Vietnam: Which entities apply Form 04.1-DK-TCT under Circular 86? How to download the Form?

Vietnam: Which entities apply Form 04.1-DK-TCT under Circular 86? How to download the Form?

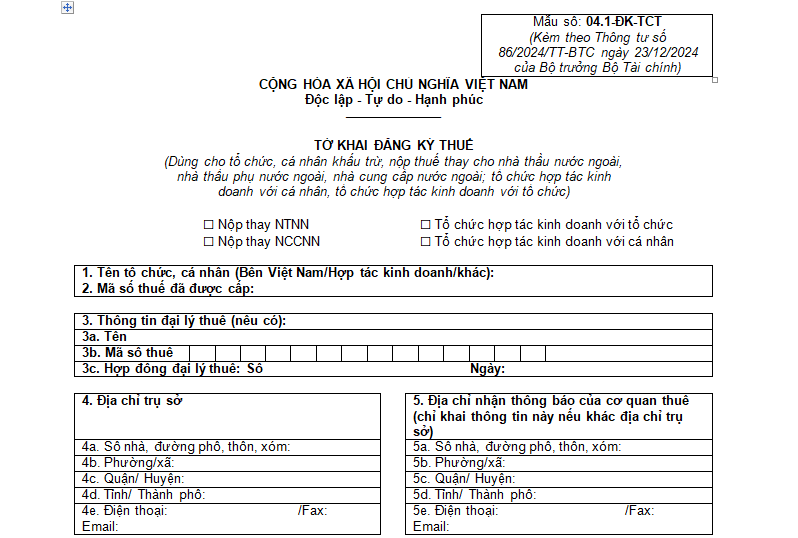

Form 04.1-DK-TCT - Tax registration application is used for organizations and individuals responsible for withholding and paying taxes on behalf of foreign contractors, foreign sub-contractors, and foreign suppliers; organizations engaging in business cooperation with individuals or other organizations, as per Appendix 2 issued with Circular 86/2024/TT-BTC (effective from February 6, 2025).

The Form 04.1-DK-TCT - Tax registration application is structured as follows:

Download Form 04.1-DK-TCT under Circular 86

Vietnam: Which entities apply Form 04.1-DK-TCT under Circular 86? How to download the Form? (Image from Internet)

What is the initial tax registration application for organizations withholding taxes from February 6, 2025

Based on Clause 6, Article 7 of Circular 86/2024/TT-BTC (effective February 6, 2025), the initial Tax registration application for organizations withholding taxes and organizations authorized by tax authorities to collect tax documentation at tax offices includes the following documents:

(1) Organizations withholding and paying on behalf of foreign contractors and foreign sub-contractors must submit the Tax registration application at the directly managing tax office. The Tax registration application includes:

- tax registration application Form 04.1-DK-TCT issued with Circular 86/2024/TT-BTC;

- List of foreign contractor contracts, foreign sub-contractor contracts with tax payment through the Vietnamese side using Form 04.1-DK-TCT-BK.

(2) Organizations engaged in business cooperation with individuals or organizations managing business cooperation agreements without setting up a separate legal entity must lodge the Tax registration application at the directly managing tax office. The Tax registration application includes:

- tax registration application Form 04.1-DK-TCT issued with Circular 86/2024/TT-BTC;

- Copies of the business cooperation contract or document.

(3) Commercial banks, intermediary payment service providers, or entities authorized by foreign suppliers to withhold and pay taxes on their behalf must submit the Tax registration application at the directly managing tax office. The Tax registration application includes: tax registration application Form 04.1-DK-TCT issued with Circular 86/2024/TT-BTC.

(4) Organizations authorized by tax authorities to collect tax must submit the Tax registration application at the tax office with which they have a tax collection mandate contract. The Tax registration application includes: tax registration application Form 04.4-DK-TCT issued with Circular 86/2024/TT-BTC.

Shall organizations withholding taxes register directly with tax authorities in Vietnam from February 6, 2025?

Based on Point g, Clause 2, Article 4 of Circular 86/2024/TT-BTC (effective February 6, 2025), stipulating taxpaying entities required to conduct direct taxpayer registration with tax authorities are specified as follows:

Taxpayer Registration Subjects

...

- Taxpayers required to conduct direct taxpayer registration with tax authorities include:

a) Enterprises operating in specialized fields not required to register business through the business registration authority as per specialized legislation (hereinafter referred to as Economic Organizations).

b) Public service units, economic organizations of armed forces, economic organizations of political, political-social, social, professional organizations operating business under law but not required to register business through the business registration authority; organizations of countries sharing a land border with Vietnam engaging in buying, selling, exchanging goods at border markets, border gate markets, and economic zone markets; representative offices of foreign organizations in Vietnam; cooperatives established and operating per Decree No. 77/2019/ND-CP dated October 10, 2019, of the Government of Vietnam on cooperatives but not falling under the business registration cases through the business registration authority stipulated at Clause 2, Article 107 of the Cooperative Law (hereinafter Economic Organizations).

c) Organizations established by competent authorities not engaging in production, business but having obligations to the state budget (hereinafter Other Organizations).

d) Foreign organizations and individuals and organizations in Vietnam using humanitarian aid, non-refundable aids from abroad to purchase goods, services with VAT in Vietnam to provide aids; diplomatic missions, consular offices, and offices of international organizations in Vietnam entitled to VAT refunds under preferential diplomatic immunity; ODA project owners entitled to VAT refunds, sponsoring offices for ODA projects, organizations designated by foreign donors to manage non-refundable ODA programs, projects (hereinafter Other Organizations).

dd) Foreign organizations without legal personality in Vietnam, foreign individuals independently doing business in compliance with Vietnamese law with income derived in Vietnam or tax obligations arising in Vietnam (hereinafter Foreign Contractors, Foreign Sub-Contractors).

e) Foreign suppliers without permanent establishments in Vietnam, non-resident foreign individuals conducting e-commerce or business on digital platforms and other services with organizations, individuals in Vietnam (hereinafter Foreign Suppliers).

g) Enterprises, organizations, and individuals responsible for withholding and paying taxes on behalf of other taxpayers must independently declare and determine tax obligations separate from the taxpayer's obligations in accordance with tax management laws (except for income payers when withholding and paying personal income tax); Commercial banks, intermediary payment service organizations, or organizations, individuals authorized by foreign suppliers to declare, withhold, and pay taxes on behalf of foreign suppliers (hereinafter Withholding Taxpayers). Organizations paying income when withholding and paying personal income tax use their assigned tax codes to declare and pay personal income tax withheld, paid on behalf of others.

h) Operators, joint operators, joint venture enterprises, organizations assigned by the Government of Vietnam to receive their share of Vietnam from overlapping oil and gas fields, contractors, investors participating in petroleum contracts, the parent company - Vietnam National Oil and Gas Group representing the host country receiving its share of profits from petroleum contracts.

i) Households, individuals engaged in production, business operations as per law but not required to register businesses through the business registration authority as stipulated by the Government of Vietnam on business households; individual traders from countries sharing land borders with Vietnam engaged in buying, selling, exchanging goods at border markets, border gate markets, and economic zone markets.

k) Individuals with income subject to personal income tax (except for business individuals).

l) Individuals defined as dependents per personal income tax laws.

m) Organizations, individuals authorized by tax authorities to collect taxes.

n) Other organizations, households, and individuals with obligations to the state budget.

Thus, as per the above provisions, organizations with the responsibility to withhold and remit taxes on behalf of other taxpayers are required to conduct direct taxpayer registration with tax authorities.