What are documents for consulting on construction price indices in Vietnam? What is the VAT rate for construction in Vietnam from July 1, 2025?

What are documents for consulting on construction price indices?

Pursuant to the provisions of Clause 1, Article 27 of Decree 10/2021/ND-CP, the construction price indices is an indicator reflecting the fluctuation level of construction prices over time, serving as a basis for determining and adjusting the preliminary total investment level in construction, total construction investment level, construction estimates, construction package prices, construction contract prices, converting construction investment capital, and managing construction investment costs.

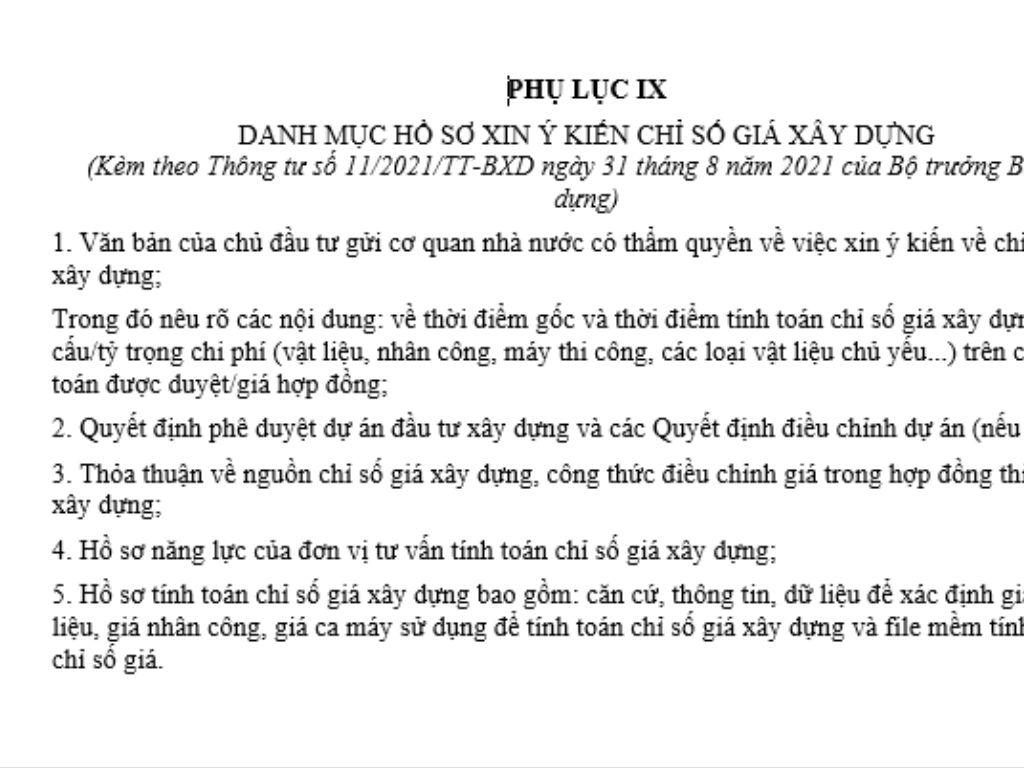

The documents for consulting on construction price indices is stipulated in Appendix IX issued together with Circular 11/2021/TT-BXD.

Latest Word file of the documents for consulting on construction price indices Download

What are documents for consulting on construction price indices in Vietnam? What is the VAT rate for construction in Vietnam from July 1, 2025? (Image from Internet)

What is the VAT rate for construction in Vietnam from July 1, 2025?

Based on Clause 12, Article 5 of the Value-added Tax Law 2024, subjects not subject to VAT include:

Exempted Subjects

...

12. Activities of maintenance, repair, construction funded by public contributions, humanitarian aid (constituting 50% or more of the total capital used for the project) for historical-cultural sites, scenic spots, cultural works, arts, public service works, infrastructure, and housing for social policy beneficiaries.

...

Simultaneously, based on point c, Clause 1, Article 9 of the Value-added Tax Law 2024, the regulation is as follows:

Tax Rates

- The 0% tax rate applies to the following goods and services:

...

c) Other exported goods and services including: international transportation; leasing services of vehicles used outside Vietnam's territory; services of the aviation and maritime industries provided directly or through agents for international transport; construction and installation activities overseas or in non-tariff areas; digital information content products supplied to foreign entities with documentation proving consumption outside Vietnam as per the regulations of the Government of Vietnam; spare parts, materials for the repair, maintenance of vehicles, machinery, equipment for foreign parties, and consumption outside Vietnam; goods processed for export according to legal regulations; goods and services subject to VAT exemption when exported, excluding cases not applying the 0% tax rate as stipulated in point d of this section;

...

Therefore, the VAT rate for construction from July 1, 2025, will be determined as follows:

(i) Construction and installation activities overseas or in non-tariff areas will apply a 0% tax rate.

(ii) Activities of maintenance, repair, construction funded by public contributions, humanitarian aid (constituting 50% or more of the total capital used for the project) for historical-cultural sites, scenic spots, cultural works, arts, public service works, infrastructure, and housing for social policy beneficiaries are not subject to VAT.

(iii) Other construction not belonging to scenarios (i) and (ii), including services provided by foreign suppliers without a permanent establishment in Vietnam to organizations or individuals in Vietnam via e-commerce and digital platforms will apply a 10% tax rate.

What is the taxable price for VAT on construction in Vietnam from July 1, 2025?

According to point g, Clause 1, Article 7 of the Value-added Tax Law 2024 regarding the taxable price for value-added tax:

Taxable Price

1. The taxable price is stipulated as follows:

...

g) For construction and installation activities, it is the value of the project, project items, or work completed and handed over without VAT. For construction and installation activities not covering materials, machinery, equipment, the taxable price is the construction and installation value excluding the value of materials and machinery, equipment;

h) For real estate business activities, it is the selling price of real estate excluding VAT minus land levy or land rent paid to the state budget (land price deductible). The Government of Vietnam stipulates the determination of deductible land prices in accordance with land law;

i) For agency, brokerage activities purchasing and selling goods and services earning commission, it is the commission earned from these activities excluding VAT;

...

2. The taxable price for goods and services specified in Clause 1 of this Article includes any surcharges and additional fees the business establishment is entitled to.

3. The Government of Vietnam stipulates the details of this Article.

Thus, the taxable price for VAT on construction and installation activities is the value of the project, project items, or work completed and handed over without value-added tax.

In cases where construction and installation do not include materials, machinery, or equipment, the taxable price is the construction and installation value excluding the value of materials, machinery, and equipment.