Vietnam: What is the tax declaration form applicable to household/individual businesses - Form 01/CNKD?

What is the tax declaration form applicable to household/individual businesses - Form 01/CNKD in Vietnam?

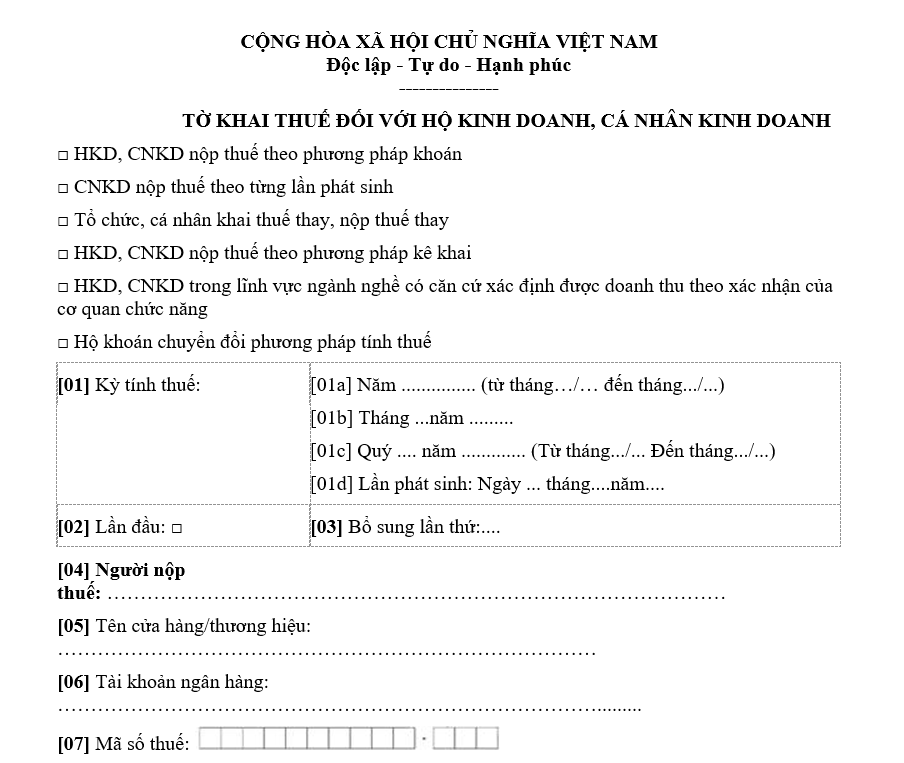

The tax declaration form applicable to household/individual businesses is currently used according to Form No. 01/CNKD issued together with Circular 40/2021/TT-BTC, as follows:

Download Form 01/CNKD - the tax declaration form applicable to household businesses and individual businesses: Here

What is the tax declaration form applicable to household/individual businesses - Form 01/CNKD in Vietnam? (Image from the Internet)

What does the tax declaration dossier submitted by household businesses and individual businesses under periodic declarations in Vietnam include?

Under Clause 1 Article 11 of Circular 40/2021/TT-BTC, the regulation is as follows:

Tax administration of household businesses and individual businesses under periodic declarations

1. Tax declaration dossier

The tax declaration dossier shall contain the documents specified in Point 8.2 of Appendix I of the Government’s Decree No. 126/2020/ND-CP dated 19/10/2020, to be specific:

a) The tax form No. 01/CNKD enclosed herewith;

a) The declaration form No. 01-2/BK-HDKD enclosed herewith (for household businesses and individual businesses paying tax under declarations). Form No. 01-2/BK-HDKD is not required if the household business or individual business is able to determine revenue as confirmed by a competent authority.

2. Receiving authorities

Household businesses and individual businesses paying tax under periodic declarations as prescribed in Clause 1 Article 45 of the Law on Tax Administration shall submit tax declaration dossiers to their supervisory sub-department of taxation.

...

The tax declaration dossier submitted by household businesses and individual businesses under periodic declarations in Vietnam includes:

- Tax declaration form for household/individual businesses Here

- Annex showing statement on the business operations during the period for household businesses, individual businesses (applicable to household businesses, individual businesses paying taxes under periodic declarations) Here

In the case of household businesses and individual businesses paying taxes under periodic declarations, if there are grounds to determine the revenue according to the confirmation of the competent authority, they do not have to submit the above-mentioned statement.

What is the deadline for submitting the tax declaration dossier by household businesses and individual businesses under periodic declarations in Vietnam?

Under clause 3 Article 11 of Circular 40/2021/TT-BTC:

Tax administration of household businesses and individual businesses under periodic declarations

...

3. Deadlines for submission of tax declaration dossiers

Household businesses and individual businesses paying tax under periodic declarations shall submit tax declaration dossiers by the deadlines specified in Clause 1 Article 44 of the Law on Tax Administration. To be specific:

a) Household businesses and individual businesses paying tax under monthly periodic declarations shall submit their tax declaration dossiers by the 20th of the month succeeding the month in which tax is incurred.

b) Household businesses and individual businesses paying tax under quarterly periodic declarations shall submit their tax declaration dossiers by the last day of the first month of the quarter succeeding the quarter in which tax is incurred.

4. Tax payment deadlines

Household businesses and individual businesses paying tax under periodic declarations shall pay tax by the deadline specified in Clause 1 Article 55 of the Law on Tax Administration, which is the deadline for submission of the tax declaration dossier. In case the tax declaration dossier has to be supplemented, tax shall be paid by the deadline for submission of the tax declaration dossier of the erroneous tax period.

5. Tax declaration in case of business suspension

The household business or individual business that suspends their business operation shall notify the tax authority as prescribed in Article 91 of the Decree No. 01/2021/ND-CP, Article 4 of Decree No. 126/2020/ND-CP, Article 12 of Circular No. 105/2020/TT-BTC and is not required to submit the tax declaration dossier, unless tax is declared monthly and the suspension lasts less than a month, or tax is declared quarterly and the suspension lasts less than a quarter.

The deadline for submitting the tax declaration dossier by household businesses and individual businesses under periodic declarations in Vietnam is as follows:

- Household businesses and individual businesses paying tax under monthly periodic declarations shall submit their tax declaration dossiers by the 20th of the month succeeding the month in which tax is incurred.

- Household businesses and individual businesses paying tax under quarterly periodic declarations shall submit their tax declaration dossiers by the last day of the first month of the quarter succeeding the quarter in which tax is incurred.