What are cases of license fee exemption in Vietnam in 2024?

Who must pay the license fee in Vietnam in 2024?

Currently, the term “license tax” is no longer used in legal documents. As of January 1, 2017, the term “license tax” has been replaced by “license fee,” but in practice, it is still commonly used by the public.

Based on the provisions of Article 2 of Decree 139/2016/ND-CP, entities liable for the license fee are organizations and individuals engaged in production and business of goods and services, excluding cases specified in Article 3 of Decree 139/2016/ND-CP (as amended and supplemented by Clause 1, Article 1 of Decree 22/2020/ND-CP) regarding cases exempt from the license fee, including:

(1) Enterprises established in accordance with the law.

(2) Organizations established under the Cooperative Law.

(3) Public service units established in accordance with the law.

(4) Economic organizations of political organizations, socio-political organizations, social organizations, socio-professional organizations, and people's armed force units.

(5) Other organizations engaged in production and business activities.

(6) Branches, representative offices, and business locations of the organizations specified in items (1), (2), (3), (4), and (5) (if any).

(7) Individuals, groups of individuals, and households engaged in production and business activities.

What are cases of license fee exemption in Vietnam? (Image from the Internet)

What are cases of license fee exemption in Vietnam?

Based on the provisions of Article 3 of Decree 139/2016/ND-CP (as amended and supplemented by Clause 1, Article 1 of Decree 22/2020/ND-CP) regarding cases exempt from the license fee, including:

(1) Individuals, groups of individuals, and households engaged in production and business activities with an annual revenue of 100 million VND or less.

(2) Individuals, groups of individuals, and households engaged in irregular production and business activities; not having a fixed business location as guided by the Ministry of Finance.

(3) Individuals, groups of individuals, and households producing salt.

(4) Organizations, individuals, groups of individuals, and households engaged in aquaculture, fishing, and fishery logistics services.

(5) Cultural post offices in communes; press agencies (printed newspapers, radio, television, electronic newspapers).

(6) Cooperatives and cooperative alliances (including branches, representative offices, and business locations) operating in the agricultural sector as per the law on agricultural cooperatives.

(7) People's credit funds; branches, representative offices, and business locations of cooperatives, cooperative alliances, and private enterprises operating in mountainous areas. Mountainous areas are defined according to the regulations of the Committee for Ethnic Minority Affairs.

(8) Exemption from license fee in the first year of establishment or when commencing production and business activities (from January 1 to December 31) for:

- Newly established organizations (granted new tax codes, new enterprise codes).

- Households, individuals, and groups of individuals first commencing production and business activities.

- During the period of license fee exemption, if the organization, household, individual, or group of individuals establishes branches, representative offices, or business locations, these entities will also be exempt from the license fee for the period in which the organization, household, individual, or group of individuals is exempt from license fee.

(9) Small and medium enterprises converting from business households (as prescribed in Article 16 of the Law on Supporting Small and Medium Enterprises 2017) are exempt from license fee for 03 years from the date of first receiving the enterprise registration certificate.

- During the license fee exemption period, if small and medium enterprises establish branches, representative offices, or business locations, these entities will also be exempt from the license fee for the period in which small and medium enterprises are exempt from license fee.

- Branches, representative offices, and business locations of small and medium enterprises (subject to license fee exemption as prescribed in Article 16 of the Law on Supporting Small and Medium Enterprises 2017) established before the effective date of this Decree shall be exempt from license fee from the effective date of this Decree until the end of the period in which small and medium enterprises are exempt from license fee.

- Small and medium enterprises converted from business households prior to the effective date of this Decree shall be exempt from license fee as prescribed in Article 16 and Article 35 of the Law on Supporting Small and Medium Enterprises 2017.

(10) Public primary schools and public preschools.

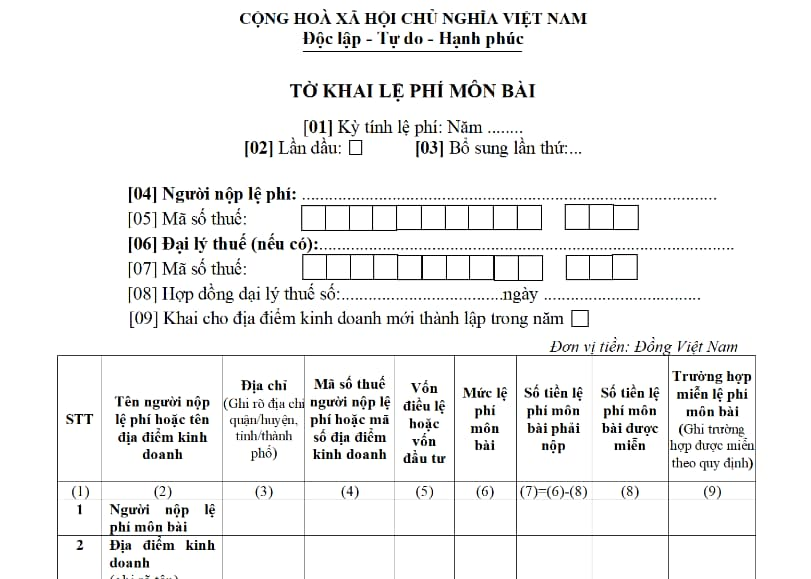

What is the latest license fee declaration form for 2024 in Vietnam?

The latest license fee declaration form for 2024 is Form 01/LPMB specified in Appendix 2 issued together with Circular 80/2021/TT-BTC.

DOWNLOAD >> Latest license fee declaration form for 2024