Vietnam: What is the notice form of TIN non-reactivation 2025?

Vietnam: What is the notice form of TIN non-reactivation 2025?

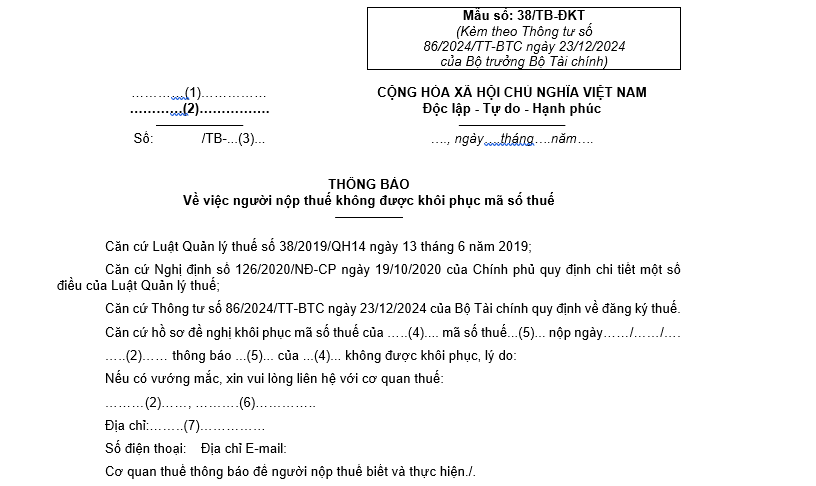

The notice form of TIN non-reactivation 2025 is form number 38/TB-DKT Appendix II issued together with Circular 86/2024/TT-BTC.

Form number 38/TB-DKT content is as follows:

>>>Download form 38/TB-DKT notice form of TIN non-reactivation

What is the notice form of TIN non-reactivation 2025? (Image from Internet)

What are cases of TIN reactivation in Vietnam?

Based on clauses 1 and 2, Article 40 of the Law on Tax Administration 2019 that stipulates the cases in which a taxpayer can reactivate their TIN as follows:

(1) Taxpayer registration along with business registration, cooperative registration, or business operation registration, if legal status is reactivated according to the law on business registration, cooperative registration, or business operation registration, then the TIN will simultaneously be reactivated.

(2) Taxpayer registration directly with the tax authority submits an application requesting to reactivate the TIN to the managing tax authority directly in the following cases:

- Authorized agency issues a written revocation of the business registration certificate or equivalent license;

- When there is a demand to continue business after submitting a TIN termination dossier to the tax authority but the tax authority has not issued a notice of TIN termination;

- When the tax authority issues a notice that the taxpayer is not operating at the registered address but the license has not been revoked, and the TIN has not been terminated.

Vietnam: What does the TIN reactivation application for organizations include?

Based on Article 18 Circular 86/2024/TT-BTC that stipulates the TIN reactivation application for an organization as follows:

(1) TIN reactivation application for a Taxpayer

- Taxpayer as stipulated in clause 2, Article 4 Circular 86/2024/TT-BTC whose Establishment and Operation License or equivalent license has been revoked by the competent authority, the tax authority has terminated the TIN according to regulations, but subsequently, the competent authority issues a written revocation cancellation, the taxpayer submits a TIN reactivation application to the managing tax authority no later than 10 (ten) working days from the date of the release of the written revocation cancellation by the competent authority.

The dossier includes:

+ A document requesting the reactivation of the TIN form number 25/DK-TCT issued together with Circular 86/2024/TT-BTC;

+ A copy of the document revoking the cancellation of the Establishment and Operation License or equivalent license by the competent authority.

- After the tax authority issues a Notice about the taxpayer not operating at the registered address under the provisions of clause 3, Article 11 or Article 17 Circular 86/2024/TT-BTC but the Business Registration Certificate, Cooperative Registration Certificate, Branch/Vice Office Activity Registration Certificate, Establishment and Operation License, or equivalent license has not been revoked, and the TIN has not been terminated, the taxpayer submits a Document Requesting reactivation of the TIN form number 25/DK-TCT issued together with Circular 86/2024/TT-BTC to the managing tax authority before the tax authority issues a Notice regarding the termination of the TIN under regulations.

+ In cases where taxpayers have changed their head office address but have not registered the change with the tax authority or business registration agency, the taxpayer must record the current head office address and explain the reasons in the document requesting the reactivation of the TIN while submitting a dossier for taxpayer registration information changes under Article 10 Circular 86/2024/TT-BTC.

- Taxpayers as stipulated in clause 2, Article 4 Circular 86/2024/TT-BTC when desiring to continue business after submitting a TIN termination dossier to the tax authority under provisions in clause 1, Article 14 Circular 86/2024/TT-BTC but the tax authority has not issued a Notice on the termination of the TIN as per Article 16 Circular 86/2024/TT-BTC shall submit a Document Requesting reactivation of the TIN form number 25/DK-TCT issued together with Circular 86/2024/TT-BTC to the managing tax authority before the tax authority issues a Notice on the termination of the TIN.

- Businesses, cooperatives, dependent units of businesses, and dependent units of cooperatives that have submitted a TIN termination dossier due to division, merger, consolidation, or cessation of dependent unit operations to the tax authority under provisions of clause 2, Article 14 Circular 86/2024/TT-BTC, thereafter having a document canceling the Decision to divide, merger contract, consolidation contract, or a document canceling the decision on cessation of dependent unit operations and the taxpayer has not submitted a cessation of operations dossier to the business registration agency, the taxpayer shall submit a TIN reactivation application to the managing tax authority.

The dossier includes:

- A document requesting the reactivation of the TIN form number 25/DK-TCT issued together with Circular 86/2024/TT-BTC;

- A copy of the document canceling the Decision to divide, Merger Contract, Consolidation Contract; or a copy of the document canceling the cessation of operations decision of the dependent unit.

Taxpayers requesting reactivation of the TIN according to points b, c, d of this clause must fully meet all tax obligations and invoices as prescribed in clause 4, Article 6, Decree 126/2020/ND-CP before the TIN can be reactivated.

(2) TIN reactivation Dossier for Enterprises, Cooperatives, Cooperative Alliances reactivated to Legal Status According to Law Provisions on Business Registration, Cooperative Registration, Cooperative Alliance Registration:

The dossier is the information on reactivating the legal status of the enterprise, cooperative, cooperative alliance, dependent unit of the enterprise, or dependent unit of the cooperative sent by the business registration agency to the tax authority through the National Business Registration Information System to the Taxpayer Registration Application System.

In cases where the enterprise, cooperative alliance, cooperative is being notified by the tax authority as not operating at the registered address, then after the business registration agency reactivates legal status according to law provisions on business registration, cooperative registration, and cooperative alliance registration, the taxpayer must submit a TIN reactivation dossier to the managing tax authority per point b, clause 1, Article 18 Circular 86/2024/TT-BTC.