What are 5 benefits of implementing import-export tariffs in Vietnam?

What are 5 benefits of implementing import-export tariffs in Vietnam?

Pursuant to Article 10 of the Law on Export and Import Taxes 2016, the 5 benefits of enacting export and import tariffs include:

Benefit 1. Encourages the importation of raw materials and materials, prioritizing those not yet meeting domestic demand; focuses on the development of high-tech, source technology, energy-saving, and environmental protection sectors.

Benefit 2. Aligns with the state's socio-economic development orientation and the commitments on export and import taxes in international treaties to which the Socialist Republic of Vietnam is a member.

Benefit 3. Contributes to market stabilization and state budget revenue.

Benefit 4. Simple, transparent, creating convenience for taxpayers and implementing tax administrative reforms.

Benefit 5. Applies uniform tax rates for goods with the same nature, structure, usage, and similar technical features; import tax rates decrease from finished products to raw materials; export tax rates increase from finished products to raw materials.

What are 5 benefits of implementing import-export tariffs in Vietnam? (Image from the Internet)

Do the import-export tariffs need to be approved by the National Assembly of Vietnam?

Pursuant to Article 11 of the Law on Export and Import Taxes 2016, the authority to issue tariffs and tax rates is as follows:

- The Government of Vietnam, based on the provisions of Article 10 of the Law on Export and Import Taxes 2016, the Export Tariff according to the list of taxable goods groups and the tax rate framework for each taxable goods group promulgated with this Law, the Preferential Tariff committed in the Protocol of accession to the World Trade Organization (WTO) ratified by the National Assembly and other international treaties to which the Socialist Republic of Vietnam is a member, to promulgate:

+ Export tariff; Preferential export tariff;

+ Preferential import tariff; Special preferential import tariff;

+ List of goods and absolute tax rates, mixed tax rates, import tax rates outside tariff quotas.

- In necessary cases, the Government of Vietnam shall submit to the Standing Committee of the National Assembly for modification, supplementation of the Export Tariff according to the list of taxable goods groups and the tax rate framework for each taxable goods group promulgated with this Law.

- The authority to apply anti-dumping tax, countervailing tax, and safeguard tax shall follow the provisions of Chapter 3 of the Law on Export and Import Taxes 2016.

Thus, according to the above provisions, the export and import tariff needs to have been approved by the National Assembly and other international treaties to which the Socialist Republic of Vietnam is a member before being promulgated.

Where to download the 2024 export and import tariff in Vietnam?

The 2024 export and import tariff is stipulated in Decree 26/2023/ND-CP on the export tariff, preferential import tariff, list of goods, and absolute tax rates, mixed tax rates, import tax rates outside tariff quotas as follows:

* About the 2024 export tariff

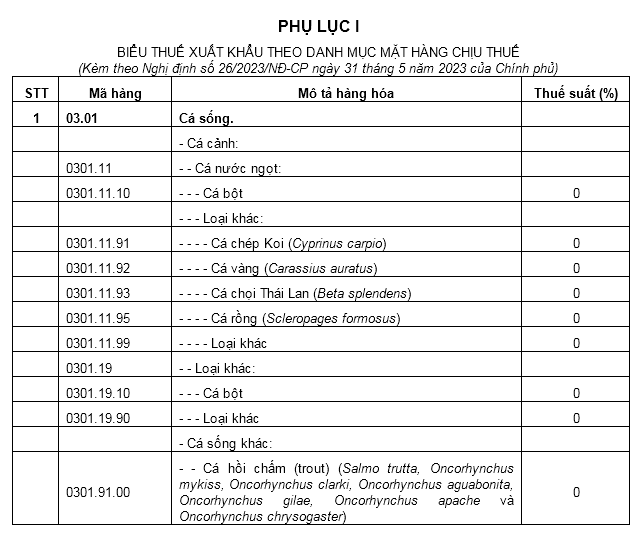

It is provided in Appendix I issued with Decree 26/2023/ND-CP including commodity code (commodity code), description of goods, export tax rates prescribed for each group of commodities, taxable items for export.

In case the exported goods are not listed in the Export Tariff, the customs declarant shall declare the commodity code of the exported goods corresponding to the 8-digit commodity code of that commodity according to the Preferential Import Tariff provided in Section 1, Appendix 2 issued with Decree 26/2023/ND-CP and there is no need to declare the tax rate on the export goods declaration form.

>>> Download the 2024 export tariff

* Import Tariff 2024

It will be provided in Appendix 2 issued with Decree 26/2023/ND-CP, including:

- Section 1: Stipulates the preferential import tax rates for 97 chapters according to the Vietnam Export, Import Goods List.

- Section 2: Stipulates the list of goods and preferential import tax rates for certain items under Chapter 98 as follows:

>>> Download the 2024 import tariff

How to implement the export and import tariffs within the framework of Free Trade Agreements?

The implementation of export and import tariffs within the framework of free trade agreements is guided in Section 2 of Official Dispatch 12167/BTC-TCHQ in 2016 as follows:

- For special preferential import tax rates under the provisions of the bilateral trade agreement between the Government of Vietnam of the Socialist Republic of Vietnam and the Government of Vietnam of the Lao People's Democratic Republic (referred to as the Vietnam - Laos Trade Agreement): implemented according to the provisions of Appendices 1b, 2b, and 3 in the Vietnam - Laos Trade Agreement.

- For special preferential import tariffs: implemented according to the list of goods and special preferential tax rates stipulated in the special preferential import tariffs of Vietnam issued with the Decrees implementing 09 free trade agreements, including: Vietnam - Korea Agreement, ASEAN - Korea, Vietnam - Japan, ASEAN - Japan, ASEAN-China, ASEAN-Australia-New Zealand, ASEAN-India, ATIGA, and Vietnam-Chile.

- The lists of goods and normal tax rates, preferential tax rates, absolute taxes, import taxes outside tariff quotas, and special preferential tax rates stipulated in the Decrees and Decisions of the Prime Minister of the Government of Vietnam stated in Section 1, Appendices 1b, 2b, 3 of the Vietnam - Laos Trade Agreement mentioned in Section 2a, and the special preferential import tariffs mentioned in Section 2b have been updated in the VNACCS system.