.The taxpayer declares income sources and related information according to the tax authority's template.

++ Case 3: The taxpayer does not directly declare during the year and only has income subject to withholding by the paying organization.

+++ If there is a change in workplace: Tick box 1 or 2.

+++ If there is no change in workplace: Tick box 3, 4, or 5.

- Step 5: Continue filling in information in the following fields:

+ Tax finalization case: Calendar year finalization; Continuous 12-month finalization different from the calendar year; Finalization of less than 12 months.

+ Declaration year: Year of finalization.

+ Type of declaration:

++ Primary declaration: For first-time tax finalization in the period.

++ Supplemental declaration: If a declaration has already been filed and the taxpayer needs to amend it.

- Step 6: Select "Continue" to declare the finalization form.

Complete the details in Appendix 02-1/BK-QTT-TNCN and Form 02/QTT-TNCN as per Circular 80/2021/TT-BTC as displayed by the system.

- Step 7: The taxpayer completes accurate personal information in Form 02/QTT-TNCN.

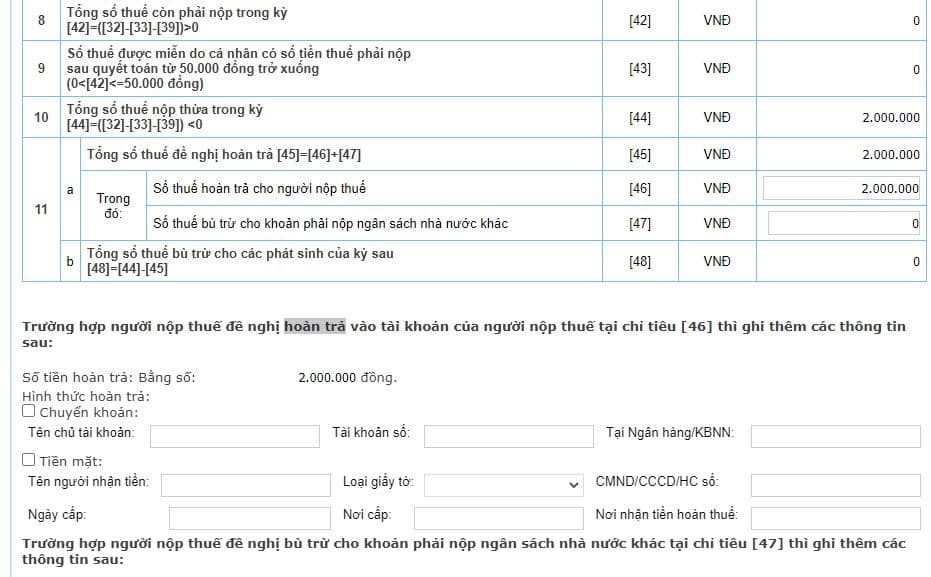

- Step 8: Upon entering data in the "Personal Income Tax Finalization Declaration," taxpayers can view the amount of refundable personal income tax in box [44].

- The tax amount displayed in this box, once complete, is the excess personal income tax paid.

- If seeking a refund, enter the amount from box [44] into box [46] and provide the account information for receiving the tax refund below.

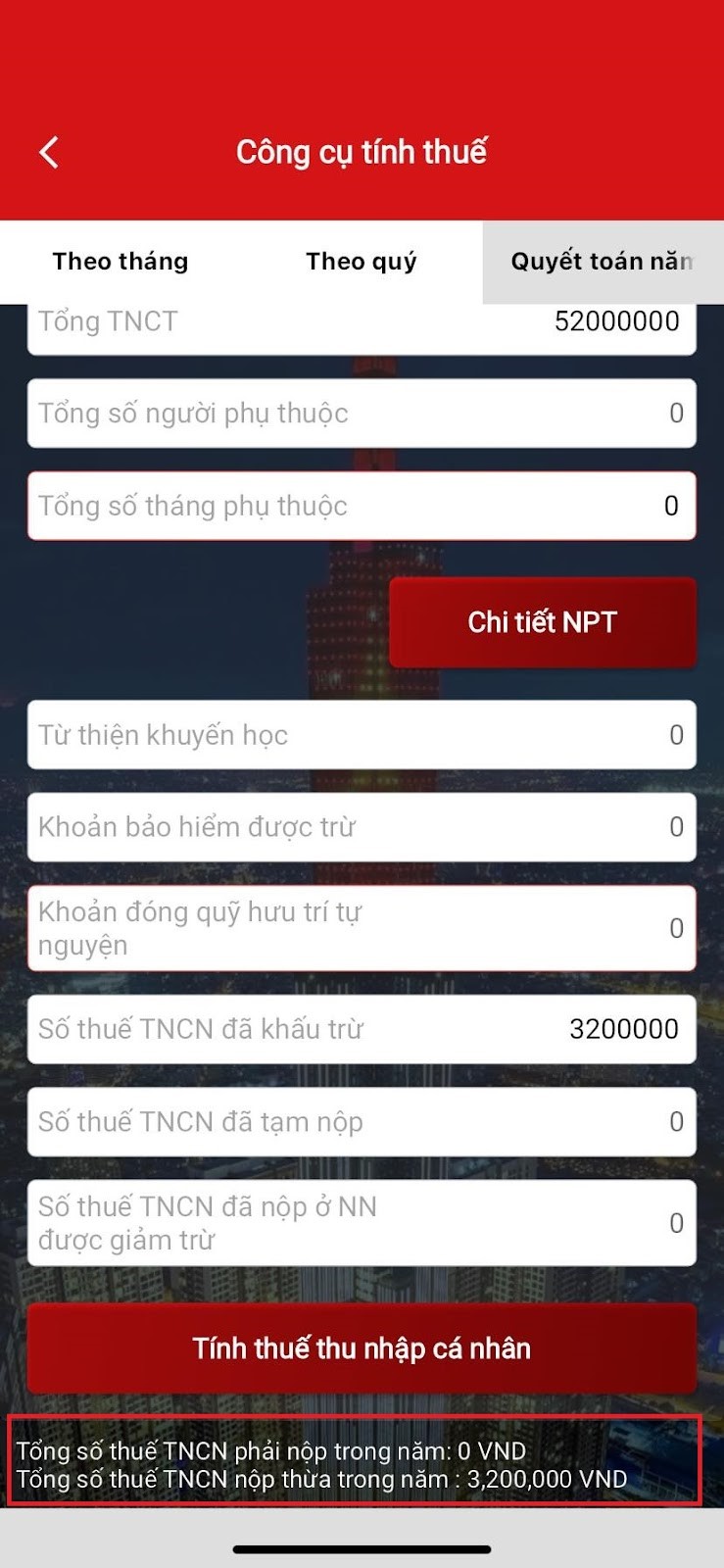

(2) Check via the Etax Mobile application:

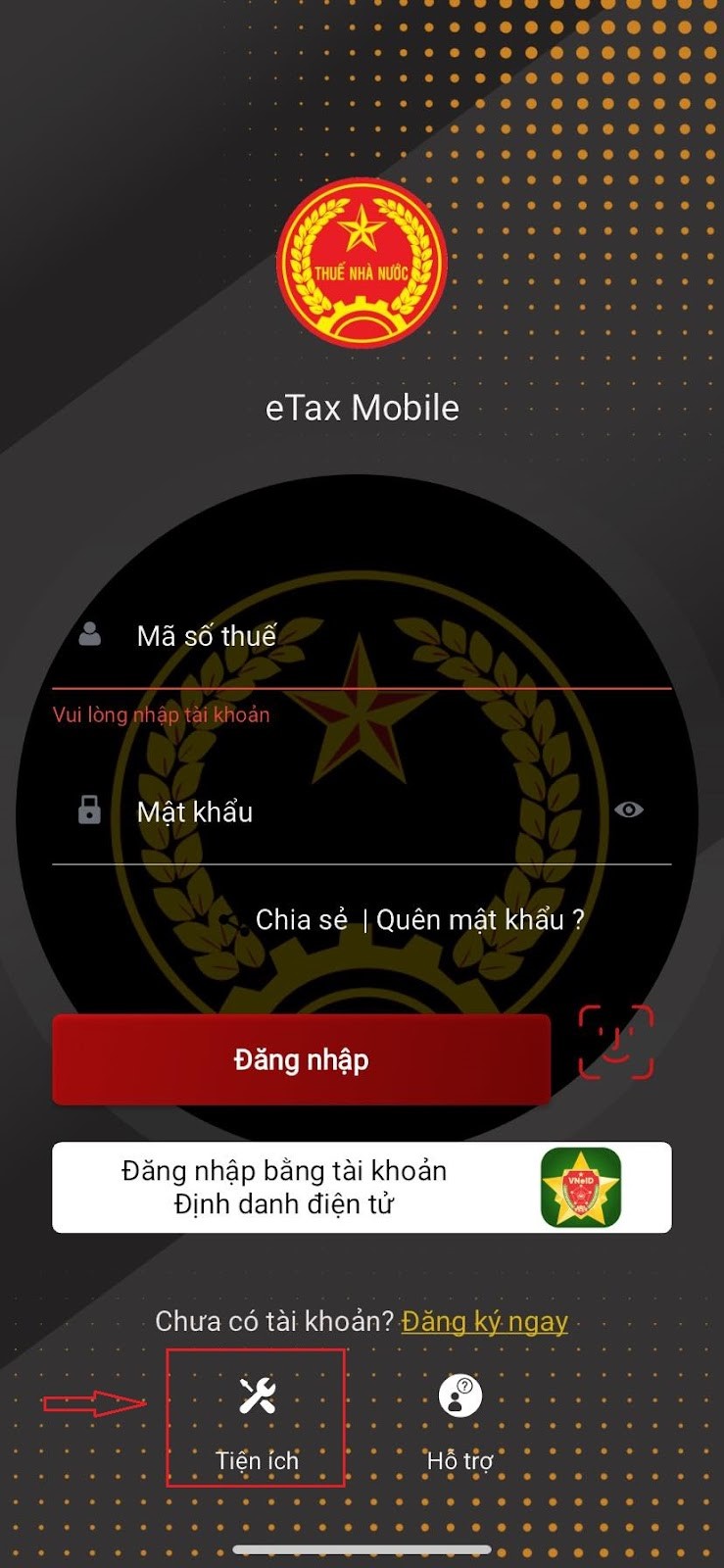

- Step 1: Access the Etax Mobile application and select "Utilities" on the login screen.

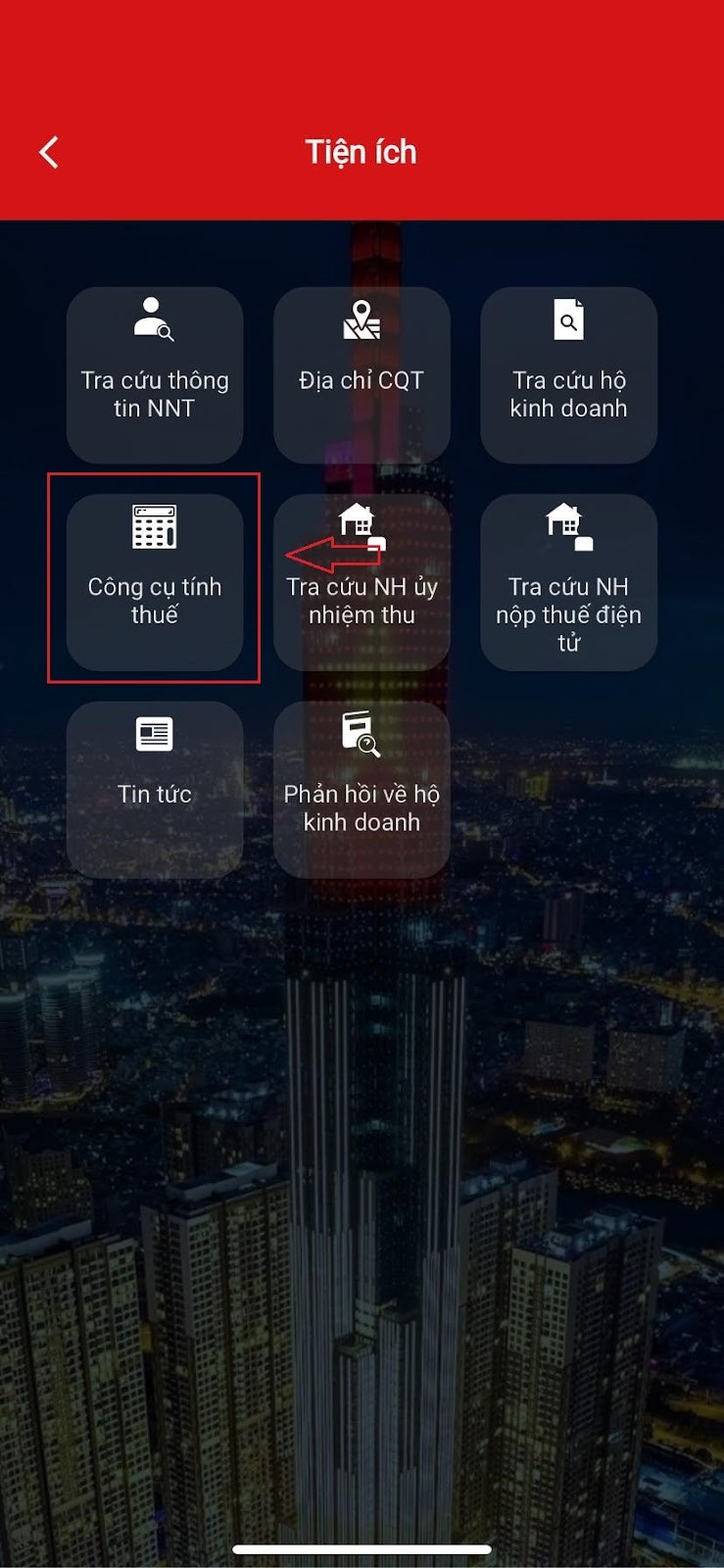

- Step 2: Choose the utility "Tax Calculation Tool"

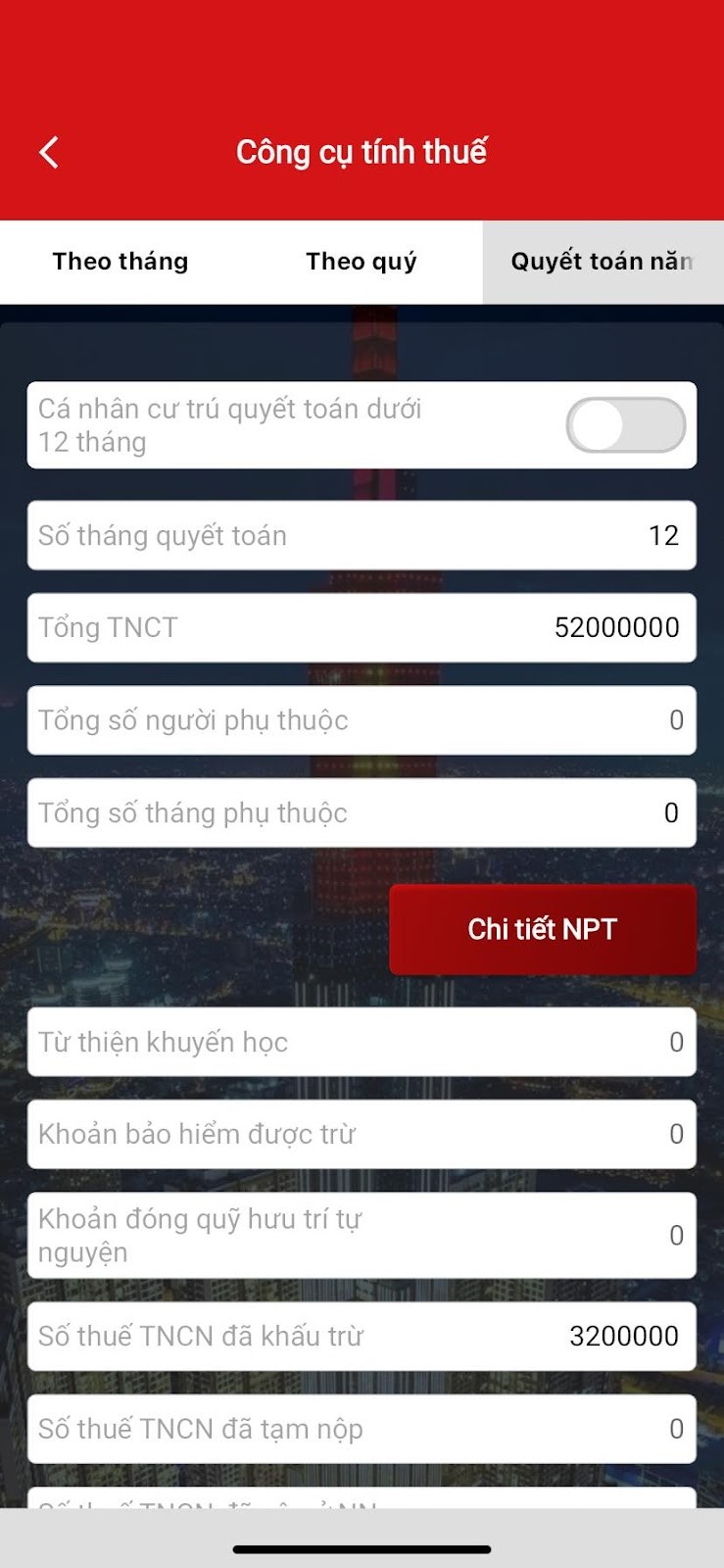

- Step 3: In the Tax Calculation Tool interface, select “Annual Finalization” and fill in the information based on withholding tax documents or income confirmation letters.

- Step 4: Click on “Calculate Personal Income Tax” to display the total tax payable and the excess tax paid.

Note: The guidelines for checking eligibility for personal income tax refunds in 2025 are for reference purposes only.

What are guidelines for checking eligibility for personal income tax refund in Vietnam in 2025? (Image from the Internet)

What are the conditions for a personal income tax refund?

According to Clause 2, Article 8 of the Law on Personal Income Tax 2007, the conditions for a personal income tax refund include:

- The amount of tax paid is greater than the tax payable;

- Individuals who have paid tax but have taxable income below the tax-paying threshold;

- Other cases as decided by competent state authorities.

What documents are required for a personal income tax refund for income from wages and salaries in Vietnam?

As prescribed in Clause 1, Article 42 of Circular 80/2021/TT-BTC, the documents required for a personal income tax refund related to income from wages and salaries include:

(1) In the case of organizations or individuals that pay income from wages and salaries that finalize on behalf of authorized individuals:

- A written request for handling overpaid tax, late payment interest, and fines using Form 01/DNXLNT issued with Appendix 1 of Circular 80/2021/TT-BTC;

- A power of attorney in accordance with the law in cases where the taxpayer does not directly carry out the refund procedure, except when a tax agency submits the refund dossier based on a contract signed between the tax agency and the taxpayer;

- A list of tax payment receipts according to Form 02-1/HT issued with Appendix 1 of Circular 80/2021/TT-BTC (applicable to organizations and individuals that pay income).

(2) Individuals with income from wages and salaries who directly finalize their tax with the tax authority and have overpaid tax, requesting a refund on the personal income tax finalization declaration do not need to submit a refund dossier.

How long is the processing time for a tax refund application in Vietnam?

Pursuant to Article 75 of the Law on Tax Administration 2019, the processing time for a tax refund application is as follows:

- For an application eligible for a refund before verification, no later than 6 business days from the date the tax authority issues a notice accepting the dossier and the time to process the refund, the tax authority must decide to refund tax to the taxpayer or notify the transfer of the taxpayer's dossier to pre-refund inspection, or notify of non-refund if the dossier does not meet refund conditions.

- For an application requiring verification before refund, no later than 40 days from the date the tax authority issues a written notice of acceptance, the tax authority must decide to refund tax to the taxpayer or deny a refund if the dossier does not meet refund conditions.