Vietnam: What is the scope of application of the Form 05/TNDN?

What is the Form 05/TNDN Corporate income tax declaration in Vietnam?

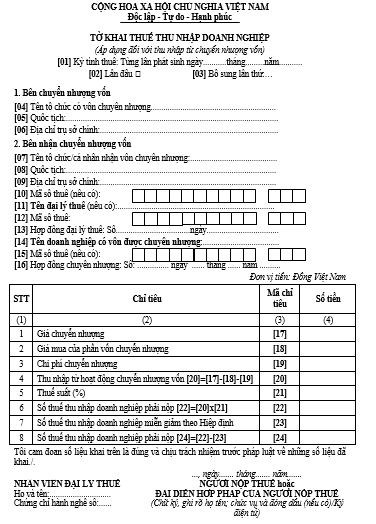

Form No. 05/TNDN Corporate Income Tax declaration for income from capital transfer is stipulated in Circular 80/2021/TT-BTC, as follows:

Download Form 05/TNDN: Here

Vietnam: What is the scope of application of the Form 05/TNDN? (Image from Internet)

Vietnam: What is the scope of application of the Form 05/TNDN?

Based on Clause 1 Article 14 of Circular 78/2014/TT-BTC, the applicable entities are regulated as follows:

- Organizations and individuals receiving capital transfers are responsible for filing tax declarations on behalf of foreign contractors. They must prepare data, compile tax declaration dossiers by each arising instance, and submit them to the tax authorities directly managing the enterprise where the foreign contractor invests.

- If the organization or individual receiving the capital transfer is also a foreign contractor, the organization established under Vietnamese law where the foreign contractor invests must compile tax declaration dossiers by each arising instance and submit them to the tax authorities directly managing the enterprise where the foreign contractor invests. The deadline for submitting tax declaration dossiers is no later than the 10th day from the date of tax liability occurrence.

Basis for calculating corporate income tax from capital transfer in Vietnam

According to Clause 1 Article 14 of Circular 78/2014/TT-BTC amended by Article 8 of Circular 96/2015/TT-BTC, the basis for calculating corporate income tax from capital transfer is as follows:

| Taxable Income | = | Transfer Price | - | Purchase Price of the Transferred Capital | - | Transfer Expenses |

In detail:

- The transfer price is determined as the total actual value earned by the transferor as per the transfer contract.

In cases where the transfer contract stipulates installment or deferred payment, the contract’s revenue does not include the installment or deferred interest as stipulated in the contract.

If the transfer contract does not specify the payment price or the tax agency has a basis to determine the payment price as inconsistent with market price, the tax agency has the right to inspect and impose the transfer price. For enterprises transferring part of their capital which does not comply with market prices, the tax agency may reassess the entire value of the enterprise at the time of transfer to establish an appropriate transfer price proportional to the transferred capital portion.

The basis for determining the transfer price is based on the investigation document of the tax agency or on the transfer price of other cases within the same timeline, same economic organization, or similar transfer contracts at the time of transfer. If the tax agency’s reevaluation of the transfer price is deemed inappropriate, the price shall be determined based on the appraisal by professional valuation organizations at the time of transfer.

For enterprises transferring capital to organizations or individuals, where the value of transferred capital in the contract exceeds twenty million VND, a non-cash payment proof is required. If no such proof is provided, the tax agency has the right to determine the transfer price.

- The purchase price of the transferred capital is determined case by case as follows:

+ For capital contribution to establish an enterprise, the purchase price is the cumulative value of capital contribution up to the time of capital transfer based on accounting books, records, certificates, and cumulatively audited results by independent auditing firms for wholly foreign-invested enterprises.

+ For acquisition of capital, the purchase price is the capital value at the acquisition time, determined based on the purchase contract and payment proof.

If the enterprise is qualified to account in foreign currency and complies with the legal regulations on accounting policies for foreign currency capital transfer, the transfer and purchase prices are determined in foreign currency. If the enterprise accounts in Vietnamese Dong but transfers capital in foreign currency, the transfer price must be converted to Vietnamese Dong at the buying rate of the commercial bank where the enterprise has an account at the transfer time.

- Transfer expenses include actual and legal expenses directly related to the transfer, with valid invoices and documents. If such expenses arise abroad, the original documents must be authenticated by a notary or independent auditor of the country where the expenses occur and must be translated into Vietnamese (with authentication of a competent representative).

Transfer expenses include costs for necessary legal procedures for transferring, fees and charges paid to complete transfer procedures, transaction, negotiation, and contract signing expenses, and other documented expenses.

Example 16: Enterprise A contributes 400 billion VND, including 320 billion VND as the value of the workshop and 80 billion VND in cash, to establish a joint venture producing toilet paper. Subsequently, Enterprise A transfers the above-mentioned capital to Enterprise B for 550 billion VND. The capital value of Enterprise A at the transfer time recorded in the accounting books is 400 billion VND, with related transfer expenses of 70 billion VND. The taxable income from the capital transfer in this case is 80 billion VND (550 - 400 - 70).

- Enterprises earning income from capital transfer must declare such income as other income and include it in taxable income for corporate income tax calculation.

- For foreign organizations doing business in Vietnam or earning income in Vietnam that do not operate under the Investment Law 2020, Enterprise Law 2020 (collectively referred to as foreign contractors) having capital transfer must declare and pay tax as follows:

Organizations or individuals receiving capital transfers are responsible for determining, declaring, deducting, and paying corporate income tax on behalf of the foreign organization. If the transferee is also a foreign organization not operating under the Investment Law 2020, Enterprise Law 2020, then the enterprise established under Vietnamese law where these foreign organizations invest must declare and pay corporate income tax on behalf of the foreign organization for the capital transfer.

Tax declaration and payment shall be conducted per the legal documents on tax management.