Vietnam: What is the time limit for issuing the taxpayer registration certificate by the tax authority?

What is the time limit for issuing the taxpayer registration certificate by the tax authority in Vietnam?

Under Clause 1, Article 34 of the Law on Tax Administration 2019, the issuance of taxpayer registration certificates is regulated as follows:

Issuance of taxpayer registration certificate

1. Tax authorities shall issue taxpayer registration certificates to taxpayers within 03 working days starting from the date of receipt of taxpayers’ satisfactory taxpayer registration application as prescribed by law. Information on a taxpayer registration certificate shall include:

a) Name of the taxpayer;

b) TIN;

c) Number, date of the business registration certificate or establishment and operation license or investment registration certificate for business organizations and individuals; number, date of the establishment decision for organizations not required to apply for business registration; information of identity card, citizen identification or passport for individuals not subject to business registration;

...

Thus, according to the above regulation, tax authorities issue taxpayer registration certificates to taxpayers within 3 working days from the date of receipt of complete taxpayer registration applications as prescribed.

What is the time limit for reissuing the taxpayer registration certificate in case of loss in Vietnam?

Under Article 34 of the Law on Tax Administration 2019, the issuance of taxpayer registration certificates is regulated as follows:

Issuance of taxpayer registration certificate

1. Tax authorities shall issue taxpayer registration certificates to taxpayers within 03 working days starting from the date of receipt of taxpayers’ satisfactory taxpayer registration application as prescribed by law. Information on a taxpayer registration certificate shall include:

a) Name of the taxpayer;

b) TIN;

c) Number, date of the business registration certificate or establishment and operation license or investment registration certificate for business organizations and individuals; number, date of the establishment decision for organizations not required to apply for business registration; information of identity card, citizen identification or passport for individuals not subject to business registration;

d) Supervisory tax authority.

2. Tax authorities shall inform TINs to taxpayers instead of taxpayer registration certificates in the following cases:

a) An individual authorizes his/her income payer to apply for taxpayer registration on behalf of the individual and his/her dependants;

b) An individual applies for taxpayer registration through the tax declaration dossier;

c) An organization or individual applies for taxpayer registration so as to deduct and pay tax on taxpayers’ behalf;

d) An individual applies for taxpayer registration for his/her dependant(s).

3. In case the taxpayer registration certificate or TIN notification is lost or damaged, tax authorities shall reissue it within 02 working days starting from the date of receipt of the satisfactory application from the taxpayer as prescribed by law.

Thus, according to the above regulation, if the taxpayer registration certificate is lost, it will be reissued within 2 working days from the date the tax authorities receive the complete application.

What is the time limit for issuing the taxpayer registration certificate by the tax authority in Vietnam? (Image from the Internet)

What are the regulations on the use of TINs when the taxpayer registration certificate is obtained?

According to Article 35 of the Law on Tax Administration 2019, the use of TINs is regulated as follows:

- Taxpayers must include their TINs in invoices, records and/or materials when making business transactions; opening deposit accounts at commercial banks and/or other credit institutions; declaring tax, pay tax, applying for tax exemption, tax reduction, tax refund and/or tax cancellation; filing customs declarations and making other tax-related transactions for all amounts payable to the state budget, including the case where taxpayers’ businesses operate across different locations.

- Taxpayers must provide their TINs to relevant agencies and/or organizations or include their TINs in their applications when following administrative procedures of tax authorities via the interlinked single-window system.

- Tax authorities, the State Treasury and commercial banks and other organizations authorized by tax authorities to collect tax shall use TINs of taxpayers for tax administration and tax collection.

- Commercial banks and other credit institutions must include TINs in the taxpayers’ applications for opening accounts and in records of transactions via accounts.

- Other organizations and individuals participating in tax administration shall use TINs of taxpayers when providing information related to the determination of tax liabilities.

- When a Vietnamese party makes a payment to an organization/individual whose cross-border business is based on a digital intermediary platform outside of Vietnamese territories, it must use the TIN assigned to this organization/individual to deduct and pay tax on behalf of such organization/individual.

- Personal identification numbers shall replace TINs when they are issued to the whole population.

What is the newest taxpayer registration certificate template in Vietnam?

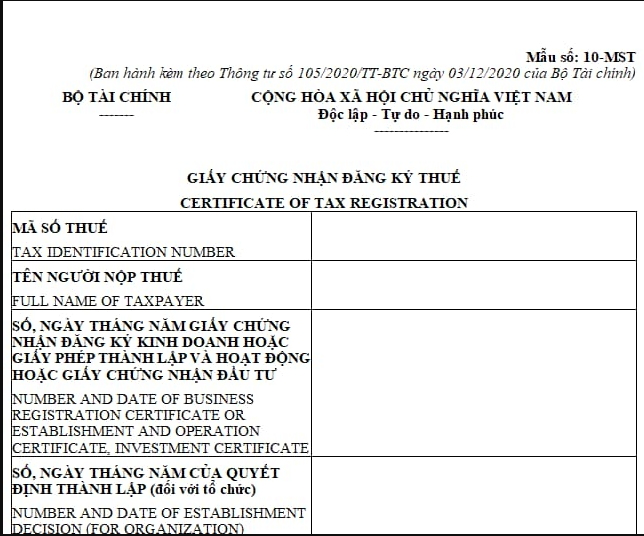

The taxpayer registration certificate template for organizations, household businesses and individual businesses is stipulated in Form No. 10-MST issued together with Circular 105/2020/TT-BTC:

Download the taxpayer registration certificate template for organizations, household businesses and individual businesses in 2024.

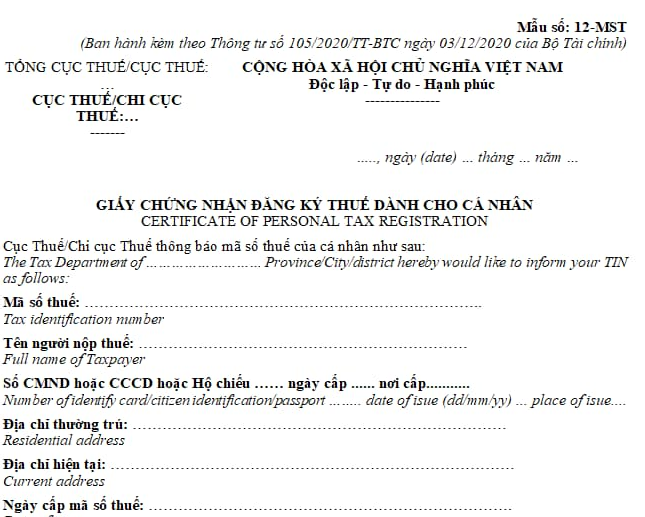

The taxpayer registration certificate template for individuals is detailed in Form No. 12-MST issued together with Circular 105/2020/TT-BTC:

Download the taxpayer registration certificate template for individuals.