What are cases for import and export tax refunds in Vietnam in 2024?

What are cases for import and export tax refunds in Vietnam in 2024?

According to Article 19 of the Law on Export and Import Taxes 2016, the cases for import and export tax refunds are as follows:

- Taxpayers have paid import or export taxes, but there are no imported or exported goods, or the quantity of imported or exported goods is less than the taxable amount; (1)

- Taxpayers have paid export taxes but the exported goods must be re-imported, in which case the export taxes are refunded, and import taxes are not required; (2)

- Taxpayers have paid import taxes but the imported goods must be re-exported, in which case the import taxes are refunded, and export taxes are not required; (3)

- Taxpayers have paid taxes on imported goods for production and business purposes but have used these goods to produce exported products;

- Taxpayers have paid taxes on machinery, equipment, tools, and transportation vehicles of organizations and individuals allowed to temporarily import for re-export, except in the case of leasing to carry out investment projects, construction, installation projects, and production. When re-exported abroad or exported to non-tariff zones, taxes are refunded.

The refunded import tax amount is determined According to the remaining value of the goods when re-exported, calculated according to the duration of use and storage in Vietnam. If the goods have no remaining value, the paid import tax will not be refunded.

No refunds will be granted for tax amounts below the minimum threshold stipulated by the Government.

*Note: Goods specified in (1), (2), and (3) will be refunded taxes if they are not used, processed, or altered.

What are cases for import and export tax refunds in Vietnam in 2024? (Image from the Internet)

Which imported goods that have paid import taxes but must be re-exported are eligible for import tax refunds and are exempt from export taxes in Vietnam?

According to Clause 1, Article 34 of Decree 134/2016/ND-CP, amended- by Clause 17, Article 1 of Decree 18/2021/ND-CP, imported goods that have paid import taxes but must be re-exported are eligible for import tax refunds and are exempt from export taxes, including:

- Imported goods that must be re-exported to foreign countries, including return to the shipper, goods exported to foreign countries or non-tariff zones for use within the non-tariff zones.

The re-export of goods must be carried out by the original importer or authorized by the original importer.

- Imported goods sent by foreign organizations or individuals to organizations or individuals in Vietnam through postal and international express services, which cannot be delivered to the recipient and must be re-exported;

- Imported goods that have paid taxes but are later sold to foreign vessels on international routes through Vietnamese ports and Vietnamese vessels on international routes as regulated;

- Imported goods that have paid import taxes but remain in warehouses or storage facilities at the border checkpoint under customs supervision and are re-exported.

Which exported goods that have paid export taxes but must be re-imported are eligible for export tax refunds and are exempt from import taxes in Vietnam?

According to Clause 1, Article 33 of Decree 134/2016/ND-CP, exported goods that have paid export taxes but must be re-imported are eligible for export tax refunds and are exempt from import taxes, including:

- Goods that have been exported but must be re-imported into Vietnam;

- Goods exported by Vietnamese organizations or individuals to foreign organizations or individuals through postal and international express services, which cannot be delivered to the recipient and must be re-imported.

How are import tax refunds handled for goods imported for production and business but have been used to produce exported products in Vietnam?

According to Clause 1, Article 36 of Decree 134/2016/ND-CP, taxpayers who have paid import taxes for goods intended for production and business but have used them to produce exported products, either to foreign countries or to non-tariff zones, are eligible for import tax refunds.

* The import tax refund is applicable to:

- Raw materials, supplies (including packaging materials or packaging for exported products), components, and semi-finished products directly used in export production or directly involved in the production process but not directly transformed into products;

- Complete products imported for assembly into exported products or included as a part of the finished exported product;

- Components and spare parts imported for the warranty of exported products.

* Criteria to determine goods eligible for tax refund:

- Organizations and individuals that produce exported goods must have production facilities within Vietnam and have ownership or usage rights for machinery and equipment at the production facilities suitable for the imported materials, supplies, and components used to manufacture the exported goods;

- The value or quantity of imported materials, supplies, and components eligible for tax refund is determined by the actual quantities used to produce the actually exported products;

- Exported products must complete customs procedures under the export production category;

- Organizations and individuals directly or authorizing the import and export of goods.

Taxpayers are responsible for accurately and truthfully declaring the exported products produced from previously imported goods on the customs declaration.

* In cases where a type of raw material, supply, or component is used to produce several different products, but only one product is exported, the refund will be proportional to the materials, supplies, and components used to produce the exported products, calculated according to the total value of all products obtained.

The total value of the obtained products is the sum of the exported product value and the sold product value within the domestic market. The value of the exported product does not include the part of the value of domestic materials, supplies, and components used in the exported product.

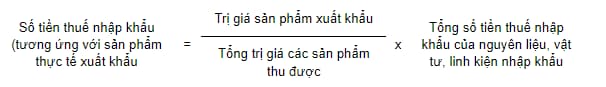

The refundable import tax amount is calculated by the allocation method using the following formula:

The value of the exported product is determined by multiplying the actual exported quantity by the taxable value of the exported goods.