What are cases of exemption from registration fees for real estate in Vietnam?

What are cases of exemption from registration fees for real estate in Vietnam?

Based on Article 10 of Decree No. 10/2022/ND-CP, cases of exemption from registration fees for real estate in Vietnam include:

- Properties and lands used as headquarters of diplomatic representatives, consular offices, and international organizations under the United Nations system, and residence of the heads of these organizations in Vietnam.

In addition, according to guidance in Clause 1 Article 5 of Circular No. 13/2022/TT-BTC, the headquarters of diplomatic representatives and consular offices are buildings or parts thereof, including the land attached, used for official purposes by diplomatic missions or consular offices (including the residences and accompanying land for the heads of these offices).

- Land assigned or leased by the State under a one-time payment for the entire lease period for the following purposes:

+ Public use

+ Mineral exploration, mining; scientific research with permits or confirmation from competent state agencies.

+ Investment in infrastructure construction, house construction for transfer, including organizations or individuals acquiring property transfer rights to continue the investment in infrastructure and house construction.

- Land assigned, leased or recognized by the State for agricultural production, forestry, aquaculture, and salt-making purposes.

- Agricultural land where usage rights are exchanged among households and individuals within the same commune to facilitate agricultural production.

- Agricultural land claimed by households, individuals in line with approved land-use planning without dispute, certified by competent state agencies.

- Land leased from the State under an annual land rent payment or leased from organizations, individuals with lawful land-use rights.

- Properties and lands used for community purposes by recognized religious organizations or belief establishments permitted by the State.

According to guidance in Clause 2 Article 5 of Circular No. 13/2022/TT-BTC, properties used for recognized religious organizations or belief establishments permitted by the State include:

+ Land with structures such as temples, churches, chapels, sanctuaries, monasteries, religious schools, headquarters of religious organizations, and other religious facilities.

+ Land with structures such as communal houses, shrines, towers, or altars.

- Land used for cemeteries, burial grounds.

- Properties and lands inherited or given between: spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and children-in-law; grandparents and grandchildren; siblings, upon obtaining certificates of land-use rights, ownership of residential houses, and other assets attached to the land from competent state agencies.

- Residential houses created by families or individuals through separate housing development.

- Special assets, utility assets, management-specific utility assets for defense and security, including:

+ Properties and lands used specifically for defense and security as per legal regulations;

+ Ships, boats, cars, motorcycles categorized as special assets or for management-specific utility serving defense and security, as per law, registered by the Ministry of National Defense, Ministry of Public Security, or authorized units thereof.

- Properties and lands used as headquarters of public offices, armed forces units, public service providers, political organizations, socio-political organizations, professional socio-political organizations, social organizations, and professional social organizations.

- Properties and lands compensated or resettled (for individuals whose properties, lands are confiscated and have paid registration fees).

- Social housing, solidarity housing, and humanitarian-subsidized houses, including accompanying land registered in the recipient's name.

- Industrial facilities; warehouses, canteens, and garages of production facilities. Industrial facilities as per this clause are defined under construction classification laws.

- Residences and homestead land for poor households; houses and homestead land for ethnic minority groups in difficult and Central Highlands regions; houses and homestead land for households, individuals in special socioeconomic development programs for particularly disadvantaged communes, mountainous, remote regions.

Among these, poor households are identified by their certificates at the time of registration fee declaration; households, individual ethnic minorities wherein either or both spouses belong to an ethnic minority; difficult areas defined by decisions from the Prime Minister of the Government of Vietnam listing difficult administrative units.

- Properties and lands of privately invested institutions in education, training, vocational training; healthcare; culture; sports; environment sectors, lawfully registered for these activities.

However, these institutions must comply with specific criteria, scale, and standards defined in a Decision by the Prime Minister of the Government of Vietnam and guiding documents.

- Properties and lands of non-public entities registered for use in education, training, healthcare, culture, sports, science, technology, environment, society, population, family, and child protection activities similar to those of private investment institutions in respective fields.

Again, compliance with specific criteria, scale, and standards is mandatory as per a Decision by the Prime Minister of the Government of Vietnam and guiding documents.

- Properties and lands of scientific and technological enterprises registered in accordance with the law.

What are cases of exemption from registration fees for real estate in Vietnam? (Image from the Internet)

What documents are required in the application for exemption from registration fees for real estate regarding estate that need documents proving the asset or asset owner?

Based on Article 61 of Circular No. 80/2021/TT-BTC:

- For land assigned, leased or recognized by the State for agricultural, forestry, aquaculture, and salt production purposes: Confirmation from the Land Registration Office on the “Information Transfer Form for Financial Obligations on Land” regarding the land's eligibility for the State's land-use rights certificate.

- For land used for community purposes by recognized religious organizations or belief establishments: Documentation proving the State's recognition of the religious establishment.

- For special assets, utility assets, management-specific utility assets serving defense and security: Approval decision from competent authorities on asset assignment or investment in special assets, or confirmation from competent police or defense agencies on the unit’s properties and lands used for defense, security purposes.

- For compensated or resettled properties and lands:

+ Decisions on the old property clearance and new property assignment from competent state agencies.

+ The land-use rights, home ownership, and other assets attached to land certificates for those whose land was reclaimed, issued by competent authorities with no deferred financial obligations.

Should the land-use right holder have settled the registration fee but not received or lost the certificate: Receipts of paid registration fees for properties and lands taken by the State; or confirmation from the property and land file management agency; or competent state agency's exemption confirmation.

+ Invoices or legal land-use rights transfer contracts, house sale contracts, together with original compensation receipts or payment support from the reclaiming agency (in case of monetary compensation).

How to determine the registration fee for property and land in Vietnam?

According to Clause 1 Article 7 of Decree No. 10/2022/ND-CP, the value used to determine the registration fee for property and land is the land price stipulated by the provincial People's Committee at the time of the registration fee declaration.

If the selling price in the house sale contract or land-use rights transfer contract is higher than the provincial People’s Committee's set price, the value used to determine the registration fee is the price in the transfer contract.

Some specific cases:

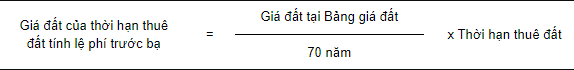

- For land leased from the State with a one-time land rent payment for the entire lease period if the lease period is shorter than the land type's term prescribed in the provincial People's Committee's land price list:

The land price for the lease term used for registration fee calculation will be determined as follows:

- For state-owned houses sold to tenants:

The registration fee value is the actual selling price per the provincial People’s Committee's decision.

- For properties and lands purchased through auction or bidding:

The registration fee value is the actual auction or bidding price recorded on the invoice or in the auction/bidding result approval documents (if any) by competent state agencies.

- For multi-storey multiple dwelling houses or condominiums:

The registration fee value includes the allocated land value. The allocated land value is determined by multiplying the land price in the provincial People’s Committee's land price list by the allocation coefficient.

The allocation coefficient is determined as per Decree No. 53/2011/ND-CP and any replacing, amending, or supplementing documents (if any).

- If the contract price is higher than the price set by the provincial or city-level People’s Committee, the registration fee is calculated based on the contract price.