What are cases where duties on exports and imports are not paid before customs clearance in Vietnam?

What are cases where duties on exports and imports are not paid before customs clearance in Vietnam?

Based on Article 9 of the Law on Export and Import Duties 2016, the regulations are as follows:

Deadline for Tax Payment

1. Exported and imported goods that are subject to tax must pay the tax before customs clearance or release of goods as prescribed by the Customs Law, except for the cases stipulated in Clause 2, Article 9 of the Law on Export and Import Duties 2016.

In cases where a credit institution guarantees the tax payable, the goods can be cleared or released, but late payment interest must be paid according to the provisions of the Law on Tax Administration from the date of clearance or release of goods to the date of tax payment. The maximum guarantee period is 30 days from the date of customs declaration registration.

In cases where the credit institution has provided a guarantee, but the guarantee period expires and the taxpayer has not yet paid the tax and late payment interest, the guarantor is responsible for paying the full tax and late payment interest on behalf of the taxpayer.

2. Taxpayers who are entitled to prioritized policies according to the provisions of the Customs Law may delay the tax payment for customs declarations that have been cleared or released in a month, but no later than the tenth day of the following month. If this deadline is exceeded without tax payment, the taxpayer must pay the full tax arrears and late payment interest according to the provisions of the Law on Tax Administration.

Thus, export and import dutiesable goods are not required to pay tax before customs clearance or release in the following cases:

(1) When a credit institution guarantees the payable tax, goods can be cleared or released, but late payment interest must be paid as regulated by the Law on Tax Administration from the date of clearance or release to the date of tax payment;

(2) When a taxpayer is subject to prioritized policies under the Customs Law, taxes on cleared or released customs declarations within the month can be paid no later than the tenth day of the following month.

*Note: If this time limit is exceeded without tax payment, the taxpayer must pay the full tax arrears and late payment interest according to the provisions of the Law on Tax Administration.

What are cases where duties on exports and imports are not paid before customs clearance in Vietnam? (Image from Internet)

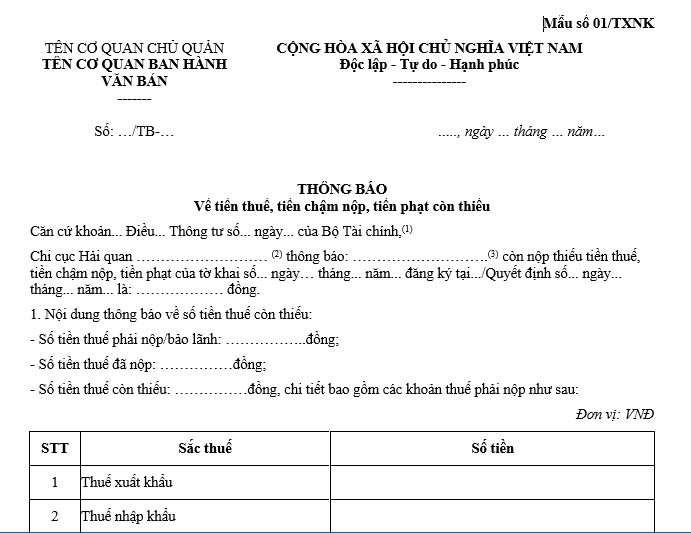

What is the form number for notification of export and import duties and late payment tax in Vietnam?

The notification form for tax and late payment tax on exported-imported goods is form number 01/TXNK, Appendix I, issued together with Circular 06/2021/TT-BTC as follows:

>>> Download Notification form for tax and late payment tax of export-import goods.

What are the procedures for handling late payment of export and import duties in Vietnam?

Based on Clause 2, Article 9 of Circular 06/2021/TT-BTC the regulations are as follows:

Guidance on Clause 9 Article 59 of the Law on Tax Administration regarding procedures for handling late tax payment

....

2. Procedures for handling late tax payment are as follows:

a) Responsibility of the taxpayer:

The taxpayer shall self-determine the late payment amount as stipulated in Clause 1 of this Article and pay it to the state budget.

b) Responsibility of the customs authority:

The customs authority checks and processes the late payment amount as follows:

b.1) In cases where after 30 days from the tax payment deadline, the taxpayer has not yet paid the tax, late payment, fine or has paid but the tax amount, late payment, fine amount is still lacking, the customs authority will notify the taxpayer of the outstanding tax, fine amount, and the number of late payment days through the System using Form number 1 Appendix II or paper according to Form number 01/TXNK Appendix I issued with this Circular.

In cases where the overdue payment has exceeded the required amount, the customs authority will handle the surplus late payment according to the provisions of Article 10 of this Circular.

b.2) In cases where the taxpayer declares additional tax return submissions resulting in a decrease in payable tax or the tax administration agency, competent state agencies find a reduction in payable tax, the customs authority adjusts the calculated late payment amount corresponding to the reduced difference.

For exported-imported goods, the procedures for handling late tax payment are as follows:

- The taxpayer self-determines the late payment amount and pays it to the state budget.

- The customs authority checks and processes the late payment amount as follows:

+ In cases where after 30 days from the deadline, the taxpayer has not yet paid the tax, late payment, fine, or has paid but the amount is still short, the customs authority will notify the taxpayer of the outstanding tax, fine amount, and number of late payment days through the System.

+ In cases where the amount paid for late payment exceeds the required amount, the customs authority will handle the surplus according to Article 10 of Circular 06/2012/TT-BTC.

+ In cases where the taxpayer declares additional tax return submissions resulting in a reduction of payable tax or the tax administration, competent state agencies detect a reduction in payable tax, the customs authority adjusts the calculated late payment amount corresponding to the reduced difference.