Vietnam: What is the PIT finalization declaration form - Form 02/QTT-TNCN about?

What is the PIT finalization declaration form - Form 02/QTT-TNCN in Vietnam about?

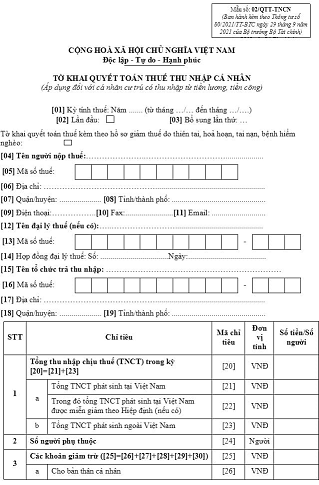

The PIT finalization declaration form - Form 02/QTT-TNCN issued according to Appendix 2 of Circular 80/2021/TT-BTC is as follows:

Download Form 02/QTT-TNCN here: download

What is the PIT finalization declaration form - Form 02/QTT-TNCN in Vietnam about? (Image from the Internet)

What documents are required for PIT finalization for employees who have resigned in Vietnam?

Under the provisions of point a, clause 1.1, sub-clause 1, Section 4 of Official Dispatch 883/TCT-DNNCN of 2022, the PIT finalization documents for 2023 for employees who have resigned include:

- PIT finalization declaration form - Form 02/QTT-TNCN issued according to Appendix 2 of Circular 80/2021/TT-BTC

- Appendix listing family relief deductions for dependents, form No. 02-1/BK-QTT-TNCN issued according to Appendix 2 of Circular 80/2021/TT-BTC.

- Copies (photocopies from the originals) of documents proving the tax amounts withheld, temporarily paid during the year, or paid abroad (if any).

+ In case the income paying organization does not issue tax withholding documents to the individual due to the termination of the organization, the tax authority will rely on its database to review the finalization documents rather than mandating tax withholding documents.

+ If the income paying organization or individual uses electronic PIT withholding documents, the taxpayer should use the printout of the electronic PIT withholding document (a paper form printed by the taxpayer from the electronic original sent by the income paying organization).

- Copy of the Tax Deduction Certificate (clearly stating the tax paid according to which income tax declaration) issued by the income-paying agency, or a copy of the bank document proving tax paid abroad with the taxpayer's certification in cases where foreign laws do not mandate issuing tax paid certificates.

- Copies of invoices and documents proving donations to charity, humanitarian, or study promotion funds (if any).

- Documents proving payments made by entities or organizations abroad for individuals receiving income from international organizations, embassies, consulates, and income from abroad.

- Dependent registration documents (if claiming dependent relief at the tax finalization time for dependents who have not been registered previously).

Is it possible to authorize PIT finalization upon resignation before the time of finalization in Vietnam?

According to sub-clause d.2 point d clause 6 Article 8 Decree 126/2020/ND-CP, resident individuals with income from salaries and remunerations can authorize PIT finalization to income-paying organizations/individuals in the following cases:

Taxes paid monthly, quarterly, annually, per occurrence, and annual finalization

...

6. Types of taxes and fees annually finalized and finalized up to dissolution, bankruptcy, ceasing operations, contract termination, or business reorganization. In case of a business type transformation (excluding state enterprises going public) where the transformed enterprise inherits all tax obligations of the original entity, finalization up to the transformation decision is not required, and finalization will be done at year-end. Specifically:

...

d) PIT for entities or individuals paying taxable income from salaries and remunerations; individuals with income from salaries and remunerations authorizing tax finalization to the payer; individuals with income from salaries and remunerations directly finalizing with tax authorities. Specifically:

...

d.2) Resident individuals with income from salaries and remunerations authorize finalization to the payer organization. Specifically:

Individual with salaries and remunerations income signing labor contracts of 03 months or more at one place and actually working there at the time the payer organization finalizes taxes, even if not working for the full 12 months of the year. If the individual is transferred between entities as specified in point d.1 of this clause, they can authorize finalization to the new entity.

Individual with salaries and remunerations income signing labor contracts of 03 months or more at one place and actually working there at the time the payer organization finalizes taxes, even if not working for the full 12 months of the year; and having casual income elsewhere not exceeding an average of 10 million VND per month and already taxed at 10% withholding rate without requesting finalization for this part.

...

Therefore, at the time of authorizing tax finalization, the individual must be working at that enterprise; otherwise, authorization is not permitted.

In addition, according to sub-clause 1, Section 1 of Official Dispatch 883/TCT-DNNCN of 2022, the General Department of Taxation of Vietnam also guides that resident individuals with income from salaries and remunerations from two or more places not meeting authorization conditions must personally finalize PIT with the tax authorities if additional tax is payable or if overpaid tax needs to be refunded or carried forward to the next tax period.